WEEKLY QUOTE

“Never tell people how to do things. Tell them what to do and they will surprise you with their ingenuity.”

– George S. Patton

WEEKLY TIP

When a divorce settlement requires a party to keep up their life insurance, the insured should go through the underwriting process before signing the agreement. If new coverage cannot be easily obtained, trusts or other estate planning tools can be created in response.

WEEKLY RIDDLE

Picture three trees. Whatever happens to the third tree must happen to the first tree, and anything that happens to the second tree must be replicated on the third. What happens if the second tree is cut down?

RETAIL SALES ROSE 0.4% in JANUARY

Consumer spending on household electronics and appliances powered this gain. Analysts polled by Reuters had expected a 0.1% advance. Core retail purchases also rose 0.4% last month. The Department of Commerce revised the December increase for retail sales upward to 1.0%. Across the 12 months ending in January, retail sales advanced 5.6%.1

INFLATION PRESSURE MOUNTS

In January, the headline Consumer Price Index climbed 0.6%. That was its greatest monthly gain in four years, and it took annualized inflation to a 4-year high of 2.5%. Producer prices also jumped 0.6% in January, in the largest monthly increase seen since September 2012; that development left them up 1.6% year-over-year.1,2

BUILDING PERMITS UP, HOUSING STARTS DOWN

Unsurprisingly, groundbreaking declined in January. The Census Bureau recorded a 2.6% fall for housing starts in the winter weather. The rate of permits issued for future projects, however, increased by 4.6%.3

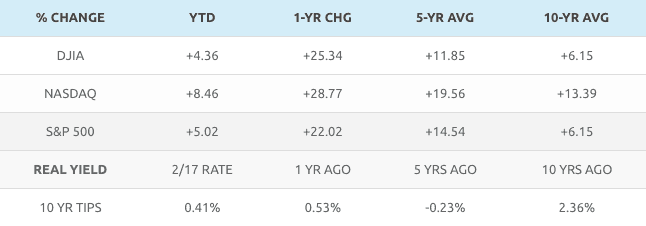

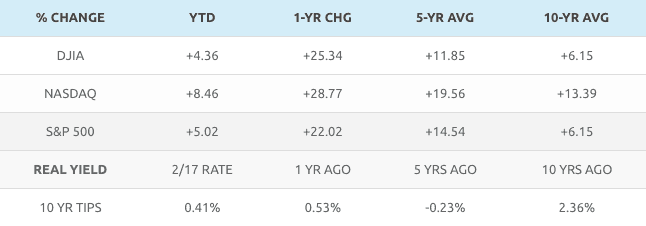

FURTHER GAINS IN A BULLISH FEBRUARY

The S&P 500 pulled off another weekly advance, adding 1.51% from February 13-17 on its way to a Friday settlement of 2,351.16. Its 5-day performance actually lagged both the Dow and the Nasdaq: the blue chips gained 1.75%, to 20,624.05, as the broad tech sector benchmark rose 1.82%, to 5,838.58.4

THIS WEEK: Monday is Presidents Day, so U.S. stock and bond markets are closed; America’s Car-Mart and Dillard’s report Q4 results. Tuesday, Advance Auto Parts, Cracker Barrel, HealthSouth, Home Depot, Kaiser Aluminum, La-Z-Boy, Macy’s, Medtronic, Newmont Mining, Nautilus, Papa John’s, Red Robin, and Walmart all join the earnings parade. On Wednesday, earnings from Cheesecake Factory, Chico’s FAS, DISH Network, Fitbit, Garmin, Green Dot, HP, Jack-in-the-Box, L Brands, Popeyes, Public Storage, Six Flags Entertainment, Square, Sunoco, Tesla, TJX, Toll Brothers, Transocean, and Weibo complement minutes from February’s Federal Reserve policy meeting and January existing home sales numbers. A new initial claims report arrives Thursday, along with earnings from AMC Networks, Baidu, Chesapeake Energy, Gap, Herbalife, Hewlett Packard Enterprise, Hormel Foods, iHeartMedia, Intuit, Kohl’s, Live Nation, Mitel, Nordstrom, Pinnacle Foods, Sears Holdings, Sprouts, and Toro. Friday, earnings from Berkshire Hathaway, Boise Cascade, Foot Locker, JCPenney, Magellan Health, and Revlon emerge, plus the final February University of Michigan consumer sentiment index and the January new home sales report.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

Citations.

