WEEKLY QUOTE

“Humor is just another defense against the universe.”

– Mel Brooks

WEEKLY TIP

The classic way to balance a household budget is to reduce expenses. But what about earning more money? In this strong economy, consider asking for a raise at work or creating another income stream.

WEEKLY RIDDLE

They can darken the dark; they can also lighten the intensity of the light. What are they?

Last week’s riddle

Wherever you notice me, I’ll be in a row. My name has no letters, but my initials are MNO. What am I?

Last week’s answer:

The 6 key on a phone keypad.

YEARLY INFLATION BACK AT 2.0%

Consumer costs ticked up just 0.1% in October, according to the Department of Labor. The marginal monthly gain left the annualized increase in the headline Consumer Price Index at 2.0%, down from 2.2% a month earlier. The core CPI has risen 1.8% in 12 months. Gasoline prices influenced the October headline number: they fell 2.4% in October after a 13.1% September leap.(1)

RETAIL SALES BEAT EXPECTATIONS

Analysts surveyed by MarketWatch thought retail sales would be flat for October after their huge surge in September. That was not so. They surprised to the upside with a gain of 0.2%. Minus auto buying, the advance was 0.1%.(2)

DEVELOPERS PICK UP THE PACE AS FALL BEGINS

Newly released Census Bureau data shows a 13.7% monthly increase in housing starts in October as well as a 5.9% rise for building permits. Single-family home construction strengthened 5.3% last month.(3)

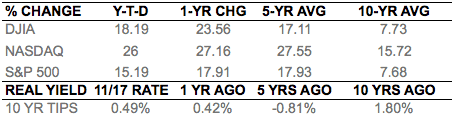

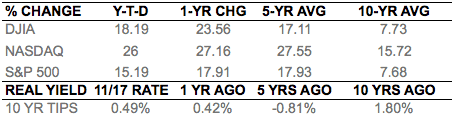

NASDAQ OUTPERFORMS DOW, S&P 500

After a volatile five days, the Nasdaq Composite closed 0.47% higher on November 17 than it had on November 10: 6,782.79. The trading week was tougher for the Dow Jones Industrial Average, which declined 0.27% to 23,358.24, and the S&P 500, which lost 0.13% on the way to a Friday settlement of 2,578.85. The Russell 2000 added 1.19% to wrap up the week at 1,492.82. Wall Street’s hottest index over the past year has been the PHLX Semiconductor – as of Friday, it had gained 49.77% in the past 52 weeks.(4)

THIS WEEK: Monday, Agilent Technologies and Urban Outfitters reveal Q3 results. On Tuesday, investors consider earnings announcements from Campbell Soup, Hormel Foods, and Lowe’s, plus the latest new home sales report from the National Association of Realtors; also, Federal Reserve chair Janet Yellen stops by New York University for a moderated Q&A session. The Fed releases the minutes from its November policy meeting on Wednesday; Wall Street will also keep an eye out for the final November consumer sentiment index from the University of Michigan, a new report on durable goods orders, and earnings from Deere & Co. On Thursday, U.S. financial markets are closed for Thanksgiving. Friday, Wall Street reopens for a shortened trading session ending at 1:00pm EST.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

Citations.

1 – cnbc.com/2017/11/15/us-consumer-price-index-oct-2017.html [11/15/17]

2 – marketwatch.com/economy-politics/calendars/economic [11/17/17]

3 – builderonline.com/money/economics/housing-starts-permits-jump-in-october_o [11/17/17]

4 – markets.wsj.com/us [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F17%2F16&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F17%2F16&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F17%2F16&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F16%2F12&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F16%2F12&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F16%2F12&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F16%2F07&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F16%2F07&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F16%2F07&x=0&y=0 [11/17/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [11/17/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [11/17/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

YEARLY INFLATION BACK AT 2.0%

Consumer costs ticked up just 0.1% in October, according to the Department of Labor. The marginal monthly gain left the annualized increase in the headline Consumer Price Index at 2.0%, down from 2.2% a month earlier. The core CPI has risen 1.8% in 12 months. Gasoline prices influenced the October headline number: they fell 2.4% in October after a 13.1% September leap.(1)

RETAIL SALES BEAT EXPECTATIONS

Analysts surveyed by MarketWatch thought retail sales would be flat for October after their huge surge in September. That was not so. They surprised to the upside with a gain of 0.2%. Minus auto buying, the advance was 0.1%.(2)

DEVELOPERS PICK UP THE PACE AS FALL BEGINS

Newly released Census Bureau data shows a 13.7% monthly increase in housing starts in October as well as a 5.9% rise for building permits. Single-family home construction strengthened 5.3% last month.(3)

NASDAQ OUTPERFORMS DOW, S&P 500

After a volatile five days, the Nasdaq Composite closed 0.47% higher on November 17 than it had on November 10: 6,782.79. The trading week was tougher for the Dow Jones Industrial Average, which declined 0.27% to 23,358.24, and the S&P 500, which lost 0.13% on the way to a Friday settlement of 2,578.85. The Russell 2000 added 1.19% to wrap up the week at 1,492.82. Wall Street’s hottest index over the past year has been the PHLX Semiconductor – as of Friday, it had gained 49.77% in the past 52 weeks.(4)

THIS WEEK: Monday, Agilent Technologies and Urban Outfitters reveal Q3 results. On Tuesday, investors consider earnings announcements from Campbell Soup, Hormel Foods, and Lowe’s, plus the latest new home sales report from the National Association of Realtors; also, Federal Reserve chair Janet Yellen stops by New York University for a moderated Q&A session. The Fed releases the minutes from its November policy meeting on Wednesday; Wall Street will also keep an eye out for the final November consumer sentiment index from the University of Michigan, a new report on durable goods orders, and earnings from Deere & Co. On Thursday, U.S. financial markets are closed for Thanksgiving. Friday, Wall Street reopens for a shortened trading session ending at 1:00pm EST.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

Citations.

1 – cnbc.com/2017/11/15/us-consumer-price-index-oct-2017.html [11/15/17]

2 – marketwatch.com/economy-politics/calendars/economic [11/17/17]

3 – builderonline.com/money/economics/housing-starts-permits-jump-in-october_o [11/17/17]

4 – markets.wsj.com/us [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F17%2F16&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F17%2F16&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F17%2F16&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F16%2F12&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F16%2F12&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F16%2F12&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F16%2F07&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F16%2F07&x=0&y=0 [11/17/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F16%2F07&x=0&y=0 [11/17/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [11/17/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [11/17/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.