MONTHLY QUOTE

“The whole life of man is but a point of time; let us enjoy it.”

– Plutarch

MONTHLY TIP

If you have assets in a workplace retirement plan or a traditional IRA, you can do a Roth conversion regardless of how much you earn. (You will be in line to pay ordinary income tax on the amount you convert.)

MONTHLY RIDDLE

It can fit down a chimney when it is down. It has a hard time going down a chimney when it is up. You can hold it with one hand, and make it expand. What is it?

Last month’s riddle

Three sisters walk toward school with just one small umbrella, which they must all try to fit under. When they reach their school, none of them are the slightest bit wet. How is this possible?

Last week’s answer:

It didn’t rain on their way to school.

THE MONTH IN BRIEF

In April, investors kept one eye on impressive corporate earnings and another on geopolitical developments in Asia and Europe. Earnings ultimately drew the most attention – the Dow Jones Industrial Average rose more than 1% for the month, while the Nasdaq Composite added more than 2%. The latest readings on some key economic indicators were disappointing, but consumer confidence and purchasing manager indices looked good. Positive economic news filtered in from both China and the eurozone. Home sales were up; mortgage rates down. Commodity futures largely struggled. All in all, the month featured more economic positives than negatives.(1)

DOMESTIC ECONOMIC HEALTH

An extremely bullish stock market climate and abundant consumer confidence often coincide. In April, the nation’s most-watched consumer confidence indices remained high; albeit, not as high as they were in March. The Conference Board’s index declined to 120.6, 4.3 points lower than the previous month; the University of Michigan’s household sentiment index ended the month at 97.0, one point lower than its preliminary April mark.(2)

Job creation had waned in March. The Department of Labor’s employment report showed only 98,000 net new hires in that month. Still, the jobless rate dipped 0.2% to 4.5%. The U-6 rate, measuring both unemployment and underemployment, declined 0.3% to 8.9%. Does all that seem incongruent? Two factors may help explain it. One, the number of unemployed Americans declined by 326,000 during March, for assorted reasons. Two, the DoL uses two different surveys to compile data for its monthly report. One tracks payrolls at businesses; the other, the employment status of individuals.(3)

Turning from the workplace to the point of purchase, March saw flat consumer spending and a 0.2% downturn in retail sales. (Consumer incomes rose 0.2%.) In related news, America’s first-quarter GDP number was lackluster – the economy grew just 0.7% in the opening three months of the year, according to the initial estimate of the Bureau of Economic Analysis.(2,4)

Consumer inflation declined 0.3% in March, with core consumer prices down 0.1%. Even after that significant dip, the yearly gain in the headline Consumer Price Index stood at 2.4%. The Producer Price Index ticked down 0.1% in March, leaving annualized wholesale inflation at 2.3%.(4)

The Institute for Supply Management’s service sector purchasing manager index was at a healthy 55.2 in the third month of the year, though it was 2.4 points below its February reading. ISM’s manufacturing PMI, which had been at 57.2 in March, came in at a still-strong 54.8 for April. Hard goods orders were up 0.7% in March after a 2.3% gain in February.(2,5)

GLOBAL ECONOMIC HEALTH

April brought news of economic improvement in China. During Q1, the nation’s economy grew at a 6.9% pace – the best pace seen in six quarters. That surpassed the 6.5% target set by its government. Real estate investment had increased 9.1% and fixed-asset investment 9.2% from a year earlier, but the real boost came from a 21.0% year-over-year gain in local and central government spending. Disposable income grew at a yearly rate of 7.0%, a high unmatched since late 2015. Chinese factory growth did fall short of expectations in April, with the nation’s official PMI hitting a 6-month trough of 51.2.(6,7)

Markit’s eurozone manufacturing PMI hit a 6-year peak in Q1, reaching 56.4; service sector PMIs for Germany, France, and Spain were all above 55 for the quarter. Markit estimated the Spanish economy growing by 0.8-0.9% in Q1, with projected expansion of 0.6% for Germany and France and 0.3-0.4% for Italy. Eurostat, the European Union’s statistical office, estimated euro area inflation at 1.9% in April, 0.4% higher than it had been in March.(8,9)

