WEEKLY QUOTE

“Whatever you are by nature, keep to it; never desert your line of talent. Be what nature intended you for and you will succeed.”

– Sydney Smith

WEEKLY TIP

If you are in your twenties, saving should be your top financial goal: saving for emergencies, for investment, and for retirement.

WEEKLY RIDDLE

What is the only type of “worm” that will never risk ending up on a hook?

Last week’s riddle

They had weight in their stomachs, tall trees on their backs, nails in their ribs, yet feet they lacked. The world saw thousands of them centuries ago.

Last week’s answer:

Sailing ships.

LATEST JOBS REPORT BRINGS GOOD NEWS

U.S. payrolls swelled with 209,000 net new workers in July, according to the Department of Labor. That beat the 183,000 estimate by analysts surveyed by Reuters. About 53,000 of the hires were at restaurants and bars, with another 49,000 in the professional and business services category. While yearly wage growth remained at 2.5%, the headline jobless rate ticked back down to 4.3%. The U-6 rate (which includes the underemployed) stayed at 8.6%.(1)

A MEAGER GAIN IN CONSUMER SPENDING

The 0.1% June advance reported by the Department of Commerce matched the (low) expectations of economists surveyed by MarketWatch. Consumer incomes were flat in June; the same group of forecasters thought they would improve 0.3%. Personal spending had increased 0.2% in May, with income up 0.3%.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

ISM PMIS SHOW CONTINUED BUSINESS GROWTH

In June, both purchasing manager indices at the Institute for Supply Management were above 57. Their July readings were lower, but still indicated significant sector expansion as both numbers were well above 50. The manufacturing PMI fell 1.5 points to 56.3, and the service sector PMI dropped 3.5 points to a mark of 53.9.(3)

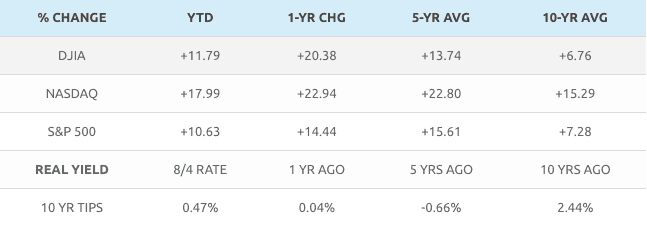

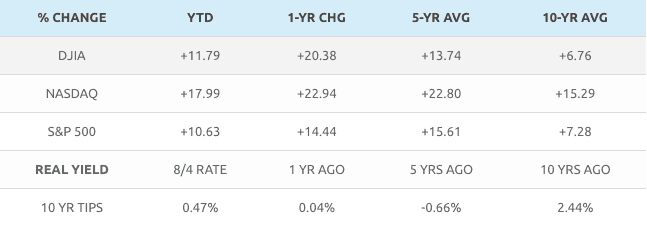

BLUE CHIPS TOP 22,000

In a mixed week for the major Wall Street indices, the Dow Jones Industrial Average seized the headlines. It reached a new milestone, thanks to its 5-day advance of 1.20%, settling Friday at 22,092.81. The S&P 500 finished the week at 2,476.83, adding 0.19%; the Nasdaq Composite fell 0.36% to settle at 6,351.56 Friday.(4)

THIS WEEK: Avis Budget Group, CBS, Marriott International, and Tyson Foods post earnings Monday. Andeavor, CVS Health, Dean Foods, Discovery Communications, GoDaddy, Green Dot, Hertz Global, Hostess Brands, Icahn Enterprises, Lions Gate, Michael Kors, Monster Beverage, Norwegian Cruise Line, Priceline, Ralph Lauren, Sunoco, TripAdvisor, Valeant Pharmaceuticals, Vivint Solar, and Walt Disney Co. present earnings news on Tuesday. Crocs, Kelly Services, Live Nation, Office Depot, Planet Fitness, Real Goods Solar, Starwood Hotels & Resorts, 21st Century Fox, Weibo, and Wendy’s offer earnings Wednesday. On Thursday, the July PPI and a new initial claims report arrive, plus earnings from Blue Apron, Brinker International, Camping World, Kohl’s, Macy’s, Nordstrom, Nvidia, and Snap. On Friday, the July CPI appears, and JC Penney reports Q2 results.

