WEEKLY QUOTE

“You cannot escape the responsibility of tomorrow by evading it today.”

– Abraham Lincoln

WEEKLY TIP

Some of the financial choices you make in the years just before and after your retirement may be unalterable. In recognition of that, an objective review of your retirement plan is a must as you approach your sixties.

WEEKLY RIDDLE

If you push me to extremes, I can rage and boil, but an hour later, I may be silent and stiff. What am I?

Last week’s riddle

What four U.S. states have names that start and end with the same vowel?

Last week’s answer:

Alabama, Alaska, Arizona, and Ohio.

CONSUMER SENTIMENT DECLINES JUST A BIT

Ending May at a mark of 97.1, the University of Michigan’s consumer sentiment index fell 0.6 points from its preliminary reading for the month. Economists polled by MarketWatch had forecast the gauge to remain at 97.7.(1)

FEWER HOMES WERE BOUGHT IN APRIL

Both new and existing home sales tapered off last month. The National Association of Realtors said that resales fell 2.3% for April, while the Census Bureau announced an 11.4% retreat for new home purchases. While demand was high, tight supply reduced the number of buyers.(2)

FED MINUTES: Q1 SLUMP “LIKELY TO BE TRANSITORY”

With the Federal Open Market Committee expressing that exact opinion in the record of its May 2-3 meeting, investors saw little that would delay the central bank from raising interest rates in June. Still, the minutes sounded a cautious note. Fed policymakers “generally judged that it would be prudent to await additional evidence,” confirming that the winter economic slowdown was short lived prior to tightening further. The Bureau of Economic Analysis did revise its Q1 GDP estimate up to 1.2% last week, compared with an initial evaluation of 0.7%.(1,3)

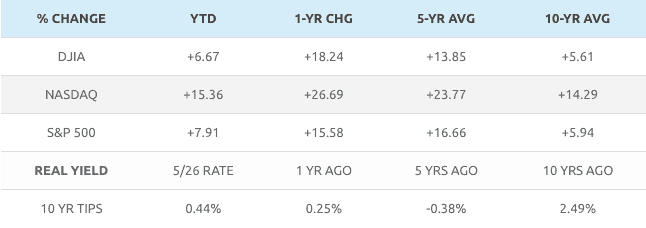

MORE RECORD HIGHS FOR NASDAQ, S&P 500

A great week for stocks saw gains of 2.08% for the Nasdaq Composite, 1.43% for the S&P 500, and 1.32% for the Dow Jones Industrial Average. Friday’s settlements: Dow, 21,080.28; S&P, 2,415.82; Nasdaq, 6,210.19. Friday’s S&P and Nasdaq closes were historic peaks for both indices. The S&P advanced for a seventh straight trading session to end the week, something it had not done since February. The Nasdaq 100 ended last week up 19.01% YTD.(4,5)

THIS WEEK: Monday is Memorial Day – U.S. stock and bond markets will be closed. Tuesday, the April personal spending report and PCE price index appear. A new Federal Reserve Beige Book and the NAR’s April pending home sales report surface Wednesday, plus earnings from Analog Devices, Hewlett-Packard Enterprise, Michael Kors, and Palo Alto Networks. Thursday is heavy on jobs data, as investors look at the ADP payroll and Challenger job-cut reports and the latest initial claims numbers; ISM’s May factory PMI also arrives, along with earnings from Boot Barn, Broadcom, Dollar General, Express, Five Below, and Lululemon Athletica. Friday, the Department of Labor issues its May employment report, and Hovnanian announces earnings.

