WEEKLY QUOTE

“All things are difficult before they are easy.”

– Thomas Fuller

WEEKLY TIP

Investing too conservatively in retirement could mean losing the chance to grow your money faster than the rate of inflation. Some fixed-income investments are earning less than 3% annually.

WEEKLY RIDDLE

There are several different types of these devices you can buy, but if you pick one, it may not work. What is this device?

Last week’s riddle

It has the scent of green paint, it pours like black paint, and it is the same color as a yellow bus. What is it?

Last week’s answer:

Yellow paint. (All paint basically pours and smells the same.)

THE MONTH IN BRIEF

In August, investors witnessed a terrible natural disaster and heard threats of war on America, and the S&P 500 still managed to gain 0.05%. September brought two terrible natural disasters and more threats of war on America, and the broad benchmark rose 1.93% and topped 2,500 for the first time. In other words, the bulls remained firmly in charge. European stocks rallied impressively last month, and oil went back above $50. U.S. economic indicators were a mixed bag, and home sales seemed to be cooling off. In what may be the month’s most important development for investors, the Federal Reserve detailed its plan for reducing its vast securities portfolio.(1)

DOMESTIC ECONOMIC HEALTH

On September 20, the Federal Reserve announced a strategy to trim its $4.2 trillion balance sheet. The quantitative tightening will be gradual. Starting this quarter, the Fed will let $10 billion of bonds mature each month; in Q1 2018, that will increase to $20 billion a month. The monthly runoff rate will keep climbing by $10 billion each quarter until hitting a ceiling of $50 billion. According to Fed Chair Janet Yellen, this strategy is fixed, barring a “sufficiently great” threat to U.S. economic stability. At last month’s Fed meeting, three-quarters of the central bank’s policymakers forecast another rate hike before the end of the year.(2)

Three of the latest economic indicators to appear were underwhelming. Consumer spending only rose 0.1% in August, the Department of Commerce noted, with wages up 0.2%. July had seen a 0.3% increase in both categories. Retail sales slipped 0.2% in August, with core sales registering the same monthly decline.(3,4)

August payrolls showed a net gain of 156,000 workers – nothing special – and less than the gains of 200,000+ noted by the Department of Labor in the previous two months. The main jobless rate ticked up to 4.4%; the U-6 rate, including the underemployed, stayed at 8.6%. Annualized wage growth remained at 2.5%.(5)

Other indicators were more encouraging. The Institute for Supply Management’s twin purchasing manager indices both rose for August. ISM’s service sector PMI gained 1.4 points to 55.3, while the factory PMI hit 58.8, climbing 2.5 points to its highest level since April 2011. These readings indicate an atmosphere of fast growth for both manufacturing and non-manufacturing businesses.(4,6)

The Bureau of Economic Analysis made its final estimate of Q2 growth, bumping the number up 0.1% to 3.1%. Durable goods orders rose 1.7% in August, and core capital goods orders improved 0.9%. Consumer confidence held steady last month in the wake of calamitous storms – the Conference Board index eased down but 0.6 points to 119.8, and the University of Michigan index moved just 0.2 points lower from its preliminary September reading to 95.1.(3,4)

Was inflation making a comeback? Maybe, maybe not. The Consumer Price Index rose 0.4% in August, but the Fed’s preferred inflation measure, the PCE price index, showed just a 0.1% gain. The year-over-year gain in the headline CPI was 1.9% through August, just underneath the Fed’s long-stated 2.0% goal; for the headline Producer Price Index, the 12-month advance was 2.4%.(3,4)

GLOBAL ECONOMIC HEALTH

European central banks appear to be poised to begin normalizing economic policy. Many analysts believe that the European Central Bank will present plans to taper its long-running stimulus program this month. The ECB believes the euro area economy will grow by 2.2% this year, which would be the fastest pace since 2007. The Bank of England delivered a strong hint last month that it might raise its main interest rate: BoE Governor Mark Carney stated that a hike could come in the “relatively near term.”(7,8)

Factory growth in important Asian economies accelerated in September. China’s official factory PMI reached its highest level in five years; this news came on the heels of 6.9% growth for the P.R.C. economy in the first half of the year, topping government projections. Manufacturing activity in South Korea expanded at the best pace since 2015 last month; factory growth was also indicated by improved PMIs in Indonesia and Taiwan. India, unfortunately, was seeing a dramatic economic slowdown. Its latest growth snapshot showed GDP of 5.7% in Q2, as opposed to 9.1% in Q2 2016; last quarter was the poorest for its economy since Q1 2014.(9,10)

