WEEKLY QUOTE

“Too much rest is rust.”

– Sir Walter Scott

WEEKLY TIP

Small business owners applying for home loans should know that if they own 25% or more of the voting stock of a corporation, they are technically classified as self-employed. They will need to provide the lender with a corporate tax return.

WEEKLY RIDDLE

What time of day can be written the same way forwards or backwards?

Last week’s riddle

A Saab travels along an avenue at 50mph, a Subaru at 30mph. The Subaru passes by the Saab, without speeding up to do so. How is this possible?

Last week’s answer:

They are traveling in opposite directions.

SEPTEMBER SAW SLIGHTLY MORE HOME BUYING

Existing home sales advanced 0.7% last month, according to a National Association of Realtors report. This gain broke a 3-month streak of retreats. Single-family home sales rose 1.1%. Housing inventory increased 1.6% last month, but it was still 6.4% under year-ago levels.(1)

GROUNDBREAKING FALLS TO A 12-MONTH LOW

Housing starts slumped 4.7% in September, the Census Bureau reported last week. Building permits also declined, decreasing 4.5%. Fall hurricanes may have slowed construction activity, but investment in homebuilding was also down 7.3% year-over-year during the second quarter.(2)

DOW SURGES ABOVE 23,000; GOLD DROPS

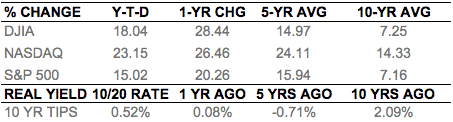

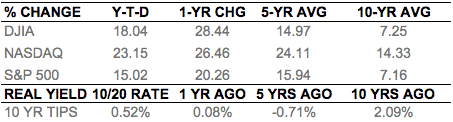

Across last week, the Dow Industrials climbed 2.00% to 23,328.63. The Nasdaq Composite advanced 0.35% to 6,629.05, while the S&P 500 gained 0.86% to 2,575.21. Gold had its worst week in a month, slipping 1.9% to a Friday COMEX settlement of $1,280.50.(3,4)

THIS WEEK: Monday’s earnings parade includes news from Halliburton, Hasbro, Kimberly-Clark, Lennox International, Logitech, Seagate, and VF Corporation. Tuesday, earnings arrive from 3M, Akamai, Ameriprise Financial, AT&T, Biogen, Canon, Capital One, Caterpillar, Chipotle, Corning, Discover Financial Services, Express Scripts, Fiat Chrysler, Fifth Third, General Motors, Infosys, JetBlue, Eli Lilly, Lockheed Martin, McDonalds, Novartis, Pentair, Regions Financial, Ryder Systems, Sherwin-Williams, Stanley Black & Decker, and TD Ameritrade. September new home sales numbers appear Wednesday, plus earnings from Aflac, Alaska Air, Ally Financial, Amgen, Anthem, Avery Dennison, Boeing, Coca-Cola, Freeport-McMoRan, GlaxoSmithKline, W.R. Grace, Ingersoll Rand, Norfolk Southern, Northrop Grumman, O’Reilly, Penske, Public Storage, Sirius XM, Six Flags, SkyWest Airlines, Suncor, Visa, and Walgreens Boots Alliance. Thursday’s earnings include Alphabet, Altria, Amazon, American Airlines, Anheuser-Busch, Baidu, Bayer, Bristol-Myers, Celgene, Chubb, Conoco-Phillips, Dunkin’ Brands, Ford Motor Co., Gilead Sciences, The Hartford, HealthSouth, Hershey, Hilton Worldwide, IMAX, Intel, Marathon Petroleum, Mattel, Microsoft, Nokia, Pinnacle Foods, Praxair, Raytheon, Stryker, Twitter, Union Pacific, UPS, Valero Energy, Waste Management, and Xerox; September pending home sales and new initial claims figures also emerge. The first estimate of Q3 GDP and the month’s final University of Michigan consumer sentiment index surface Friday, plus earnings from Chevron, Colgate-Palmolive, Exxon Mobil, Goodyear, Huntsman, Merck, Phillips 66, Rockwell Collins, and Weyerhaeuser.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – 247wallst.com/housing/2017/10/20/september-existing-home-sales-inventory-post-first-gains-in-4-months/ [10/20/17]

2 – reuters.com/article/us-usa-economy-housingstarts/u-s-housing-starts-hit-one-year-low-building-permits-tumble-idUSKBN1CN1QS [10/20/17]

