WEEKLY QUOTE

“We must learn to be still in the midst of activity and to be vibrantly alive in repose.”

INDIRA GANDHI

WEEKLY TIP

Did you know mortgage rates fluctuate daily during the week? If you are looking for a home loan, be sure to assess the terms of different loans on the same day. If you finalize negotiations on a loan, ask your lender to lock in the terms.

WEEKLY RIDDLE

What goes back and forth all the time while keeping time, causing a bit of noise only some of the time?

Last week’s riddle

A young man runs away from home. Cheered on by onlookers, he makes three lefts, then finds two masked men ahead of him, but he runs toward them. Can you explain why?

Last week’s answer:

He is rounding the bases in a baseball game and heading toward home plate.

IN OCTOBER, INFLATION JUMPED THE MOST SINCE JANUARY

The Consumer Price Index rose 0.3% last month, according to the Bureau of Labor Statistics. This was the largest monthly gain for the headline CPI since its 0.5% move in the first month of the year. A 3.0% leap in gasoline prices played a significant role. Core consumer inflation, which does not include volatile food and energy costs, increased by 0.2% in October.(1)

RETAIL SALES RISE 0.8%

Consumers certainly entered fall in a buying mood. Even with car and truck sales factored out, the gain was still 0.7% in October, and that left overall U.S. retail purchases up 4.6% year-over-year. In September, retail purchases tailed off 0.1% (the Department of Commerce first reported a 0.1% advance).(2)

WTI CRUDE FALLS INTO A BEAR MARKET

Oil’s fourth-quarter slide continued last week. Friday, light sweet crude ended the week at $56.46 on the New York Mercantile Exchange after its price slid 6.2% across five trading sessions, hitting a 12-month closing low of $55.69 on Tuesday. The commodity is now on a 6-week losing streak.(3)

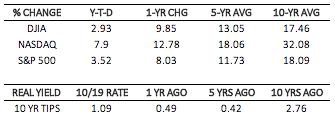

MAJOR INDICES RETREAT

Investors were left cold by some of last week’s key earnings reports, and the significant October inflation advance seemed to provide additional substantiation for a year-end Federal Reserve interest rate hike. The S&P 500 lost 1.61% in five days, falling to 2,736.27 at Friday’s closing bell. It fared better than both the Dow Industrials and Nasdaq Composite; last week, the blue chips slumped 2.22% to 25,413.22, while the tech-heavy benchmark dipped 2.15% to 7,247.87.(4)

THIS WEEK

Agilent Technologies, Intuit, Jack in the Box, and Urban Outfitters present earnings on Monday. | Analog Devices, Barnes & Noble, Best Buy, BJ’s Wholesale Club, Campbell Soup, Foot Locker, Gap, Hormel Foods, Kohl’s, Lowe’s, Medtronic, Ross Stores, Stage Stores, Target, and TJX all announce earnings on Tuesday; in addition, the Census Bureau releases a report on October housing starts. | Wednesday sees the release of the final November University of Michigan consumer sentiment index, the October existing home sales report from the National Association of Realtors, the October leading indicator index from the Conference Board, and a new monthly report on capital goods orders from the Census Bureau. | U.S. financial markets are closed Thursday in observance of Thanksgiving. | Friday, stock and bond markets reopen for a shortened trading session, with no major economic news or earnings announcements scheduled.

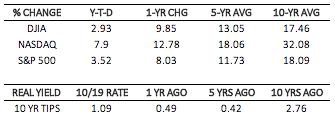

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/11/14/us-consumer-price-index-october-2018.html [11/14/18]

2 – investors.com/news/economy/retail-sales-rise-amazon-walmart-ecommerce/ [11/15/18]

3 – marketwatch.com/story/oil-reclaims-more-ground-though-the-sharp-selloff-accounts-for-a-4-weekly-loss-2018-11-16 [11/16/18]

4 – markets.wsj.com/us [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F16%2F17&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F16%2F17&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F16%2F17&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F15%2F13&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F15%2F13&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F15%2F13&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F17%2F08&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F17%2F08&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F17%2F08&x=0&y=0 [11/16/18]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [11/16/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [11/16/18]

IN OCTOBER, INFLATION JUMPED THE MOST SINCE JANUARY

The Consumer Price Index rose 0.3% last month, according to the Bureau of Labor Statistics. This was the largest monthly gain for the headline CPI since its 0.5% move in the first month of the year. A 3.0% leap in gasoline prices played a significant role. Core consumer inflation, which does not include volatile food and energy costs, increased by 0.2% in October.(1)

RETAIL SALES RISE 0.8%

Consumers certainly entered fall in a buying mood. Even with car and truck sales factored out, the gain was still 0.7% in October, and that left overall U.S. retail purchases up 4.6% year-over-year. In September, retail purchases tailed off 0.1% (the Department of Commerce first reported a 0.1% advance).(2)

WTI CRUDE FALLS INTO A BEAR MARKET

Oil’s fourth-quarter slide continued last week. Friday, light sweet crude ended the week at $56.46 on the New York Mercantile Exchange after its price slid 6.2% across five trading sessions, hitting a 12-month closing low of $55.69 on Tuesday. The commodity is now on a 6-week losing streak.(3)

MAJOR INDICES RETREAT

Investors were left cold by some of last week’s key earnings reports, and the significant October inflation advance seemed to provide additional substantiation for a year-end Federal Reserve interest rate hike. The S&P 500 lost 1.61% in five days, falling to 2,736.27 at Friday’s closing bell. It fared better than both the Dow Industrials and Nasdaq Composite; last week, the blue chips slumped 2.22% to 25,413.22, while the tech-heavy benchmark dipped 2.15% to 7,247.87.(4)

THIS WEEK

Agilent Technologies, Intuit, Jack in the Box, and Urban Outfitters present earnings on Monday. | Analog Devices, Barnes & Noble, Best Buy, BJ’s Wholesale Club, Campbell Soup, Foot Locker, Gap, Hormel Foods, Kohl’s, Lowe’s, Medtronic, Ross Stores, Stage Stores, Target, and TJX all announce earnings on Tuesday; in addition, the Census Bureau releases a report on October housing starts. | Wednesday sees the release of the final November University of Michigan consumer sentiment index, the October existing home sales report from the National Association of Realtors, the October leading indicator index from the Conference Board, and a new monthly report on capital goods orders from the Census Bureau. | U.S. financial markets are closed Thursday in observance of Thanksgiving. | Friday, stock and bond markets reopen for a shortened trading session, with no major economic news or earnings announcements scheduled.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/11/14/us-consumer-price-index-october-2018.html [11/14/18]

2 – investors.com/news/economy/retail-sales-rise-amazon-walmart-ecommerce/ [11/15/18]

3 – marketwatch.com/story/oil-reclaims-more-ground-though-the-sharp-selloff-accounts-for-a-4-weekly-loss-2018-11-16 [11/16/18]

4 – markets.wsj.com/us [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F16%2F17&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F16%2F17&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F16%2F17&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F15%2F13&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F15%2F13&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F15%2F13&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=11%2F17%2F08&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=11%2F17%2F08&x=0&y=0 [11/16/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=11%2F17%2F08&x=0&y=0 [11/16/18]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [11/16/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [11/16/18]