WORLD MARKETS

In April, Argentina’s Merval (+4.98%) and France’s CAC 40 (+4.38%) made the biggest upward moves among foreign benchmarks. Spain’s IBEX 35 went +3.15%; Germany’s DAX, +2.38%. Three other major indices gained more than 2% in April: India’s Nifty 50 went +2.23%; the FTSE Eurofirst 300, +2.11%; and the MSCI Emerging Markets, +2.04%.(10,11)

Other April performances: South Korea’s Kospi, +1.95%; India’s Sensex, +1.73%; Australia’s All Ordinaries, +1.49%; the MSCI World, +1.33%; Brazil’s Bovespa, +1.18%; Hong Kong’s Hang Seng, +1.11%; Japan’s Nikkei 225, -0.03%; Canada’s TSX Composite, -0.08%; Mexico’s Bolsa, -0.16%; the U.K.’s FTSE 100, -1.90%; China’s Shanghai Composite, -3.02%.(10,11)

COMMODITIES MARKETS

With stocks once again at or near record levels, commodities mostly cooled off. Gold was certainly an exception: it rose 1.59% last month to settle at $1,269.50 per ounce on the COMEX on April 28. Silver, on the other hand, sank 5.30% to finish April at $17.16. Copper gave back 2.23% for April; platinum, only 0.22%. The U.S. Dollar Index retreated 1.51%.(12,13)

As for oil, it ended April under $50 – at $49.19 on the NYMEX, to be precise. It lost 3.26% on the month. Unleaded gas took the big tumble among major energy futures, dropping 9.33%. Heating oil’s loss was smaller at 4.36%. Natural gas futures advanced 2.41% for April. Two crops fell particularly hard – cocoa dove 11.94%; coffee, 8.65%. Sugar lost 4.30%. Cotton futures were up 2.34% in April, but corn dipped 2.12%, and wheat, 2.34%. Soybeans were down just 0.05% on the month.(12)

REAL ESTATE

With the Federal Reserve pledging to tighten as last year ended, who would have guessed mortgage rates would be lower in April than at the start of the year? They were. Freddie Mac’s April 27 Primary Mortgage Market Survey showed average interest on the 30-year FRM at 4.03%; in the January 5 survey, the average interest rate was 4.20%. A year-to-date decline was also evident for the 15-year FRM (3.44% to 3.27%). Average interest on the 5/1-year ARM was 3.12% in April, 3.33% in December. Between March 30 and April 27, the average interest rate on the 30-year FRM lessened 0.11%; for the 15-year FRM and the 5/1-year ARM, the respective descents were 0.12% and 0.06%.(14)

Existing home sales were up 4.4% in March, according to the National Association of Realtors, a nice change from the (revised) 3.9% February retreat. New home buying, too, improved – the March gain was 5.8%, leaving the annualized advance at 15.6%.(4, 15)

Looking at other housing indicators, the January edition of the 20-city Case-Shiller home price index arrived, showing a 5.8% year-over-year increase. That bettered the 5.6% yearly rise seen in the December edition. The NAR announced a 0.8% retreat for pending home sales during March, contrasting with a 5.5% surge in February. Housing starts fell by 6.8% in the third month of 2017, but building permits rose 3.6%.(2,4)

