WEEKLY QUOTE

“We learn by example and by direct experience because there are real limits to the adequacy of verbal instruction.”

– Malcolm Gladwell

WEEKLY TIP

Do you have a child heading off to college this fall? Financially, it may be time for his or her first credit card. One idea: have your son or daughter sign up for a basic, low-limit card through a credit union or independent bank and have the monthly statements sent to you.

WEEKLY RIDDLE

What are you able to keep after you give it to someone?

Last week’s riddle

I often stand straight and tall. I can illuminate your wall or hall. If you push me, I may fall. What am I?

Last week’s answer:

A candle.

FED DELIVERS EXPECTED & UNEXPECTED NEWS

As Wall Street anticipated, the Federal Reserve raised interest rates on June 14. The Federal Open Market Committee voted 8-1 to take the benchmark interest rate north by a quarter-point to the 1.00-1.25% range. The Fed also said it would begin to reduce its $4.5 trillion balance sheet at some point “this year” by slowing reinvestments. As a start, it will let $6 billion per month in Treasury holdings run off, along with $4 billion per month in agency debt and mortgage-linked securities. This implies upward pressure on long-term interest rates.(1,2)

RETAIL SALES, HEADLINE INFLATION BOTH RETREAT

The Consumer Price Index declined 0.1% in May, noted the Bureau of Labor Statistics; core consumer inflation rose 0.1%. A bigger May decline came for retail purchases – the Census Bureau said that they fell 0.3% even with car sales factored out.(3)

HOUSING STARTS SLIP

The Census Bureau’s new residential construction snapshot showed groundbreaking at an 8-month low, with total housing starts down 5.5% in May. Total building permits decelerated 4.9% last month to their slowest pace since April 2016.(4)

GAUGE OF SENTIMENT DESCENDS

In its preliminary June edition, the University of Michigan’s consumer sentiment index fell short of expectations. Economists, polled by Briefing.com, forecast a reading of 97.0 for the index, but it came in at 94.5.(3)

DOW 30 OUTPACES S&P 500

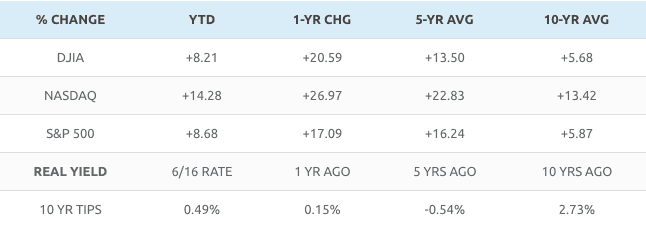

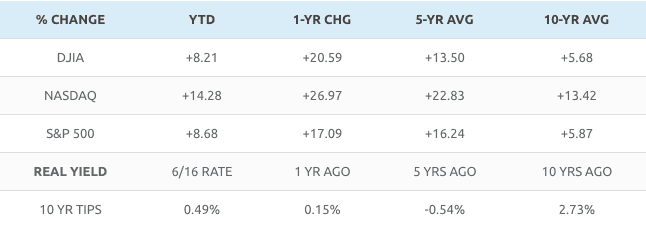

Rising 0.53% in five days, the Dow Jones Industrial Average ended the week at 21,384.28. The S&P 500 made a weekly advance of 0.06% to a Friday close of 2,433.15. Tech shares kept selling off, resulting in the Nasdaq Composite’s 0.90% weekly descent to a Friday settlement of 6,151.76. The Dow Jones Utility Average had the best week among consequential U.S. equity indices, rising 1.75%.(5)

THIS WEEK: Nothing major is scheduled for Monday. Tuesday, Adobe Systems, FedEx, La-Z-Boy, Lennar, and Red Hat all present earnings. Wednesday offers May existing home sales figures and earnings announcements from CarMax, Oracle, and Winnebago. Earnings news from Accenture, Barnes & Noble, Bed Bath & Beyond, Carnival, and Sonic arrives Thursday, plus new initial jobless claims numbers. Friday, investors consider May new home sales and Q2 results from Finish Line.

