WEEKLY QUOTE

“It is the mark of an educated mind to be able to entertain a thought without accepting it.”

– Aristotle

WEEKLY TIP

Before accepting a job offer, ask what maternity, paid leave, and short-term disability benefits are included.

WEEKLY RIDDLE

Frank got behind the wheel and traveled from Fort Lauderdale to Norfolk without any tires. How did he pull this off?

Last week’s riddle

Rob looks out at a boat full of people in a harbor. He is in disbelief when his friend Christine looks at the same boat and says there is not a single person on board. Is Rob seeing things? How could Christine be right in her assertion?

Last week’s answer:

The boat is taking married couples on a harbor cruise.

THE ECONOMY EXPANDED 2.6% in Q4

The Department of Commerce’s first estimate of fourth-quarter gross domestic product was 0.6% below the Q3 number, but still well above the 2.1% rate the nation has averaged in the recovery from the Great Recession. America saw 2.3% economic growth in 2017, according to the report.(1)

HOME SALES RETREATED DURING THE HOLIDAYS

Winter chill possibly encouraged the decline as much as high prices and low inventory. The National Association of Realtors noted a 3.6% slump in resales in December, while the Census Bureau said that new home purchases fell 9.3% last month. Existing home sales improved 1.1% during 2017; new home sales, 8.3%.(2)

OIL REBOUNDS, REACHES $66

WTI crude advanced 4.5% in five trading days, settling at $66.14 Friday on the NYMEX. That was its highest close in more than three years. Crude prices have risen for five of the past six weeks.(3)

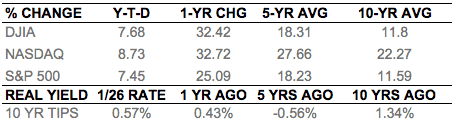

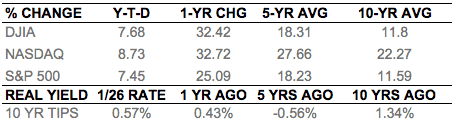

KEY STOCK INDICES CLIMB

Wall Street’s big three performed well last week, as these advances show: Dow 30, +2.09% to 26,616.71; S&P 500, +2.23% to 2,872.97; Nasdaq Composite, +2.31% to 7,505.77. Meanwhile, the NYSE Arca Biotech benchmark rose an astounding 9.16%.(4)

THIS WEEK: Monday, December personal spending figures appear, plus earnings from Lockheed Martin and Seagate. The latest Conference Board consumer confidence index surfaces Tuesday in addition to earnings from Aetna, Ally Financial, Chubb, Corning, Electronic Arts, Harley-Davidson, McDonalds, Nucor, Pfizer, Pulte Group, Stryker, and T. Rowe Price. Wednesday, the Federal Reserve wraps up a policy meeting; the Street also considers December pending home sales, an ADP payrolls report, and earnings from Aflac, Anthem, Arcelor Mittal, AT&T, Avery Dennison, Boeing, Citrix, D.R. Horton, eBay, Facebook, Ingersoll-Rand, Eli Lilly, MetLife, Microsoft, Mondelez, PayPal, Pitney Bowes, Qualcomm, Symantec, U.S. Steel, and Xerox. ISM’s January factory PMI arrives Thursday, along with earnings from Alibaba, Alphabet, Altria Group, Amazon, Amgen, Apple, AutoNation, Cigna, ConocoPhillips, DowDuPont, GoPro, Hershey, International Paper, Marathon Petroleum, MasterCard, Mattel, Motorola Solutions, Nokia, Parker Hannifin, Quest Diagnostics, Ralph Lauren, Regis, Royal Dutch Shell, Time Warner, Valero Energy, and Visa. The Department of Labor’s January jobs report and the final January University of Michigan consumer sentiment index roll out Friday, plus earnings from Chevron, Clorox, Estee Lauder, ExxonMobil, Honda, Merck, Phillips 66, Sony, Sprint, and Weyerhaeuser.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nytimes.com/2018/01/26/business/economy/gdp-economy.html [1/26/18]