Sources: wsj.com, bigcharts.com, treasury.gov – 5/26/17 (5,6,7,8)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

For more information about Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – marketwatch.com/economy-politics/calendars/economic [5/26/17]

2 – foxbusiness.com/features/2017/05/24/existing-home-sales-slip-as-housing-shortage-weighs-on-activity-update.html [5/24/17]

3 – nytimes.com/2017/05/24/business/economy/fed-interest-rates-minutes.html [5/24/17]

4 – reuters.com/article/us-usa-stocks-idUSKBN18M18R [5/26/17]

5 – markets.wsj.com/us [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F26%2F16&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F26%2F16&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F26%2F16&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F25%2F12&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F25%2F12&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F25%2F12&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F25%2F07&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F25%2F07&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F25%2F07&x=0&y=0 [5/26/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [5/26/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [5/26/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

CONSUMER SENTIMENT DECLINES JUST A BIT

Ending May at a mark of 97.1, the University of Michigan’s consumer sentiment index fell 0.6 points from its preliminary reading for the month. Economists polled by MarketWatch had forecast the gauge to remain at 97.7.(1)

FEWER HOMES WERE BOUGHT IN APRIL

Both new and existing home sales tapered off last month. The National Association of Realtors said that resales fell 2.3% for April, while the Census Bureau announced an 11.4% retreat for new home purchases. While demand was high, tight supply reduced the number of buyers.(2)

FED MINUTES: Q1 SLUMP “LIKELY TO BE TRANSITORY”

With the Federal Open Market Committee expressing that exact opinion in the record of its May 2-3 meeting, investors saw little that would delay the central bank from raising interest rates in June. Still, the minutes sounded a cautious note. Fed policymakers “generally judged that it would be prudent to await additional evidence,” confirming that the winter economic slowdown was short lived prior to tightening further. The Bureau of Economic Analysis did revise its Q1 GDP estimate up to 1.2% last week, compared with an initial evaluation of 0.7%.(1,3)

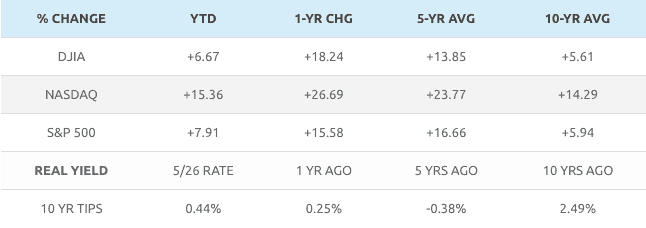

MORE RECORD HIGHS FOR NASDAQ, S&P 500

A great week for stocks saw gains of 2.08% for the Nasdaq Composite, 1.43% for the S&P 500, and 1.32% for the Dow Jones Industrial Average. Friday’s settlements: Dow, 21,080.28; S&P, 2,415.82; Nasdaq, 6,210.19. Friday’s S&P and Nasdaq closes were historic peaks for both indices. The S&P advanced for a seventh straight trading session to end the week, something it had not done since February. The Nasdaq 100 ended last week up 19.01% YTD.(4,5)

THIS WEEK: Monday is Memorial Day – U.S. stock and bond markets will be closed. Tuesday, the April personal spending report and PCE price index appear. A new Federal Reserve Beige Book and the NAR’s April pending home sales report surface Wednesday, plus earnings from Analog Devices, Hewlett-Packard Enterprise, Michael Kors, and Palo Alto Networks. Thursday is heavy on jobs data, as investors look at the ADP payroll and Challenger job-cut reports and the latest initial claims numbers; ISM’s May factory PMI also arrives, along with earnings from Boot Barn, Broadcom, Dollar General, Express, Five Below, and Lululemon Athletica. Friday, the Department of Labor issues its May employment report, and Hovnanian announces earnings.

Sources: wsj.com, bigcharts.com, treasury.gov – 5/26/17 (5,6,7,8)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

For more information about Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – marketwatch.com/economy-politics/calendars/economic [5/26/17]

2 – foxbusiness.com/features/2017/05/24/existing-home-sales-slip-as-housing-shortage-weighs-on-activity-update.html [5/24/17]

3 – nytimes.com/2017/05/24/business/economy/fed-interest-rates-minutes.html [5/24/17]

4 – reuters.com/article/us-usa-stocks-idUSKBN18M18R [5/26/17]

5 – markets.wsj.com/us [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F26%2F16&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F26%2F16&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F26%2F16&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F25%2F12&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F25%2F12&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F25%2F12&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=5%2F25%2F07&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=5%2F25%2F07&x=0&y=0 [5/26/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=5%2F25%2F07&x=0&y=0 [5/26/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [5/26/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [5/26/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.