By The Numbers

Month-To-Date: 1.27%

Quarter-To-Date: 10.77%

Year-To-Date: 15.77%

1 Year: 22.68%

Since Inception (Annualized): 23.51%

Investment Objective

Growth

Inception: 01/04/2017

All data for this report is as of 09/30/2018

James Adams

Portfolio Manager

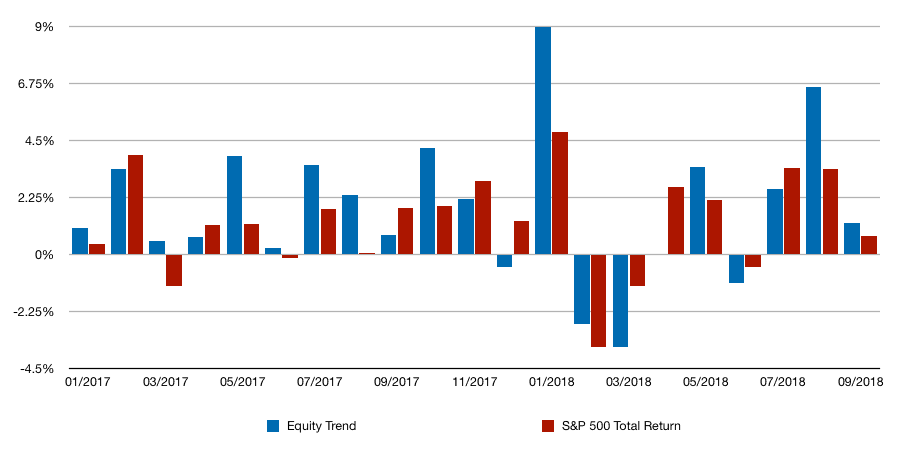

Equity Trend Post Strong Month for August

Month in Review: Equity Trend followed up its strong strong month in August with a positive return for September gaining 1.27%. The S&P 500 Total Return posted a modest gain of 0.73%. The market’s positive performance largely contributed to the monthly return for the model. The top three performers for the model were Square (SQ): 11.55%, Marathon Oil Corp. (MRO) 8.46%, and Honeywell International Inc. (HON): 5.10%. While First Data Corp (FDC): -4.88%, Valero Energy Corp (VLO): -2.85%, and Sysco Corp (SYY): -2.13% were the three worst performing holdings for the model.

The Equity Trend Model now closes the third quarter of 2018 with a cumulative return since inception of 44.46% versus the S&P 500 Total Return Index of 32.77% for the same time period.

About the model: Adams Wealth Management’s Equity Trend Model is a quantitative, trend-following model portfolio that invests in up to 25 individual equities. Our rules-driven model takes a risk-on/risk-off approach to investing focusing on stocks that are appreciating in price as the broader market trends higher. When the broader market is trending lower, the model will invest in fixed-income ETFs (exchange-traded funds) or a basket of fixed-income ETFs. The investment objective of this model is growth and may not be suitable for all investors. For purposes of comparison, this report uses the S&P 500 Total Return Index. For more information about this model, please read our disclosures.

Return by Month

Book your own FREE Strategy Session

Ins and Outs: The model had a low turnover for the month as expected by the previous month’s strong returns. However, Alibaba Group (BABA) closed the previous month below the model’s exit signal communicating a trend reversal. As a result, the model exited Alibaba Group. We replaced that position with Medtronic PLC (MDT) as the company created another new high during the previous month.

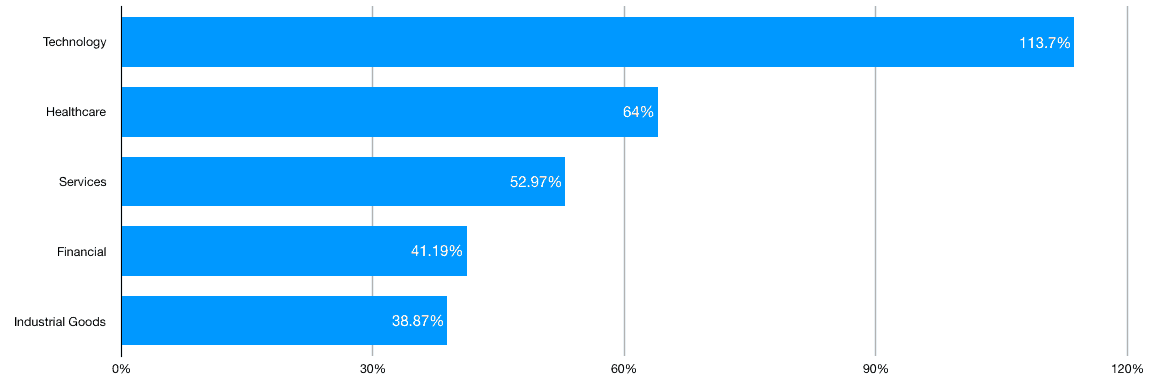

Top 5 Current Sectors by Cumulative Return

Disclosures

This information provided is an investment model and does not reflect actual client(s) performance. This model may not be suitable for all investors. Adams Wealth Management seeks to provide investments suitable for all of our clients. As a result, many if not all of our clients will own varying allocations to this and/or other models. Clients with different objects have different results portrayed from this model.

The information provided is net of fees (1.5%). In addition, the results of this model reflect divided payments and other income from investments made.

The Standard & Poor’s 500 Total Return Index (S&P 500 Total Return) measures the total return including distributions of the Standard and Poor’s 500 Index (S&P 500). The S&P 500 is an unmanaged, market capitalization weighted index of 500 widely held stocks. The index is composed of 500 constituent companies and is often used as a benchmark for the U.S. stock market. Please note that investors cannot directly invest in an index.

All investing involves risk, including the potential for loss of principal. There is no guarantee this model will be successful.