2 – apnews.com/721aacbd0d354c2e8c4e32d6daf332da [1/25/18]

3 – marketwatch.com/story/oil-takes-to-split-path-as-dollar-rally-fades-2018-01-26 [1/26/18]

4 – markets.wsj.com/us [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F26%2F17&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F26%2F17&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F26%2F17&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F25%2F13&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F25%2F13&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F25%2F13&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F25%2F08&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F25%2F08&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F25%2F08&x=0&y=0 [1/26/18]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [1/26/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [1/26/18]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

THE ECONOMY EXPANDED 2.6% in Q4

The Department of Commerce’s first estimate of fourth-quarter gross domestic product was 0.6% below the Q3 number, but still well above the 2.1% rate the nation has averaged in the recovery from the Great Recession. America saw 2.3% economic growth in 2017, according to the report.(1)

HOME SALES RETREATED DURING THE HOLIDAYS

Winter chill possibly encouraged the decline as much as high prices and low inventory. The National Association of Realtors noted a 3.6% slump in resales in December, while the Census Bureau said that new home purchases fell 9.3% last month. Existing home sales improved 1.1% during 2017; new home sales, 8.3%.(2)

OIL REBOUNDS, REACHES $66

WTI crude advanced 4.5% in five trading days, settling at $66.14 Friday on the NYMEX. That was its highest close in more than three years. Crude prices have risen for five of the past six weeks.(3)

KEY STOCK INDICES CLIMB

Wall Street’s big three performed well last week, as these advances show: Dow 30, +2.09% to 26,616.71; S&P 500, +2.23% to 2,872.97; Nasdaq Composite, +2.31% to 7,505.77. Meanwhile, the NYSE Arca Biotech benchmark rose an astounding 9.16%.(4)

THIS WEEK: Monday, December personal spending figures appear, plus earnings from Lockheed Martin and Seagate. The latest Conference Board consumer confidence index surfaces Tuesday in addition to earnings from Aetna, Ally Financial, Chubb, Corning, Electronic Arts, Harley-Davidson, McDonalds, Nucor, Pfizer, Pulte Group, Stryker, and T. Rowe Price. Wednesday, the Federal Reserve wraps up a policy meeting; the Street also considers December pending home sales, an ADP payrolls report, and earnings from Aflac, Anthem, Arcelor Mittal, AT&T, Avery Dennison, Boeing, Citrix, D.R. Horton, eBay, Facebook, Ingersoll-Rand, Eli Lilly, MetLife, Microsoft, Mondelez, PayPal, Pitney Bowes, Qualcomm, Symantec, U.S. Steel, and Xerox. ISM’s January factory PMI arrives Thursday, along with earnings from Alibaba, Alphabet, Altria Group, Amazon, Amgen, Apple, AutoNation, Cigna, ConocoPhillips, DowDuPont, GoPro, Hershey, International Paper, Marathon Petroleum, MasterCard, Mattel, Motorola Solutions, Nokia, Parker Hannifin, Quest Diagnostics, Ralph Lauren, Regis, Royal Dutch Shell, Time Warner, Valero Energy, and Visa. The Department of Labor’s January jobs report and the final January University of Michigan consumer sentiment index roll out Friday, plus earnings from Chevron, Clorox, Estee Lauder, ExxonMobil, Honda, Merck, Phillips 66, Sony, Sprint, and Weyerhaeuser.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nytimes.com/2018/01/26/business/economy/gdp-economy.html [1/26/18]

2 – apnews.com/721aacbd0d354c2e8c4e32d6daf332da [1/25/18]

3 – marketwatch.com/story/oil-takes-to-split-path-as-dollar-rally-fades-2018-01-26 [1/26/18]

4 – markets.wsj.com/us [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F26%2F17&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F26%2F17&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F26%2F17&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F25%2F13&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F25%2F13&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F25%2F13&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=1%2F25%2F08&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=1%2F25%2F08&x=0&y=0 [1/26/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=1%2F25%2F08&x=0&y=0 [1/26/18]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [1/26/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [1/26/18]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.