Gen Y is doing some things right when it comes to saving & investing.

Financially, Generation Y is often criticized for being risk averse & unaware. Is this truth, or is it fiction? In some instances, pure fiction. Here are some good financial habits common to millennials – habits their parents and grandparents might do well to emulate.

Millennials are good savers. Last year, Bankrate found that about 60% of American adults younger than 30 were saving 5% or more of their paychecks. Only around half of the adults older than 30 were doing so. This difference is even more interesting when you think about the overhanging college debt faced by many millennials and the comparatively greater incomes of older workers. Twenty-nine percent of millennials were saving 10% of their incomes last year, right in line with the average for other generations (28%).(1)

More from Adams Wealth Management.

June 26, 2017 Weekly Economic Update

Millennials value experiences more than possessions. Data affirms this view – in a Harris Poll of millennials, 78% of those surveyed said that they would rather spend their money on an experience or an event rather than some pricy material item. In contrast, some members of Gen X and the baby boom generation have spent too much money on depreciating consumer goods, with too little to show for it.(2)

Relatively speaking, Gen Y is less prone to drawing down its retirement funds. In the 2016 Transamerica Retirement Survey, just 22% of Gen Y workplace retirement plan participants said that they had tapped into a plan for a loan or a withdrawal. That compares with 28% of boomers and 30% of those in Generation X.(3)

Millennials are directing money into equity investments at a relatively early age. As Investors Business Daily reported in May, the median age at which millennials begin investing in these vehicles is 23. For Generation X, it was 26. Younger baby boomers made their first such investments at a median age of 32, and older baby boomers did so at a median age of 35. While roughly one-third of millennials are invested in equities, their comparative head start may help them compensate.(4)

They also embrace technology in a way that some boomers do not. The Internet is filled with financial information, and millennials may go out and learn on their own about investment types, tax laws, and saving and investing resources rather than waiting for a tax, financial, or human resources professional to explain things to them. While a little knowledge can be dangerous, having some information is better than none.

In short, the members of Generation Y are doing some things that may really pay off for their financial futures. Other generations might want to take notice.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. This information has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All indices are unmanaged and are not illustrative of any particular investment.

Citations.

1 – cnbc.com/2016/03/28/are-you-as-good-at-saving-as-millennials.html [3/28/16]

2 – money.usnews.com/money/personal-finance/articles/2016-10-07/5-finance-lessons-baby-boomers-could-learn-from-millennials [10/7/16]

4 – investors.com/etfs-and-funds/mutual-funds/why-many-millennials-retirement-savings-will-be-more-than-twice-baby-boomers/ [5/15/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

SEPTEMBER BRINGS A MEDIOCRE JOBS REPORT

The Department of Labor’s latest employment snapshot shows payrolls expanding by 156,000 net new jobs in August. This was a retreat from the job gains of 200,000+ reported in both June and July. The headline jobless rate ticked up to 4.4%; the U-6 rate, which factors in the underemployed, held steady at 8.6%. Annualized wage growth remained stuck at 2.5%.(1)

POSITIVE NEWS FROM MAIN STREET

Climbing once again, the Conference Board’s consumer confidence index ascended 2.9 points to 122.9 in August. That topped the forecast of economists surveyed by MarketWatch, who anticipated a 122.5 reading. Additionally, the Department of Commerce said that consumer spending advanced 0.3% in July, up from 0.2% in June. Household incomes rose 0.4% in July; they were unchanged in June.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

ISM: FACTORY SECTOR IN FINE SHAPE

Can the Institute for Supply Management’s manufacturing purchasing manager index top 60 soon? It rose 2.5 points to 58.8 in August, indicating a high degree of expansion. This was the best reading on the index since April 2011. So far in 2017, the factory PMI has averaged a reading of 56.7.(3)

WALL STREET ENDS THE SUMMER WITH A RALLY

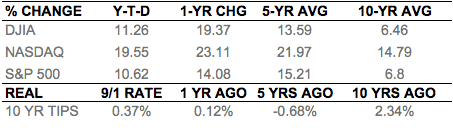

All three major U.S. stock benchmarks gained ground last week. Out in front was the Nasdaq Composite, which added 2.71% in five days to settle at 6,435.33 Friday. The S&P 500 rose 1.37% for the week, closing September 1 at 2,476.55. As for the Dow Jones Industrial Average, it moved north 0.80% to 21,987.56. The CBOE VIX dropped 10.02% in five days to 10.15 at Friday’s closing bell. One last detail worth noting: the NYSE Arca Biotech index jumped 8.98% last week to go up 37.65% on the year.(4)

THIS WEEK: Wall Street is closed Monday for the Labor Day holiday. Investors consider earnings from Casey’s General Stores, Hewlett Packard Enterprise, and the Hudson’s Bay Company on Tuesday, plus a report on July factory orders. A new Federal Reserve Beige Book and the August ISM service sector PMI arrive Wednesday, along with earnings releases from Fred’s and Navistar. Thursday, earnings arrive from Barnes & Noble, Dell Technologies, Hovnanian Enterprises, and Verifone, and a new initial unemployment claims report surfaces. On Friday, Kroger reports quarterly results.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – foxbusiness.com/markets/2017/09/01/us-hiring-cools-off-with-156000-new-jobs-in-august.html [9/1/17]

2 – marketwatch.com/economy-politics/calendars/economic [9/1/17]

3 – instituteforsupplymanagement.org/ISMReport/MfgROB.cfm [9/1/17]

4 – markets.wsj.com/us [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F1%2F16&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F1%2F16&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F1%2F16&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F31%2F12&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F31%2F12&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F31%2F12&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F31%2F07&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F31%2F07&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F31%2F07&x=0&y=0 [9/1/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/1/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/1/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.