WEEKLY QUOTE

“Focusing is about saying no.”

– Steve Jobs

WEEKLY TIP

Small business budgeting includes defining your risks. As a first step, detail your monthly, guaranteed income and expenses to help determine your level of liquidity. This may help you recognize potential long-term and short-term risks.

WEEKLY RIDDLE

Nate gets messages every day from people who want his services, yet he gets paid when he drives away his customers. What does he do for a living?

Last week’s riddle

It can hold back cattle, pets, and even people, but never with an order or a command. What is it?

Last week’s answer:

A fence.

FEBRUARY SAW A HIRING SURGE

Payroll growth was truly impressive last month. According to the latest Department of Labor report, employers added 313,000 net new jobs, including 61,000 in the construction industry; economists polled by Reuters projected a total February gain of 200,000. With the labor force participation rate reaching a 6-month high, the headline jobless rate stayed at 4.1% and the broader U-6 rate at 8.2%. Yearly wage growth declined to 2.6%.(1)

SERVICE BUSINESSES ARE THRIVING

The Institute for Supply Management’s February snapshot of service industry growth was quite positive. ISM’s non-manufacturing purchasing manager index did wane slightly, losing 0.4 points to 59.5, but the reading shows a very healthy service sector. January’s 59.9 mark was the best seen since August 2005.(2)

WTI CRUDE TOPS $62

As Wall Street’s closing bell sounded Friday, oil settled at $62.04. A 3% Friday gain left the commodity up for the week, even after the Energy Information Agency said that daily U.S. output had increased to nearly 10.4 million barrels, a record.(3)

FRIDAY RALLY ENDS BULLISH WEEK

Nothing major is slated for Monday. February’s Consumer Price Index arrives Tuesday, plus quarterly results from Dick’s Sporting Goods and DSW. Investors consider reports on February retail sales and wholesale inflation on Wednesday, along with earnings news from Del Taco, Smart & Final, Smith Micro, Stein Mart, Tailored Brands, and Williams-Sonoma. Wall Street looks at new initial claims figures Thursday, and earnings from Broadcom Ltd., Dollar General, Jabil, and Lifetime Brands. On Friday, the Census Bureau releases data on February housing starts and building permits, the University of Michigan publishes its preliminary March consumer sentiment index, and Kirkland’s, Perry Ellis, and Tiffany & Co. make earnings announcements.

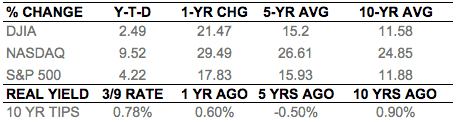

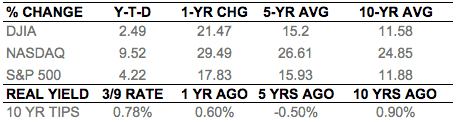

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/03/09/nonfarm-payrolls-february.html [3/9/18]

2 – briefing.com/Investor/Calendars/Economic/Releases/napmserv.htm [3/9/18]

4 – markets.wsj.com/us [3/9/18]

5 – reuters.com/article/us-usa-tech-stocks/high-performance-u-s-tech-stocks-drive-nasdaq-to-record-high-idUSKCN1GL2QC [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F9%2F17&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F9%2F17&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F9%2F17&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F8%2F13&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F8%2F13&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F8%2F13&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F10%2F08&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F10%2F08&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F10%2F08&x=0&y=0 [3/9/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [3/9/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [3/9/18]

FEBRUARY SAW A HIRING SURGE

Payroll growth was truly impressive last month. According to the latest Department of Labor report, employers added 313,000 net new jobs, including 61,000 in the construction industry; economists polled by Reuters projected a total February gain of 200,000. With the labor force participation rate reaching a 6-month high, the headline jobless rate stayed at 4.1% and the broader U-6 rate at 8.2%. Yearly wage growth declined to 2.6%.(1)

SERVICE BUSINESSES ARE THRIVING

The Institute for Supply Management’s February snapshot of service industry growth was quite positive. ISM’s non-manufacturing purchasing manager index did wane slightly, losing 0.4 points to 59.5, but the reading shows a very healthy service sector. January’s 59.9 mark was the best seen since August 2005.(2)

WTI CRUDE TOPS $62

As Wall Street’s closing bell sounded Friday, oil settled at $62.04. A 3% Friday gain left the commodity up for the week, even after the Energy Information Agency said that daily U.S. output had increased to nearly 10.4 million barrels, a record.(3)

FRIDAY RALLY ENDS BULLISH WEEK

Nothing major is slated for Monday. February’s Consumer Price Index arrives Tuesday, plus quarterly results from Dick’s Sporting Goods and DSW. Investors consider reports on February retail sales and wholesale inflation on Wednesday, along with earnings news from Del Taco, Smart & Final, Smith Micro, Stein Mart, Tailored Brands, and Williams-Sonoma. Wall Street looks at new initial claims figures Thursday, and earnings from Broadcom Ltd., Dollar General, Jabil, and Lifetime Brands. On Friday, the Census Bureau releases data on February housing starts and building permits, the University of Michigan publishes its preliminary March consumer sentiment index, and Kirkland’s, Perry Ellis, and Tiffany & Co. make earnings announcements.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/03/09/nonfarm-payrolls-february.html [3/9/18]

2 – briefing.com/Investor/Calendars/Economic/Releases/napmserv.htm [3/9/18]

4 – markets.wsj.com/us [3/9/18]

5 – reuters.com/article/us-usa-tech-stocks/high-performance-u-s-tech-stocks-drive-nasdaq-to-record-high-idUSKCN1GL2QC [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F9%2F17&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F9%2F17&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F9%2F17&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F8%2F13&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F8%2F13&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F8%2F13&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F10%2F08&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F10%2F08&x=0&y=0 [3/9/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F10%2F08&x=0&y=0 [3/9/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [3/9/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [3/9/18]