LOOKING BACK…LOOKING FORWARD

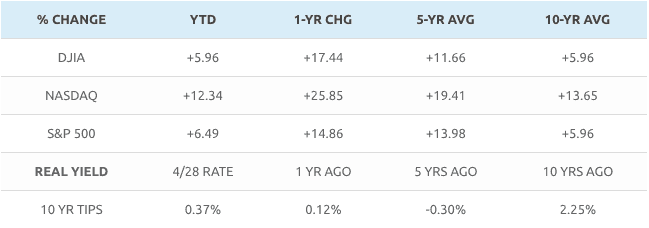

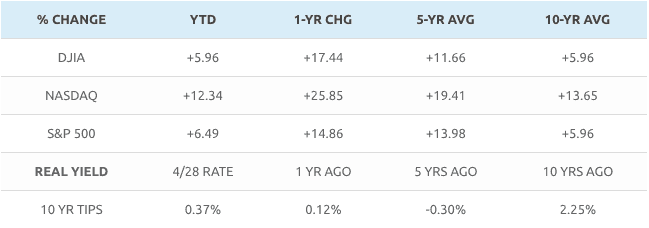

The Nasdaq Composite surpassed 6,000 for the first time in April, gaining 2.30% for the month. At the closing bell on April 28, the index’s 52-week advance stood at 26.64%. The S&P 500 added 0.91% in April; the Dow Jones Industrial Average, 1.34%. The small-cap Russell 2000 improved 1.05%. April’s stock rally thrust the CBOE VIX south by 12.53%; it ended the month at 10.82. The Nasdaq 100 was the pacesetter among consequential U.S. equity indices in April, rising 2.71%. At the end of April, the foremost equity indices watched by Wall Street settled as follows: DJIA, 20,940.51; NASDAQ, 6,047.61; S&P, 2,384.20; RUT, 1,400.43.(1, 16)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

On April 28, FactSet estimated 12.5% blended earnings growth for companies in the S&P 500. If that projected annualized growth rate holds, Q1 will turn out to be the best quarter for earnings growth in nearly six years. Earnings gains will certainly vary over succeeding quarters, but for the near term, this story of solid growth may continue to be the narrative. In early May, the most attention may be paid to the Department of Labor’s latest jobs report (Did the March data amount to an aberration? Did payroll growth pick up in April?) and the Federal Reserve’s newest policy statement (Will the central bank send hawkish or dovish signals?). Most investors are looking at the markets through a bullish lens right now, and barring some abrupt, troubling event, the bulls look ready to run for another month.(20)

UPCOMING ECONOMIC RELEASES: Here is what investors will watch for in May: the FOMC’s latest policy statement and the April ISM service sector PMI (5/3), the April Challenger job-cut report and March factory orders (5/4), the April jobs report from the Department of Labor (5/5), the April PPI (5/11), the April CPI, April retail sales, and the initial May consumer sentiment index from the University of Michigan (5/12), April housing starts, building permits, and industrial production (5/16), April new home sales (5/23), April existing home sales (5/24), April durable goods orders, the federal government’s second estimate of Q1 growth, and the University of Michigan’s final May consumer sentiment index (5/26), the Conference Board’s latest consumer confidence index, April personal spending, and the April PCE price index (5/30), and then April pending home sales, plus the Federal Reserve’s latest Beige Book (5/31).

For more information about Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The MERVAL Index (MERcado de VALores, literally Stock Exchange) is the most important index of the Buenos Aires Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. The DAX 30 is a Blue Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The NIFTY 50 is a diversified 50-stock index accounting for 12 sectors of the Indian economy. The FTSE Eurofirst 300 measures the performance of Europe’s largest 300 companies by market capitalization and covers 70% of Europe’s market cap. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The Korea Composite Stock Price Index or KOSPI is the major stock market index of South Korea, representing all common stocks traded on the Korea Exchange. The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also-called the BSE 30 (BOMBAY STOCK EXCHANGE) or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange (BSE). The All Ordinaries (XAO) is considered a total market barometer for the Australian stock market and contains the 500 largest ASX-listed companies by way of market capitalization. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. The Bovespa Index is a gross total return index weighted by traded volume & is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – markets.wsj.com/us [4/28/17]

2 – marketwatch.com/economy-politics/calendars/economic [5/1/17]

3 – forbes.com/sites/maggiemcgrath/2017/04/07/u-s-adds-just-98000-jobs-in-march-missing-expectations-by-a-wide-margin/ [4/7/17]

4 – investing.com/economic-calendar/ [4/28/17]

5 – instituteforsupplymanagement.org/ismreport/nonmfgrob.cfm?SSO=1 [4/5/17]

6 – reuters.com/article/us-china-economy-gdp-idUSKBN17J04E [4/17/17]

7 – straitstimes.com/business/economy/china-manufacturing-growth-slows-faster-than-expected-in-april [4/29/17]

8 – businessinsider.com/ihs-markit-european-pmis-for-march-2017-2017-4 [4/5/17]

9 – ec.europa.eu/eurostat [4/29/17]

10 – markets.on.nytimes.com/research/markets/worldmarkets/worldmarkets.asp [4/28/17]

11 – msci.com/end-of-day-data-search [4/28/17]