WORLD MARKETS

Major European stock exchanges soared last month. Germany’s DAX jumped 7.39%. France’s CAC 40 added 5.92%. The FTSE Eurofirst 300 advanced 5.29%, and Russia’s Micex surged 4.43%. Lesser gains came for Spain’s IBEX 35 (1.85%) and the United Kingdom’s FTSE 100 (0.48%).(11)

Big gains occurred elsewhere. Argentina’s MERVAL climbed 11.24% for the month, and in Tokyo, the Nikkei 225 improved 5.13%. Brazil’s Bovespa rose 4.15%, while Canada’s TSX Composite gained 3.66%. The MSCI World posted a 2.08% advance; South Korea’s KOSPI benchmark went north 1.26%. As for September losers, Mexico’s Bolsa fell 1.89%; Hong Kong’s Hang Seng, 0.76%; MSCI’s Emerging Markets index, 0.55%; China’s Shanghai Composite, 0.48%; India’s Sensex, 0.33.(11,12)

COMMODITIES MARKETS

The big story here was the ascent of WTI crude. Oil settled at $51.64 on September 29, completing a 9.66% rise for the month. Gasoline futures, on the other hand, fell hard – they dropped 25.24% during September after a major rally in late August. Heating oil futures advanced 3.08%, while natural gas futures retreated 0.40%.(13)

There were more gains than losses in the ag sector. Sugar was the only major crop that retreated last month, declining 8.12%. Wheat rose 9.51%; cocoa, 5.54%; corn, 4.24%; soybeans, 3.31%; coffee, 0.47%.(13)

While the U.S. Dollar Index improved 0.43% to a month-ending settlement of 93.07, all key metals fell. Gold lost 2.97% for the month; silver, 4.44%; platinum, 8.62%; copper, 4.74%. On the COMEX, gold finished September at $1,282.50; silver, at $16.69.(13,14)

REAL ESTATE

Both new and existing home sales slowed in August. The latest report from the National Association of Realtors showed resales down 1.7%; Census Bureau data had new home buying slumping 3.4%. A month earlier, new home sales had fallen 5.5%, while existing home purchases dipped 1.3%. High prices and slim pickings were hindrances to buyers. The latest 20-city S&P/Case-Shiller home price index (July) showed a 0.3% gain, lifting the 12-month advance from 5.6% to 5.8%. The NAR’s pending home sales index staged a 2.6% retreat in August.(3,4)

Developers built fewer projects during the summer. Housing starts were down 0.8% in August after a (revised) 2.2% retreat in July, according to the Census Bureau. The Bureau’s August report on new construction activity did show a 5.7% rebound for building permits, more than offsetting the 4.1% July fall.(4)

For those who could buy or refinance, mortgage rates were still cheap. They barely budged last month; comparing Freddie Mac’s August 31 and September 28 Primary Mortgage Market Surveys, only the average rate on the 5/1-year ARM showed real movement, up 0.06% to 3.20%. The respective average rates for 30-year and 15-year FRMs ticked just 0.01% higher to 3.83% and 3.13%.(15)

LOOKING BACK…LOOKING FORWARD

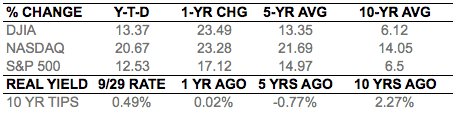

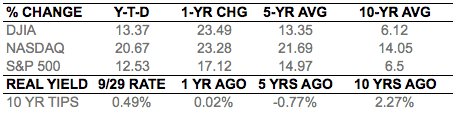

The Russell 2000 has lagged the big three all year, but it made up some serious ground in September, rising 6.08% across the month to 1,490.86. America’s prime small cap benchmark finished the third quarter up 9.85% YTD. Closing September at 22,405.09, the Dow Jones Industrial Average gained 2.08% for the month. As noted earlier, the S&P 500 rose 1.93% to 2,519.36; the Nasdaq Composite improved 1.05% to 6,495.96. The CBOE VIX “fear index” fell 10.20% to an extremely low close of 9.51 on the month’s last trading day, taking its YTD loss to 32.26%.(16,17,18)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