1 – reuters.com/article/us-usa-economy-idUSKBN15U1NB [2/15/17]

2 – tradingeconomics.com/united-states/producer-prices [2/17/17]

3 – investing.com/economic-calendar/ [2/17/17]

4 – markets.wsj.com/us [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F17%2F16&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F17%2F16&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F17%2F16&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F17%2F12&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F17%2F12&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F17%2F12&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F16%2F07&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F16%2F07&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F16%2F07&x=0&y=0 [2/17/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/17/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/17/17]

RETAIL SALES ROSE 0.4% in JANUARY

Consumer spending on household electronics and appliances powered this gain. Analysts polled by Reuters had expected a 0.1% advance. Core retail purchases also rose 0.4% last month. The Department of Commerce revised the December increase for retail sales upward to 1.0%. Across the 12 months ending in January, retail sales advanced 5.6%.1

INFLATION PRESSURE MOUNTS

In January, the headline Consumer Price Index climbed 0.6%. That was its greatest monthly gain in four years, and it took annualized inflation to a 4-year high of 2.5%. Producer prices also jumped 0.6% in January, in the largest monthly increase seen since September 2012; that development left them up 1.6% year-over-year.1,2

BUILDING PERMITS UP, HOUSING STARTS DOWN

Unsurprisingly, groundbreaking declined in January. The Census Bureau recorded a 2.6% fall for housing starts in the winter weather. The rate of permits issued for future projects, however, increased by 4.6%.3

FURTHER GAINS IN A BULLISH FEBRUARY

The S&P 500 pulled off another weekly advance, adding 1.51% from February 13-17 on its way to a Friday settlement of 2,351.16. Its 5-day performance actually lagged both the Dow and the Nasdaq: the blue chips gained 1.75%, to 20,624.05, as the broad tech sector benchmark rose 1.82%, to 5,838.58.4

THIS WEEK: Monday is Presidents Day, so U.S. stock and bond markets are closed; America’s Car-Mart and Dillard’s report Q4 results. Tuesday, Advance Auto Parts, Cracker Barrel, HealthSouth, Home Depot, Kaiser Aluminum, La-Z-Boy, Macy’s, Medtronic, Newmont Mining, Nautilus, Papa John’s, Red Robin, and Walmart all join the earnings parade. On Wednesday, earnings from Cheesecake Factory, Chico’s FAS, DISH Network, Fitbit, Garmin, Green Dot, HP, Jack-in-the-Box, L Brands, Popeyes, Public Storage, Six Flags Entertainment, Square, Sunoco, Tesla, TJX, Toll Brothers, Transocean, and Weibo complement minutes from February’s Federal Reserve policy meeting and January existing home sales numbers. A new initial claims report arrives Thursday, along with earnings from AMC Networks, Baidu, Chesapeake Energy, Gap, Herbalife, Hewlett Packard Enterprise, Hormel Foods, iHeartMedia, Intuit, Kohl’s, Live Nation, Mitel, Nordstrom, Pinnacle Foods, Sears Holdings, Sprouts, and Toro. Friday, earnings from Berkshire Hathaway, Boise Cascade, Foot Locker, JCPenney, Magellan Health, and Revlon emerge, plus the final February University of Michigan consumer sentiment index and the January new home sales report.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

Citations.

1 – reuters.com/article/us-usa-economy-idUSKBN15U1NB [2/15/17]

2 – tradingeconomics.com/united-states/producer-prices [2/17/17]

3 – investing.com/economic-calendar/ [2/17/17]

4 – markets.wsj.com/us [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F17%2F16&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F17%2F16&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F17%2F16&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F17%2F12&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F17%2F12&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F17%2F12&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F16%2F07&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F16%2F07&x=0&y=0 [2/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F16%2F07&x=0&y=0 [2/17/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/17/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/17/17]