12 – money.cnn.com/data/commodities/ [4/28/17]

13 – marketwatch.com/investing/index/dxy/historical [4/28/17]

14 – freddiemac.com/pmms/archive.html?year=2017 [4/28/17]

15 – blogs.barrons.com/incomeinvesting/2017/04/25/new-home-sales-move-into-higher-gear/ [4/28/17]

16 – foxbusiness.com/markets/2017/04/28/wall-street-slips-on-weak-gdp-data-but-indexes-rise-in-april.html [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F28%2F16&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F28%2F16&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F28%2F16&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F27%2F12&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F27%2F12&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F27%2F12&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F27%2F07&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F27%2F07&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F27%2F07&x=0&y=0 [4/28/17]

18 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [4/28/17]

19 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [4/28/17]

20 – insight.factset.com/earningsinsight_04.28.17 [4/28/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

THE MONTH IN BRIEF

In April, investors kept one eye on impressive corporate earnings and another on geopolitical developments in Asia and Europe. Earnings ultimately drew the most attention – the Dow Jones Industrial Average rose more than 1% for the month, while the Nasdaq Composite added more than 2%. The latest readings on some key economic indicators were disappointing, but consumer confidence and purchasing manager indices looked good. Positive economic news filtered in from both China and the eurozone. Home sales were up; mortgage rates down. Commodity futures largely struggled. All in all, the month featured more economic positives than negatives.(1)

DOMESTIC ECONOMIC HEALTH

An extremely bullish stock market climate and abundant consumer confidence often coincide. In April, the nation’s most-watched consumer confidence indices remained high; albeit, not as high as they were in March. The Conference Board’s index declined to 120.6, 4.3 points lower than the previous month; the University of Michigan’s household sentiment index ended the month at 97.0, one point lower than its preliminary April mark.(2)

Job creation had waned in March. The Department of Labor’s employment report showed only 98,000 net new hires in that month. Still, the jobless rate dipped 0.2% to 4.5%. The U-6 rate, measuring both unemployment and underemployment, declined 0.3% to 8.9%. Does all that seem incongruent? Two factors may help explain it. One, the number of unemployed Americans declined by 326,000 during March, for assorted reasons. Two, the DoL uses two different surveys to compile data for its monthly report. One tracks payrolls at businesses; the other, the employment status of individuals.(3)

Turning from the workplace to the point of purchase, March saw flat consumer spending and a 0.2% downturn in retail sales. (Consumer incomes rose 0.2%.) In related news, America’s first-quarter GDP number was lackluster – the economy grew just 0.7% in the opening three months of the year, according to the initial estimate of the Bureau of Economic Analysis.(2,4)

Consumer inflation declined 0.3% in March, with core consumer prices down 0.1%. Even after that significant dip, the yearly gain in the headline Consumer Price Index stood at 2.4%. The Producer Price Index ticked down 0.1% in March, leaving annualized wholesale inflation at 2.3%.(4)

The Institute for Supply Management’s service sector purchasing manager index was at a healthy 55.2 in the third month of the year, though it was 2.4 points below its February reading. ISM’s manufacturing PMI, which had been at 57.2 in March, came in at a still-strong 54.8 for April. Hard goods orders were up 0.7% in March after a 2.3% gain in February.(2,5)

GLOBAL ECONOMIC HEALTH

April brought news of economic improvement in China. During Q1, the nation’s economy grew at a 6.9% pace – the best pace seen in six quarters. That surpassed the 6.5% target set by its government. Real estate investment had increased 9.1% and fixed-asset investment 9.2% from a year earlier, but the real boost came from a 21.0% year-over-year gain in local and central government spending. Disposable income grew at a yearly rate of 7.0%, a high unmatched since late 2015. Chinese factory growth did fall short of expectations in April, with the nation’s official PMI hitting a 6-month trough of 51.2.(6,7)

Markit’s eurozone manufacturing PMI hit a 6-year peak in Q1, reaching 56.4; service sector PMIs for Germany, France, and Spain were all above 55 for the quarter. Markit estimated the Spanish economy growing by 0.8-0.9% in Q1, with projected expansion of 0.6% for Germany and France and 0.3-0.4% for Italy. Eurostat, the European Union’s statistical office, estimated euro area inflation at 1.9% in April, 0.4% higher than it had been in March.(8,9)

