WEEKLY QUOTE

“It’s a rare person who wants to hear what he doesn’t want to hear.”

– Dick Cavett

WEEKLY TIP

One way to save money on auto insurance premiums: raise your deductible. In some cases, that could lower your yearly premium by 10% or more. Of course, you must be able to handle the larger deductible if damage occurs.

WEEKLY RIDDLE

Isabella’s mother has three children. The first child’s name is April. The second child’s name is May. What is the third child’s name?

Last week’s riddle

What time of day can be written the same way forwards or backwards?

Last week’s answer:

Noon.

THIRD QUARTER SAW SOLID ECONOMIC GROWTH

Friday, the Bureau of Economic Analysis issued its first estimate of Q3 GDP: 3.0%. Its report showed increases in personal spending and business stockpiling offsetting a dip in home building. The economy grew 3% or more for a second straight quarter for the first time since 2014. Growth has averaged 2.2% per quarter since the end of the recession in 2009.(1)

NEW HOME SALES LEAP UP

Unexpectedly, new home buying increased by 18.9% in September; the Census Bureau said that the sales pace reached a ten-year peak. The surge put the year-over-year gain for new home purchases at 17.0%.(2)

CONSUMERS RETAIN THEIR OPTIMISM

The University of Michigan’s consumer sentiment index finished October at 100.7, just 0.1 points beneath the forecast of economists polled by MarketWatch. That very high reading was below the initial October mark of 101.1, however.(3)

NASDAQ CLIMBS 144 POINTS IN A DAY

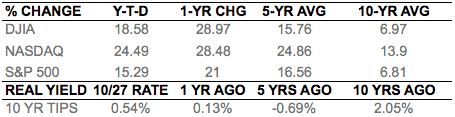

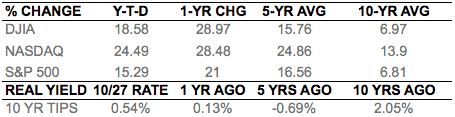

Impressive earnings news sent the tech benchmark up 2.20% Friday to a close of 6,701.26; it gained 1.09% for the week. The S&P 500 added 0.23% last week, settling Friday at 2,581.07; the Dow Industrials rose 0.45% to 23,434.19 in the same span.(4)

THIS WEEK: Monday, September’s personal spending numbers and PCE price index appear, along with earnings from CNA Financial, Edison International, Kemper, Loews, Mondelez, Nautilus, Rent-A-Center, and Sempra Energy. The Conference Board’s latest consumer confidence index surfaces Tuesday, plus earnings from Aetna, Anadarko Petroleum, Archer Daniels Midland, BP, Cummins, Electronic Arts, Kellogg, MasterCard, Pfizer, Regis Corp., Under Armour, and Voya Financial. On Wednesday, a Federal Reserve policy statement, the October ADP payrolls report, and a new ISM factory PMI arrive; earnings emerge from Allergan, Allstate, Brinker International, Clorox, Estee Lauder, Facebook, Garmin, GoPro, Hanesbrands, Honda, Kraft Heinz, La Quinta Holdings, Marathon Oil, MetLife, Molson Coors, Prudential Financial, Qualcomm, Shake Shack, Symantec, Tesla, Transocean, and Yelp. Thursday’s earnings parade includes Activision Blizzard, Alibaba, AMC Networks, Apple, AutoNation, CBS, Chesapeake Energy, Cigna, Exelon, Fluor, Genworth Financial, Hyatt, Live Nation, Motorola Solutions, Pandora Media, Parker-Hannifin, Ralph Lauren, Starbucks, Vulcan Materials, Wayfair, and Yum! Brands. The Department of Labor’s October jobs report rolls out Friday as well as the October ISM services PMI and earnings from Bloomin’ Brands, CBRE Group, Duke Energy, Revlon, and Shell Midstream Partners.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – tinyurl.com/ybkdsjh3 [10/27/17]

