WEEKLY QUOTE

“People need to be reminded more often than they need to be instructed.”

– Samuel Johnson

WEEKLY TIP

Did you just get a raise or a promotion? Beware of lifestyle creep – the tendency to spend more when you make more. Be sure to direct appropriate amounts of your increased income into savings and investments.

WEEKLY RIDDLE

Take three letters, arrange them one way, and you have a word for “conflict.” Arrange them another way, and you have a word for “uncooked.” What are the three letters?

Last week’s riddle

I walk and run on all fours, and I laugh while stalking my prey, but I seldom go in for the kill. What animal am I?

Last week’s answer:

A hyena.

INFLATION SPIKED IN AUGUST

Economists had long assumed consumer prices would rise abruptly at some point, and they certainly did last month. The Consumer Price Index increased 0.4% in August, its biggest one-month advance since its 0.6% gain in January. Higher gas prices were a major influence: they rose 6.3% for August. Core inflation was up 0.2% after four straight 0.1% monthly gains. Yearly consumer inflation is now at 1.9%. Wholesale inflation, as measured by the Producer Price Index, rose 0.2% in August to an annualized pace of 2.4%. (1,2)

RETAIL SALES STAGE A LATE-SUMMER RETREAT

Americans cut back on retail purchases during August. Retail sales declined 0.2%, a disappointment after the 0.3% July gain. The silver lining: the core number, minus gasoline and auto buying, rose 0.2%.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

September 2017 Monthly Economic Update

Has Your Identity Been Stolen?

CONSUMER SENTIMENT INDEX DIPS SLIGHTLY

The University of Michigan’s twice-monthly barometer of the American consumer’s mood fell 1.5 points in its initial September edition. At a mark of 95.3, the index was still 4.5% above where it was a year earlier. While the index’s current conditions component hit its highest level in nearly 17 years, 9% of survey respondents believed that Hurricanes Irma and Harvey had hurt the overall economy.(3)

A MILESTONE FOR THE S&P 500

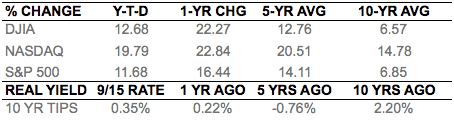

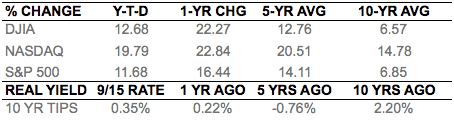

Recording its highest close ever, the broad equities benchmark settled at 2,500.23 Friday, capping off a 5-day gain of 1.58% and attaining its third round-number highpoint of 2017. The Nasdaq Composite advanced 1.39% for the week to 6,448.47. Setting the pace for the big three, the Dow Jones Industrial Average added 2.16% last week to close Friday at 22,268.34. The Russell 2000 had an even better week, rising 2.31% to 1,431.71; the CBOE VIX again neared historic lows, dropping 16.09% in five days to 10.17.(4,5)

THIS WEEK: On Monday, Steelcase shares quarterly results. Earnings calls Tuesday include announcements from Adobe Systems, AutoZone, Bed Bath & Beyond, and FedEx, and investors will also look at the Census Bureau’s August report on new residential construction. Wednesday, the Federal Reserve could reveal plans for unwinding its balance sheet as it wraps up a monetary policy meeting; Wall Street will also consider August existing home sales numbers and Q3 results from General Mills. A new initial unemployment claims report arrives Thursday. CarMax and Finish Line present earnings Friday.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2017/09/14/us-consumer-price-index-aug-2017.html [9/14/17]

2 – investing.com/economic-calendar/ [9/15/17]

3 – sca.isr.umich.edu/ [9/15/17]

4 – bloomberg.com/news/articles/2017-09-15/u-s-stocks-reach-another-milestone-as-s-p-500-vaults-past-2-500 [9/15/17]

5 – markets.wsj.com/us [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F15%2F16&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F15%2F16&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F15%2F16&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F14%2F12&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F14%2F12&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F14%2F12&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F14%2F07&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F14%2F07&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F14%2F07&x=0&y=0 [9/15/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/15/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/15/17]

INFLATION SPIKED IN AUGUST

Economists had long assumed consumer prices would rise abruptly at some point, and they certainly did last month. The Consumer Price Index increased 0.4% in August, its biggest one-month advance since its 0.6% gain in January. Higher gas prices were a major influence: they rose 6.3% for August. Core inflation was up 0.2% after four straight 0.1% monthly gains. Yearly consumer inflation is now at 1.9%. Wholesale inflation, as measured by the Producer Price Index, rose 0.2% in August to an annualized pace of 2.4%. (1,2)

RETAIL SALES STAGE A LATE-SUMMER RETREAT

Americans cut back on retail purchases during August. Retail sales declined 0.2%, a disappointment after the 0.3% July gain. The silver lining: the core number, minus gasoline and auto buying, rose 0.2%.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

September 2017 Monthly Economic Update

Has Your Identity Been Stolen?

CONSUMER SENTIMENT INDEX DIPS SLIGHTLY

The University of Michigan’s twice-monthly barometer of the American consumer’s mood fell 1.5 points in its initial September edition. At a mark of 95.3, the index was still 4.5% above where it was a year earlier. While the index’s current conditions component hit its highest level in nearly 17 years, 9% of survey respondents believed that Hurricanes Irma and Harvey had hurt the overall economy.(3)

A MILESTONE FOR THE S&P 500

Recording its highest close ever, the broad equities benchmark settled at 2,500.23 Friday, capping off a 5-day gain of 1.58% and attaining its third round-number highpoint of 2017. The Nasdaq Composite advanced 1.39% for the week to 6,448.47. Setting the pace for the big three, the Dow Jones Industrial Average added 2.16% last week to close Friday at 22,268.34. The Russell 2000 had an even better week, rising 2.31% to 1,431.71; the CBOE VIX again neared historic lows, dropping 16.09% in five days to 10.17.(4,5)

THIS WEEK: On Monday, Steelcase shares quarterly results. Earnings calls Tuesday include announcements from Adobe Systems, AutoZone, Bed Bath & Beyond, and FedEx, and investors will also look at the Census Bureau’s August report on new residential construction. Wednesday, the Federal Reserve could reveal plans for unwinding its balance sheet as it wraps up a monetary policy meeting; Wall Street will also consider August existing home sales numbers and Q3 results from General Mills. A new initial unemployment claims report arrives Thursday. CarMax and Finish Line present earnings Friday.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2017/09/14/us-consumer-price-index-aug-2017.html [9/14/17]

2 – investing.com/economic-calendar/ [9/15/17]

3 – sca.isr.umich.edu/ [9/15/17]

4 – bloomberg.com/news/articles/2017-09-15/u-s-stocks-reach-another-milestone-as-s-p-500-vaults-past-2-500 [9/15/17]

5 – markets.wsj.com/us [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F15%2F16&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F15%2F16&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F15%2F16&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F14%2F12&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F14%2F12&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F14%2F12&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F14%2F07&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F14%2F07&x=0&y=0 [9/15/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F14%2F07&x=0&y=0 [9/15/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/15/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/15/17]