UPCOMING ECONOMIC RELEASES: As October unfolds further, investors will await these important news releases: the September Challenger job-cut report (10/5), the Department of Labor’s September employment snapshot (10/6), the September PPI (10/12), September retail sales, the September CPI, and the initial University of Michigan consumer sentiment index for October (10/13), September industrial output (10/17), a new Federal Reserve Beige Book and September groundbreaking and building permits (10/18), September existing home sales (10/20), September durable goods orders and new home sales (10/25), September pending home sales (10/26), the month’s final University of Michigan consumer sentiment index reading and the first estimate of Q3 growth from the Bureau of Economic Analysis (10/27), the September PCE price index and September personal spending report (10/30), and the Conference Board’s latest consumer confidence index (10/31). The Federal Reserve’s next policy announcement occurs November 1.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The DAX 30 is a Blue-Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The FTSE Eurofirst 300 measures the performance of Europe’s largest 300 companies by market capitalization and covers 70% of Europe’s market cap. The MICEX 10 Index is an unweighted price index that tracks the ten most liquid Russian stocks listed on MICEX-RTS in Moscow. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The MERVAL Index (MERcado de VALores, literally Stock Exchange) is the most important index of the Buenos Aires Stock Exchange. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The Bovespa Index is a gross total return index weighted by traded volume & is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. The Korea Composite Stock Price Index or KOSPI is the major stock market index of South Korea, representing all common stocks traded on the Korea Exchange. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also-called the BSE 30 (BOMBAY STOCK EXCHANGE) or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange (BSE). The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – money.cnn.com/data/markets/sandp/ [10/1/17]2 – nytimes.com/2017/09/20/business/economy/fed-bond-buying.html [9/20/17]3 – marketwatch.com/economy-politics/calendars/economic [10/1/17]4 – investing.com/economic-calendar/ [10/1/17]5 – foxbusiness.com/markets/2017/09/01/us-hiring-cools-off-with-156000-new-jobs-in-august.html [9/1/17]6 – instituteforsupplymanagement.org/ISMReport/MfgROB.cfm [9/1/17]7 – bbc.com/news/business-41186368 [9/7/17]8 – reuters.com/article/us-funds-poll-europe/equity-bulls-hold-strong-in-europe-but-favor-u-s-stocks-reuters-poll-idUSKCN1C41Q5 [9/29/17]9 – reuters.com/article/us-global-economy/asian-factories-rev-up-in-september-ahead-of-year-end-spending-spree-idUSKCN1C70C5 [10/1/17]10 – bbc.com/news/world-asia-41332272 [9/26/17]11 – markets.on.nytimes.com/research/markets/worldmarkets/worldmarkets.asp [9/29/17]12 – msci.com/end-of-day-data-search [9/29/17]13 – money.cnn.com/data/commodities/ [9/29/17]14 – marketwatch.com/investing/index/dxy/historical [9/29/17]15 – freddiemac.com/pmms/archive.html?year=2017 [10/1/17]16 – finance.google.com/finance?q=INDEXSP%3A.INX&ei=dNjOWfLRHsb_jAGU5qX4DQ [9/29/17]17 – money.cnn.com/quote/quote.html?symb=VIX [9/29/17]18 – markets.wsj.com/us [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F29%2F16&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F29%2F16&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F29%2F16&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F28%2F12&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F28%2F12&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F28%2F12&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F28%2F07&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F28%2F07&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F28%2F07&x=0&y=0 [9/29/17]20 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/29/17]21 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/29/17]22 – nerdwallet.com/blog/investing/will-october-spook-stock-market-investors/ [9/29/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

THE MONTH IN BRIEF

In August, investors witnessed a terrible natural disaster and heard threats of war on America, and the S&P 500 still managed to gain 0.05%. September brought two terrible natural disasters and more threats of war on America, and the broad benchmark rose 1.93% and topped 2,500 for the first time. In other words, the bulls remained firmly in charge. European stocks rallied impressively last month, and oil went back above $50. U.S. economic indicators were a mixed bag, and home sales seemed to be cooling off. In what may be the month’s most important development for investors, the Federal Reserve detailed its plan for reducing its vast securities portfolio.(1)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

DOMESTIC ECONOMIC HEALTH

On September 20, the Federal Reserve announced a strategy to trim its $4.2 trillion balance sheet. The quantitative tightening will be gradual. Starting this quarter, the Fed will let $10 billion of bonds mature each month; in Q1 2018, that will increase to $20 billion a month. The monthly runoff rate will keep climbing by $10 billion each quarter until hitting a ceiling of $50 billion. According to Fed Chair Janet Yellen, this strategy is fixed, barring a “sufficiently great” threat to U.S. economic stability. At last month’s Fed meeting, three-quarters of the central bank’s policymakers forecast another rate hike before the end of the year.(2)

