WEEKLY QUOTE

“Make up your mind to act decidedly and take the consequences. No good is ever done in this world by hesitation.”

THOMAS HENRY HUXLEY

WEEKLY TIP

Is your home a showcase for fine art, collectibles, or antiques? If your collection has significant value, it may not be adequately insured by a standard homeowner policy. You may want to consider specialized property coverage.

WEEKLY RIDDLE

Take a word with four letters. Take away one, and what remains will be better – better than zero, anyway. What word is this?

Last week’s riddle

It can be open, closed, empty, or full. Sometimes you see one, sometimes two. It can be bare, but never a bear. What is it?

Last week’s answer:

A hand.

HIRING PACE SLOWS

In November, U.S. employers added a net 155,000 hires to their payrolls. That compares with a (revised) gain of 237,000 recorded by the federal government for October. The Department of Labor’s latest jobs report showed the main unemployment rate holding steady at just 3.7%, and the U-6 rate (unemployed and underemployed) rising 0.2% to 7.6%. Annualized wage growth was at 3.1%. Will this middling job growth make the Federal Reserve think twice about a year-end rate move? Perhaps not: Friday, the CME Group’s Fed Watch tool put the chances of a 0.25% December rate hike at 76.6%.(1)

SERVICE & FACTORY SECTORS CONTINUE TO HUM

Early each month, investors and economists alike look at the Institute for Supply Management’s twin purchasing manager indices tracking expansion and contraction in manufacturing and service industries. The latest data is quite good. ISM’s November service sector PMI improved to 60.7, up 0.4 points from October; its factory sector PMI also rose, ascending 1.6 points on the month to an impressive 59.3.(2)

OPEC ADDRESSES IMBALANCE OF OIL SUPPLY, OIL DEMAND

Members of the Organization of the Petroleum Exporting Countries (OPEC) and other key foreign producers agreed on Friday to cut production by a total of 1.2 million barrels per day for at least six months. That brought some relief to stateside oil investors, who watched WTI crude jump about 5% Friday; the commodity ended the week at $52.34 on the NYMEX.(3,4)

FOUR DAYS OF UPS AND DOWNS

Volatility reigned on Wall Street during an abbreviated market week. (U.S. financial markets were closed Wednesday in observance of the national day of mourning for President George H.W. Bush.) Institutional investors found plenty of motivation to sell, partly due to a dimming outlook for a truce in the U.S.-China trade war. During the worst week for shares in nine months, the Dow Industrials fell 4.50% to 24,388.95; the S&P 500, 4.60% to 2,633.08; the Nasdaq Composite, 4.93% to 6,969.25.(5,6)

THIS WEEK

Casey’s General Stores announces quarterly results on Monday. | A new Producer Price Index arrives Tuesday, plus earnings from American Eagle Outfitters and DSW. | On Wednesday, investors will consider the November Consumer Price Index. | Thursday offers earnings from Adobe, Costco, and Fred’s, along with the Department of Labor’s latest initial claims numbers. | Federal government reports on November retail sales and industrial output appear Friday.

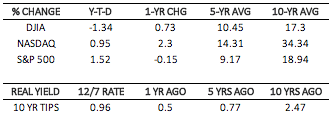

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – tinyurl.com/y93zzeuv [12/7/18]

2 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?SSO=1 [12/6/18]

3 – cnn.com/2018/12/07/investing/opec-oil-prices/index.html [12/7/18]

4 – money.cnn.com/data/commodities/ [12/7/18]

5 – markets.ft.com/data/world [12/7/18]

6 – bloomberg.com/news/articles/2018-12-06/asia-signals-mixed-start-for-stocks-yields-drop-markets-wrap [12/7/18]

7 – markets.wsj.com/us [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=12%2F7%2F17&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=12%2F7%2F17&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=12%2F7%2F17&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=12%2F6%2F13&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=12%2F6%2F13&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=12%2F6%2F13&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=12%2F8%2F08&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=12%2F8%2F08&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=12%2F8%2F08&x=0&y=0 [12/7/18]

9 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [12/7/18]

10 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [12/7/18]

HIRING PACE SLOWS

In November, U.S. employers added a net 155,000 hires to their payrolls. That compares with a (revised) gain of 237,000 recorded by the federal government for October. The Department of Labor’s latest jobs report showed the main unemployment rate holding steady at just 3.7%, and the U-6 rate (unemployed and underemployed) rising 0.2% to 7.6%. Annualized wage growth was at 3.1%. Will this middling job growth make the Federal Reserve think twice about a year-end rate move? Perhaps not: Friday, the CME Group’s Fed Watch tool put the chances of a 0.25% December rate hike at 76.6%.(1)

SERVICE & FACTORY SECTORS CONTINUE TO HUM

Early each month, investors and economists alike look at the Institute for Supply Management’s twin purchasing manager indices tracking expansion and contraction in manufacturing and service industries. The latest data is quite good. ISM’s November service sector PMI improved to 60.7, up 0.4 points from October; its factory sector PMI also rose, ascending 1.6 points on the month to an impressive 59.3.(2)

OPEC ADDRESSES IMBALANCE OF OIL SUPPLY, OIL DEMAND

Members of the Organization of the Petroleum Exporting Countries (OPEC) and other key foreign producers agreed on Friday to cut production by a total of 1.2 million barrels per day for at least six months. That brought some relief to stateside oil investors, who watched WTI crude jump about 5% Friday; the commodity ended the week at $52.34 on the NYMEX.(3,4)

FOUR DAYS OF UPS AND DOWNS

Volatility reigned on Wall Street during an abbreviated market week. (U.S. financial markets were closed Wednesday in observance of the national day of mourning for President George H.W. Bush.) Institutional investors found plenty of motivation to sell, partly due to a dimming outlook for a truce in the U.S.-China trade war. During the worst week for shares in nine months, the Dow Industrials fell 4.50% to 24,388.95; the S&P 500, 4.60% to 2,633.08; the Nasdaq Composite, 4.93% to 6,969.25.(5,6)

THIS WEEK

Casey’s General Stores announces quarterly results on Monday. | A new Producer Price Index arrives Tuesday, plus earnings from American Eagle Outfitters and DSW. | On Wednesday, investors will consider the November Consumer Price Index. | Thursday offers earnings from Adobe, Costco, and Fred’s, along with the Department of Labor’s latest initial claims numbers. | Federal government reports on November retail sales and industrial output appear Friday.

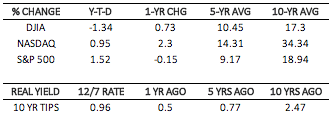

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs, or expenses. Investors cannot invest directly in indices. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – tinyurl.com/y93zzeuv [12/7/18]

2 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?SSO=1 [12/6/18]

3 – cnn.com/2018/12/07/investing/opec-oil-prices/index.html [12/7/18]

4 – money.cnn.com/data/commodities/ [12/7/18]

5 – markets.ft.com/data/world [12/7/18]

6 – bloomberg.com/news/articles/2018-12-06/asia-signals-mixed-start-for-stocks-yields-drop-markets-wrap [12/7/18]

7 – markets.wsj.com/us [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=12%2F7%2F17&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=12%2F7%2F17&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=12%2F7%2F17&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=12%2F6%2F13&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=12%2F6%2F13&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=12%2F6%2F13&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=12%2F8%2F08&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=12%2F8%2F08&x=0&y=0 [12/7/18]

8 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=12%2F8%2F08&x=0&y=0 [12/7/18]

9 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [12/7/18]

10 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [12/7/18]