3 – markets.wsj.com/us [10/20/17]

4 – marketwatch.com/story/gold-drops-to-2-week-low-as-dollar-gains-strength-on-tax-reform-hopes-2017-10-20/ [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F20%2F16&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F20%2F16&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F20%2F16&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F19%2F12&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F19%2F12&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F19%2F12&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F19%2F07&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F19%2F07&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F19%2F07&x=0&y=0 [10/20/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [10/20/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [10/20/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

SEPTEMBER SAW SLIGHTLY MORE HOME BUYING

Existing home sales advanced 0.7% last month, according to a National Association of Realtors report. This gain broke a 3-month streak of retreats. Single-family home sales rose 1.1%. Housing inventory increased 1.6% last month, but it was still 6.4% under year-ago levels.(1)

GROUNDBREAKING FALLS TO A 12-MONTH LOW

Housing starts slumped 4.7% in September, the Census Bureau reported last week. Building permits also declined, decreasing 4.5%. Fall hurricanes may have slowed construction activity, but investment in homebuilding was also down 7.3% year-over-year during the second quarter.(2)

DOW SURGES ABOVE 23,000; GOLD DROPS

Across last week, the Dow Industrials climbed 2.00% to 23,328.63. The Nasdaq Composite advanced 0.35% to 6,629.05, while the S&P 500 gained 0.86% to 2,575.21. Gold had its worst week in a month, slipping 1.9% to a Friday COMEX settlement of $1,280.50.(3,4)

THIS WEEK: Monday’s earnings parade includes news from Halliburton, Hasbro, Kimberly-Clark, Lennox International, Logitech, Seagate, and VF Corporation. Tuesday, earnings arrive from 3M, Akamai, Ameriprise Financial, AT&T, Biogen, Canon, Capital One, Caterpillar, Chipotle, Corning, Discover Financial Services, Express Scripts, Fiat Chrysler, Fifth Third, General Motors, Infosys, JetBlue, Eli Lilly, Lockheed Martin, McDonalds, Novartis, Pentair, Regions Financial, Ryder Systems, Sherwin-Williams, Stanley Black & Decker, and TD Ameritrade. September new home sales numbers appear Wednesday, plus earnings from Aflac, Alaska Air, Ally Financial, Amgen, Anthem, Avery Dennison, Boeing, Coca-Cola, Freeport-McMoRan, GlaxoSmithKline, W.R. Grace, Ingersoll Rand, Norfolk Southern, Northrop Grumman, O’Reilly, Penske, Public Storage, Sirius XM, Six Flags, SkyWest Airlines, Suncor, Visa, and Walgreens Boots Alliance. Thursday’s earnings include Alphabet, Altria, Amazon, American Airlines, Anheuser-Busch, Baidu, Bayer, Bristol-Myers, Celgene, Chubb, Conoco-Phillips, Dunkin’ Brands, Ford Motor Co., Gilead Sciences, The Hartford, HealthSouth, Hershey, Hilton Worldwide, IMAX, Intel, Marathon Petroleum, Mattel, Microsoft, Nokia, Pinnacle Foods, Praxair, Raytheon, Stryker, Twitter, Union Pacific, UPS, Valero Energy, Waste Management, and Xerox; September pending home sales and new initial claims figures also emerge. The first estimate of Q3 GDP and the month’s final University of Michigan consumer sentiment index surface Friday, plus earnings from Chevron, Colgate-Palmolive, Exxon Mobil, Goodyear, Huntsman, Merck, Phillips 66, Rockwell Collins, and Weyerhaeuser.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – 247wallst.com/housing/2017/10/20/september-existing-home-sales-inventory-post-first-gains-in-4-months/ [10/20/17]

2 – reuters.com/article/us-usa-economy-housingstarts/u-s-housing-starts-hit-one-year-low-building-permits-tumble-idUSKBN1CN1QS [10/20/17]

3 – markets.wsj.com/us [10/20/17]

4 – marketwatch.com/story/gold-drops-to-2-week-low-as-dollar-gains-strength-on-tax-reform-hopes-2017-10-20/ [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F20%2F16&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F20%2F16&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F20%2F16&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F19%2F12&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F19%2F12&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F19%2F12&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F19%2F07&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F19%2F07&x=0&y=0 [10/20/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F19%2F07&x=0&y=0 [10/20/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [10/20/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [10/20/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.