WORLD MARKETS

In April, Argentina’s Merval (+4.98%) and France’s CAC 40 (+4.38%) made the biggest upward moves among foreign benchmarks. Spain’s IBEX 35 went +3.15%; Germany’s DAX, +2.38%. Three other major indices gained more than 2% in April: India’s Nifty 50 went +2.23%; the FTSE Eurofirst 300, +2.11%; and the MSCI Emerging Markets, +2.04%.(10,11)

Other April performances: South Korea’s Kospi, +1.95%; India’s Sensex, +1.73%; Australia’s All Ordinaries, +1.49%; the MSCI World, +1.33%; Brazil’s Bovespa, +1.18%; Hong Kong’s Hang Seng, +1.11%; Japan’s Nikkei 225, -0.03%; Canada’s TSX Composite, -0.08%; Mexico’s Bolsa, -0.16%; the U.K.’s FTSE 100, -1.90%; China’s Shanghai Composite, -3.02%.(10,11)

COMMODITIES MARKETS

With stocks once again at or near record levels, commodities mostly cooled off. Gold was certainly an exception: it rose 1.59% last month to settle at $1,269.50 per ounce on the COMEX on April 28. Silver, on the other hand, sank 5.30% to finish April at $17.16. Copper gave back 2.23% for April; platinum, only 0.22%. The U.S. Dollar Index retreated 1.51%.(12,13)

As for oil, it ended April under $50 – at $49.19 on the NYMEX, to be precise. It lost 3.26% on the month. Unleaded gas took the big tumble among major energy futures, dropping 9.33%. Heating oil’s loss was smaller at 4.36%. Natural gas futures advanced 2.41% for April. Two crops fell particularly hard – cocoa dove 11.94%; coffee, 8.65%. Sugar lost 4.30%. Cotton futures were up 2.34% in April, but corn dipped 2.12%, and wheat, 2.34%. Soybeans were down just 0.05% on the month.(12)

REAL ESTATE

With the Federal Reserve pledging to tighten as last year ended, who would have guessed mortgage rates would be lower in April than at the start of the year? They were. Freddie Mac’s April 27 Primary Mortgage Market Survey showed average interest on the 30-year FRM at 4.03%; in the January 5 survey, the average interest rate was 4.20%. A year-to-date decline was also evident for the 15-year FRM (3.44% to 3.27%). Average interest on the 5/1-year ARM was 3.12% in April, 3.33% in December. Between March 30 and April 27, the average interest rate on the 30-year FRM lessened 0.11%; for the 15-year FRM and the 5/1-year ARM, the respective descents were 0.12% and 0.06%.(14)

Existing home sales were up 4.4% in March, according to the National Association of Realtors, a nice change from the (revised) 3.9% February retreat. New home buying, too, improved – the March gain was 5.8%, leaving the annualized advance at 15.6%.(4, 15)

Looking at other housing indicators, the January edition of the 20-city Case-Shiller home price index arrived, showing a 5.8% year-over-year increase. That bettered the 5.6% yearly rise seen in the December edition. The NAR announced a 0.8% retreat for pending home sales during March, contrasting with a 5.5% surge in February. Housing starts fell by 6.8% in the third month of 2017, but building permits rose 3.6%.(2,4)

LOOKING BACK…LOOKING FORWARD

The Nasdaq Composite surpassed 6,000 for the first time in April, gaining 2.30% for the month. At the closing bell on April 28, the index’s 52-week advance stood at 26.64%. The S&P 500 added 0.91% in April; the Dow Jones Industrial Average, 1.34%. The small-cap Russell 2000 improved 1.05%. April’s stock rally thrust the CBOE VIX south by 12.53%; it ended the month at 10.82. The Nasdaq 100 was the pacesetter among consequential U.S. equity indices in April, rising 2.71%. At the end of April, the foremost equity indices watched by Wall Street settled as follows: DJIA, 20,940.51; NASDAQ, 6,047.61; S&P, 2,384.20; RUT, 1,400.43.(1, 16)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