Sources: wsj.com, bigcharts.com, treasury.gov – 6/16/17 (5,6,7,8)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

For more news from Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – marketwatch.com/story/fed-raises-interest-rates-to-reduce-balance-sheet-this-year-2017-06-14 [6/14/17]

2 – businessinsider.com/federal-reserve-rate-hike-plan-to-unwind-45-trillion-balance-sheet-2017-6 [6/14/17]

3 – briefing.com/investor/calendars/economic/2017/06/12-16 [6/16/17]

4 – reuters.com/article/us-usa-economy-idUSKBN197277 [6/16/17]

5 – markets.wsj.com/us [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F16%2F16&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F16%2F16&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F16%2F16&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F15%2F12&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F15%2F12&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F15%2F12&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F15%2F07&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F15%2F07&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F15%2F07&x=0&y=0 [6/16/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [6/16/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/16/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

FED DELIVERS EXPECTED & UNEXPECTED NEWS

As Wall Street anticipated, the Federal Reserve raised interest rates on June 14. The Federal Open Market Committee voted 8-1 to take the benchmark interest rate north by a quarter-point to the 1.00-1.25% range. The Fed also said it would begin to reduce its $4.5 trillion balance sheet at some point “this year” by slowing reinvestments. As a start, it will let $6 billion per month in Treasury holdings run off, along with $4 billion per month in agency debt and mortgage-linked securities. This implies upward pressure on long-term interest rates.(1,2)

RETAIL SALES, HEADLINE INFLATION BOTH RETREAT

The Consumer Price Index declined 0.1% in May, noted the Bureau of Labor Statistics; core consumer inflation rose 0.1%. A bigger May decline came for retail purchases – the Census Bureau said that they fell 0.3% even with car sales factored out.(3)

HOUSING STARTS SLIP

The Census Bureau’s new residential construction snapshot showed groundbreaking at an 8-month low, with total housing starts down 5.5% in May. Total building permits decelerated 4.9% last month to their slowest pace since April 2016.(4)

GAUGE OF SENTIMENT DESCENDS

In its preliminary June edition, the University of Michigan’s consumer sentiment index fell short of expectations. Economists, polled by Briefing.com, forecast a reading of 97.0 for the index, but it came in at 94.5.(3)

DOW 30 OUTPACES S&P 500

Rising 0.53% in five days, the Dow Jones Industrial Average ended the week at 21,384.28. The S&P 500 made a weekly advance of 0.06% to a Friday close of 2,433.15. Tech shares kept selling off, resulting in the Nasdaq Composite’s 0.90% weekly descent to a Friday settlement of 6,151.76. The Dow Jones Utility Average had the best week among consequential U.S. equity indices, rising 1.75%.(5)

THIS WEEK: Nothing major is scheduled for Monday. Tuesday, Adobe Systems, FedEx, La-Z-Boy, Lennar, and Red Hat all present earnings. Wednesday offers May existing home sales figures and earnings announcements from CarMax, Oracle, and Winnebago. Earnings news from Accenture, Barnes & Noble, Bed Bath & Beyond, Carnival, and Sonic arrives Thursday, plus new initial jobless claims numbers. Friday, investors consider May new home sales and Q2 results from Finish Line.

Sources: wsj.com, bigcharts.com, treasury.gov – 6/16/17 (5,6,7,8)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

For more news from Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – marketwatch.com/story/fed-raises-interest-rates-to-reduce-balance-sheet-this-year-2017-06-14 [6/14/17]

2 – businessinsider.com/federal-reserve-rate-hike-plan-to-unwind-45-trillion-balance-sheet-2017-6 [6/14/17]

3 – briefing.com/investor/calendars/economic/2017/06/12-16 [6/16/17]

4 – reuters.com/article/us-usa-economy-idUSKBN197277 [6/16/17]

5 – markets.wsj.com/us [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F16%2F16&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F16%2F16&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F16%2F16&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F15%2F12&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F15%2F12&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F15%2F12&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F15%2F07&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F15%2F07&x=0&y=0 [6/16/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F15%2F07&x=0&y=0 [6/16/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [6/16/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/16/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.