Sources: wsj.com, bigcharts.com, treasury.gov – 8/4/17 (4,5,6,7)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2017/08/04/us-nonfarm-payrolls-july-2017.html [8/4/17]

2 – marketwatch.com/economy-politics/calendars/economic [8/4/17]

3 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?SSO=1 [8/3/17]

4 – markets.wsj.com/us [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F4%2F16&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F4%2F16&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F4%2F16&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F3%2F12&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F3%2F12&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F3%2F12&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F3%2F07&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F3%2F07&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F3%2F07&x=0&y=0 [8/4/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [8/4/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [8/4/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

LATEST JOBS REPORT BRINGS GOOD NEWS

U.S. payrolls swelled with 209,000 net new workers in July, according to the Department of Labor. That beat the 183,000 estimate by analysts surveyed by Reuters. About 53,000 of the hires were at restaurants and bars, with another 49,000 in the professional and business services category. While yearly wage growth remained at 2.5%, the headline jobless rate ticked back down to 4.3%. The U-6 rate (which includes the underemployed) stayed at 8.6%.(1)

A MEAGER GAIN IN CONSUMER SPENDING

The 0.1% June advance reported by the Department of Commerce matched the (low) expectations of economists surveyed by MarketWatch. Consumer incomes were flat in June; the same group of forecasters thought they would improve 0.3%. Personal spending had increased 0.2% in May, with income up 0.3%.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

ISM PMIS SHOW CONTINUED BUSINESS GROWTH

In June, both purchasing manager indices at the Institute for Supply Management were above 57. Their July readings were lower, but still indicated significant sector expansion as both numbers were well above 50. The manufacturing PMI fell 1.5 points to 56.3, and the service sector PMI dropped 3.5 points to a mark of 53.9.(3)

BLUE CHIPS TOP 22,000

In a mixed week for the major Wall Street indices, the Dow Jones Industrial Average seized the headlines. It reached a new milestone, thanks to its 5-day advance of 1.20%, settling Friday at 22,092.81. The S&P 500 finished the week at 2,476.83, adding 0.19%; the Nasdaq Composite fell 0.36% to settle at 6,351.56 Friday.(4)

THIS WEEK: Avis Budget Group, CBS, Marriott International, and Tyson Foods post earnings Monday. Andeavor, CVS Health, Dean Foods, Discovery Communications, GoDaddy, Green Dot, Hertz Global, Hostess Brands, Icahn Enterprises, Lions Gate, Michael Kors, Monster Beverage, Norwegian Cruise Line, Priceline, Ralph Lauren, Sunoco, TripAdvisor, Valeant Pharmaceuticals, Vivint Solar, and Walt Disney Co. present earnings news on Tuesday. Crocs, Kelly Services, Live Nation, Office Depot, Planet Fitness, Real Goods Solar, Starwood Hotels & Resorts, 21st Century Fox, Weibo, and Wendy’s offer earnings Wednesday. On Thursday, the July PPI and a new initial claims report arrive, plus earnings from Blue Apron, Brinker International, Camping World, Kohl’s, Macy’s, Nordstrom, Nvidia, and Snap. On Friday, the July CPI appears, and JC Penney reports Q2 results.

Sources: wsj.com, bigcharts.com, treasury.gov – 8/4/17 (4,5,6,7)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2017/08/04/us-nonfarm-payrolls-july-2017.html [8/4/17]

2 – marketwatch.com/economy-politics/calendars/economic [8/4/17]

3 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?SSO=1 [8/3/17]

4 – markets.wsj.com/us [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F4%2F16&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F4%2F16&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F4%2F16&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F3%2F12&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F3%2F12&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F3%2F12&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F3%2F07&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F3%2F07&x=0&y=0 [8/4/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F3%2F07&x=0&y=0 [8/4/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [8/4/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [8/4/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.