On April 28, FactSet estimated 12.5% blended earnings growth for companies in the S&P 500. If that projected annualized growth rate holds, Q1 will turn out to be the best quarter for earnings growth in nearly six years. Earnings gains will certainly vary over succeeding quarters, but for the near term, this story of solid growth may continue to be the narrative. In early May, the most attention may be paid to the Department of Labor’s latest jobs report (Did the March data amount to an aberration? Did payroll growth pick up in April?) and the Federal Reserve’s newest policy statement (Will the central bank send hawkish or dovish signals?). Most investors are looking at the markets through a bullish lens right now, and barring some abrupt, troubling event, the bulls look ready to run for another month.(20)

UPCOMING ECONOMIC RELEASES: Here is what investors will watch for in May: the FOMC’s latest policy statement and the April ISM service sector PMI (5/3), the April Challenger job-cut report and March factory orders (5/4), the April jobs report from the Department of Labor (5/5), the April PPI (5/11), the April CPI, April retail sales, and the initial May consumer sentiment index from the University of Michigan (5/12), April housing starts, building permits, and industrial production (5/16), April new home sales (5/23), April existing home sales (5/24), April durable goods orders, the federal government’s second estimate of Q1 growth, and the University of Michigan’s final May consumer sentiment index (5/26), the Conference Board’s latest consumer confidence index, April personal spending, and the April PCE price index (5/30), and then April pending home sales, plus the Federal Reserve’s latest Beige Book (5/31).

For more information about Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The MERVAL Index (MERcado de VALores, literally Stock Exchange) is the most important index of the Buenos Aires Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. The DAX 30 is a Blue Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The NIFTY 50 is a diversified 50-stock index accounting for 12 sectors of the Indian economy. The FTSE Eurofirst 300 measures the performance of Europe’s largest 300 companies by market capitalization and covers 70% of Europe’s market cap. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The Korea Composite Stock Price Index or KOSPI is the major stock market index of South Korea, representing all common stocks traded on the Korea Exchange. The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also-called the BSE 30 (BOMBAY STOCK EXCHANGE) or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange (BSE). The All Ordinaries (XAO) is considered a total market barometer for the Australian stock market and contains the 500 largest ASX-listed companies by way of market capitalization. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. The Bovespa Index is a gross total return index weighted by traded volume & is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – markets.wsj.com/us [4/28/17]

2 – marketwatch.com/economy-politics/calendars/economic [5/1/17]

3 – forbes.com/sites/maggiemcgrath/2017/04/07/u-s-adds-just-98000-jobs-in-march-missing-expectations-by-a-wide-margin/ [4/7/17]

4 – investing.com/economic-calendar/ [4/28/17]

5 – instituteforsupplymanagement.org/ismreport/nonmfgrob.cfm?SSO=1 [4/5/17]

6 – reuters.com/article/us-china-economy-gdp-idUSKBN17J04E [4/17/17]

7 – straitstimes.com/business/economy/china-manufacturing-growth-slows-faster-than-expected-in-april [4/29/17]

8 – businessinsider.com/ihs-markit-european-pmis-for-march-2017-2017-4 [4/5/17]

9 – ec.europa.eu/eurostat [4/29/17]

10 – markets.on.nytimes.com/research/markets/worldmarkets/worldmarkets.asp [4/28/17]

11 – msci.com/end-of-day-data-search [4/28/17]

12 – money.cnn.com/data/commodities/ [4/28/17]

13 – marketwatch.com/investing/index/dxy/historical [4/28/17]

14 – freddiemac.com/pmms/archive.html?year=2017 [4/28/17]

15 – blogs.barrons.com/incomeinvesting/2017/04/25/new-home-sales-move-into-higher-gear/ [4/28/17]

16 – foxbusiness.com/markets/2017/04/28/wall-street-slips-on-weak-gdp-data-but-indexes-rise-in-april.html [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F28%2F16&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F28%2F16&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F28%2F16&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F27%2F12&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F27%2F12&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F27%2F12&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F27%2F07&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F27%2F07&x=0&y=0 [4/28/17]

17 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F27%2F07&x=0&y=0 [4/28/17]

18 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [4/28/17]

19 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [4/28/17]

20 – insight.factset.com/earningsinsight_04.28.17 [4/28/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.