2 – marketwatch.com/story/new-home-sales-roar-to-a-10-year-high-in-september-2017-10-25 [10/25/17]

3 – marketwatch.com/economy-politics/calendars/economic [10/27/17]

4 – markets.wsj.com/us [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F27%2F16&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F27%2F16&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F27%2F16&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F26%2F12&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F26%2F12&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F26%2F12&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F26%2F07&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F26%2F07&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F26%2F07&x=0&y=0 [10/27/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [10/27/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [10/27/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

THIRD QUARTER SAW SOLID ECONOMIC GROWTH

Friday, the Bureau of Economic Analysis issued its first estimate of Q3 GDP: 3.0%. Its report showed increases in personal spending and business stockpiling offsetting a dip in home building. The economy grew 3% or more for a second straight quarter for the first time since 2014. Growth has averaged 2.2% per quarter since the end of the recession in 2009.(1)

NEW HOME SALES LEAP UP

Unexpectedly, new home buying increased by 18.9% in September; the Census Bureau said that the sales pace reached a ten-year peak. The surge put the year-over-year gain for new home purchases at 17.0%.(2)

CONSUMERS RETAIN THEIR OPTIMISM

The University of Michigan’s consumer sentiment index finished October at 100.7, just 0.1 points beneath the forecast of economists polled by MarketWatch. That very high reading was below the initial October mark of 101.1, however.(3)

NASDAQ CLIMBS 144 POINTS IN A DAY

Impressive earnings news sent the tech benchmark up 2.20% Friday to a close of 6,701.26; it gained 1.09% for the week. The S&P 500 added 0.23% last week, settling Friday at 2,581.07; the Dow Industrials rose 0.45% to 23,434.19 in the same span.(4)

THIS WEEK: Monday, September’s personal spending numbers and PCE price index appear, along with earnings from CNA Financial, Edison International, Kemper, Loews, Mondelez, Nautilus, Rent-A-Center, and Sempra Energy. The Conference Board’s latest consumer confidence index surfaces Tuesday, plus earnings from Aetna, Anadarko Petroleum, Archer Daniels Midland, BP, Cummins, Electronic Arts, Kellogg, MasterCard, Pfizer, Regis Corp., Under Armour, and Voya Financial. On Wednesday, a Federal Reserve policy statement, the October ADP payrolls report, and a new ISM factory PMI arrive; earnings emerge from Allergan, Allstate, Brinker International, Clorox, Estee Lauder, Facebook, Garmin, GoPro, Hanesbrands, Honda, Kraft Heinz, La Quinta Holdings, Marathon Oil, MetLife, Molson Coors, Prudential Financial, Qualcomm, Shake Shack, Symantec, Tesla, Transocean, and Yelp. Thursday’s earnings parade includes Activision Blizzard, Alibaba, AMC Networks, Apple, AutoNation, CBS, Chesapeake Energy, Cigna, Exelon, Fluor, Genworth Financial, Hyatt, Live Nation, Motorola Solutions, Pandora Media, Parker-Hannifin, Ralph Lauren, Starbucks, Vulcan Materials, Wayfair, and Yum! Brands. The Department of Labor’s October jobs report rolls out Friday as well as the October ISM services PMI and earnings from Bloomin’ Brands, CBRE Group, Duke Energy, Revlon, and Shell Midstream Partners.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – tinyurl.com/ybkdsjh3 [10/27/17]

2 – marketwatch.com/story/new-home-sales-roar-to-a-10-year-high-in-september-2017-10-25 [10/25/17]

3 – marketwatch.com/economy-politics/calendars/economic [10/27/17]

4 – markets.wsj.com/us [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F27%2F16&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F27%2F16&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F27%2F16&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F26%2F12&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F26%2F12&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F26%2F12&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=10%2F26%2F07&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=10%2F26%2F07&x=0&y=0 [10/27/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=10%2F26%2F07&x=0&y=0 [10/27/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [10/27/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [10/27/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.