WEEKLY QUOTE

“Reflect on your present blessings, of which every man has many; not on your past misfortunes, of which all men have some.”

– Charles Dickens

WEEKLY TIP

If you get an email asking for your personal or financial information from what appears to be the Internal Revenue Service, it is probably a scam. The I.R.S. does not use emails, text messages, or social media to make initial inquiries about these matters.

WEEKLY RIDDLE

I am plain, thin, and lonely, but you use me all the time. I can appear with one keystroke or just one movement when you write. What am I?

Last week’s riddle

You can put me on a table and cut me, but you will never eat me. What am I?

Last week’s answer:

A deck of cards.

100 MONTHS OF GROWTH FOR SERVICE BUSINESSES

The Institute for Supply Management announced this milestone as it revealed a 58.6 May reading for its non-manufacturing purchasing manager index. That excellent reading was well north of the 56.8 mark seen in April. Fourteen of the fifteen service industries followed by the PMI reported expansion in May; the information sector was the only outlier.(1)

Q2 GDP OUTLOOK BRIGHTENS

Is the economy now expanding at the rate of 5% a year? The bold new estimate by the Federal Reserve Bank of Atlanta nearly says as much. The Atlanta Fed projects a 4.6% GDP reading for Q2. The first quarter saw a 2.2% rate of growth, and the economy grew 2.3% for all of 2017.(2)

SOCIAL SECURITY TO TAP ITS RESERVES THIS YEAR

Last week, Social Security’s trustees announced that the program needs to dip into its trust funds for the first time in 36 years in order to fully fund itself in 2018. In their annual report, the trustees noted that monthly benefits could be reduced as much as 23% by 2034 if no legislative action is taken on Capitol Hill between now and then. The report also noted that Medicare’s hospital insurance fund risks being depleted by 2026; barring a fix, Medicare might only pay out 91% of hospital costs at that point.(3)

NASDAQ ATTAINS RECORD TERRITORY AGAIN

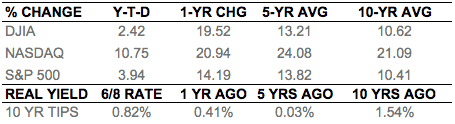

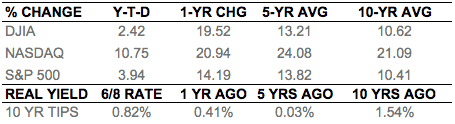

Finishing Friday at 7,645.51, the Nasdaq Composite retreated from its historic closes on Monday, Tuesday, and Wednesday of last week. Even so, it gained 1.21% across five trading sessions. The S&P 500 added 1.62% last week to settle at 2,779.03 Friday. The Dow Jones Industrial Average? It rose 2.77% for the week, reaching 25,316.53 at Friday’s closing bell.(4,5)

THIS WEEK: Nothing major is scheduled on Monday. The May Consumer Price Index appears Tuesday, plus earnings from H&R Block. Wednesday, Wall Street awaits a Federal Reserve interest rate decision and considers the May Producer Price Index. May retail sales numbers appear Thursday, in addition to a new initial jobless claims report and quarterly results from Michaels Companies. On Friday, the University of Michigan releases its preliminary June consumer sentiment index.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nytimes.com/aponline/2018/06/05/us/politics/ap-us-economy-services.html [6/5/18]

2 – cnbc.com/2018/06/08/gdp-for-second-quarter-on-track-to-double-2018-full-year-pace-of-2017.html [6/8/18]

3 – marketwatch.com/story/new-warnings-about-cuts-to-social-security-and-medicare-are-a-reason-to-worry-2018-06-07 [6/7/18]

4 – reuters.com/article/us-usa-stocks/tesla-drives-fourth-day-of-gains-for-nasdaq-banks-up-idUSKCN1J21E8 [6/6/18]

5 – markets.wsj.com/us [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F8%2F17&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F8%2F17&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F8%2F17&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F7%2F13&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F7%2F13&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F7%2F13&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F9%2F08&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F9%2F08&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F9%2F08&x=0&y=0 [6/8/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [6/8/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/8/18]

100 MONTHS OF GROWTH FOR SERVICE BUSINESSES

The Institute for Supply Management announced this milestone as it revealed a 58.6 May reading for its non-manufacturing purchasing manager index. That excellent reading was well north of the 56.8 mark seen in April. Fourteen of the fifteen service industries followed by the PMI reported expansion in May; the information sector was the only outlier.(1)

Q2 GDP OUTLOOK BRIGHTENS

Is the economy now expanding at the rate of 5% a year? The bold new estimate by the Federal Reserve Bank of Atlanta nearly says as much. The Atlanta Fed projects a 4.6% GDP reading for Q2. The first quarter saw a 2.2% rate of growth, and the economy grew 2.3% for all of 2017.(2)

SOCIAL SECURITY TO TAP ITS RESERVES THIS YEAR

Last week, Social Security’s trustees announced that the program needs to dip into its trust funds for the first time in 36 years in order to fully fund itself in 2018. In their annual report, the trustees noted that monthly benefits could be reduced as much as 23% by 2034 if no legislative action is taken on Capitol Hill between now and then. The report also noted that Medicare’s hospital insurance fund risks being depleted by 2026; barring a fix, Medicare might only pay out 91% of hospital costs at that point.(3)

NASDAQ ATTAINS RECORD TERRITORY AGAIN

Finishing Friday at 7,645.51, the Nasdaq Composite retreated from its historic closes on Monday, Tuesday, and Wednesday of last week. Even so, it gained 1.21% across five trading sessions. The S&P 500 added 1.62% last week to settle at 2,779.03 Friday. The Dow Jones Industrial Average? It rose 2.77% for the week, reaching 25,316.53 at Friday’s closing bell.(4,5)

THIS WEEK: Nothing major is scheduled on Monday. The May Consumer Price Index appears Tuesday, plus earnings from H&R Block. Wednesday, Wall Street awaits a Federal Reserve interest rate decision and considers the May Producer Price Index. May retail sales numbers appear Thursday, in addition to a new initial jobless claims report and quarterly results from Michaels Companies. On Friday, the University of Michigan releases its preliminary June consumer sentiment index.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nytimes.com/aponline/2018/06/05/us/politics/ap-us-economy-services.html [6/5/18]

2 – cnbc.com/2018/06/08/gdp-for-second-quarter-on-track-to-double-2018-full-year-pace-of-2017.html [6/8/18]

3 – marketwatch.com/story/new-warnings-about-cuts-to-social-security-and-medicare-are-a-reason-to-worry-2018-06-07 [6/7/18]

4 – reuters.com/article/us-usa-stocks/tesla-drives-fourth-day-of-gains-for-nasdaq-banks-up-idUSKCN1J21E8 [6/6/18]

5 – markets.wsj.com/us [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F8%2F17&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F8%2F17&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F8%2F17&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F7%2F13&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F7%2F13&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F7%2F13&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F9%2F08&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F9%2F08&x=0&y=0 [6/8/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F9%2F08&x=0&y=0 [6/8/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [6/8/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/8/18]