Three of the latest economic indicators to appear were underwhelming. Consumer spending only rose 0.1% in August, the Department of Commerce noted, with wages up 0.2%. July had seen a 0.3% increase in both categories. Retail sales slipped 0.2% in August, with core sales registering the same monthly decline.(3,4)

August payrolls showed a net gain of 156,000 workers – nothing special – and less than the gains of 200,000+ noted by the Department of Labor in the previous two months. The main jobless rate ticked up to 4.4%; the U-6 rate, including the underemployed, stayed at 8.6%. Annualized wage growth remained at 2.5%.(5)

Other indicators were more encouraging. The Institute for Supply Management’s twin purchasing manager indices both rose for August. ISM’s service sector PMI gained 1.4 points to 55.3, while the factory PMI hit 58.8, climbing 2.5 points to its highest level since April 2011. These readings indicate an atmosphere of fast growth for both manufacturing and non-manufacturing businesses.(4,6)

The Bureau of Economic Analysis made its final estimate of Q2 growth, bumping the number up 0.1% to 3.1%. Durable goods orders rose 1.7% in August, and core capital goods orders improved 0.9%. Consumer confidence held steady last month in the wake of calamitous storms – the Conference Board index eased down but 0.6 points to 119.8, and the University of Michigan index moved just 0.2 points lower from its preliminary September reading to 95.1.(3,4)

Was inflation making a comeback? Maybe, maybe not. The Consumer Price Index rose 0.4% in August, but the Fed’s preferred inflation measure, the PCE price index, showed just a 0.1% gain. The year-over-year gain in the headline CPI was 1.9% through August, just underneath the Fed’s long-stated 2.0% goal; for the headline Producer Price Index, the 12-month advance was 2.4%.(3,4)

GLOBAL ECONOMIC HEALTH

European central banks appear to be poised to begin normalizing economic policy. Many analysts believe that the European Central Bank will present plans to taper its long-running stimulus program this month. The ECB believes the euro area economy will grow by 2.2% this year, which would be the fastest pace since 2007. The Bank of England delivered a strong hint last month that it might raise its main interest rate: BoE Governor Mark Carney stated that a hike could come in the “relatively near term.”(7,8)

Factory growth in important Asian economies accelerated in September. China’s official factory PMI reached its highest level in five years; this news came on the heels of 6.9% growth for the P.R.C. economy in the first half of the year, topping government projections. Manufacturing activity in South Korea expanded at the best pace since 2015 last month; factory growth was also indicated by improved PMIs in Indonesia and Taiwan. India, unfortunately, was seeing a dramatic economic slowdown. Its latest growth snapshot showed GDP of 5.7% in Q2, as opposed to 9.1% in Q2 2016; last quarter was the poorest for its economy since Q1 2014.(9,10)

WORLD MARKETS

Major European stock exchanges soared last month. Germany’s DAX jumped 7.39%. France’s CAC 40 added 5.92%. The FTSE Eurofirst 300 advanced 5.29%, and Russia’s Micex surged 4.43%. Lesser gains came for Spain’s IBEX 35 (1.85%) and the United Kingdom’s FTSE 100 (0.48%).(11)

Big gains occurred elsewhere. Argentina’s MERVAL climbed 11.24% for the month, and in Tokyo, the Nikkei 225 improved 5.13%. Brazil’s Bovespa rose 4.15%, while Canada’s TSX Composite gained 3.66%. The MSCI World posted a 2.08% advance; South Korea’s KOSPI benchmark went north 1.26%. As for September losers, Mexico’s Bolsa fell 1.89%; Hong Kong’s Hang Seng, 0.76%; MSCI’s Emerging Markets index, 0.55%; China’s Shanghai Composite, 0.48%; India’s Sensex, 0.33.(11,12)

COMMODITIES MARKETS

The big story here was the ascent of WTI crude. Oil settled at $51.64 on September 29, completing a 9.66% rise for the month. Gasoline futures, on the other hand, fell hard – they dropped 25.24% during September after a major rally in late August. Heating oil futures advanced 3.08%, while natural gas futures retreated 0.40%.(13)

There were more gains than losses in the ag sector. Sugar was the only major crop that retreated last month, declining 8.12%. Wheat rose 9.51%; cocoa, 5.54%; corn, 4.24%; soybeans, 3.31%; coffee, 0.47%.(13)

While the U.S. Dollar Index improved 0.43% to a month-ending settlement of 93.07, all key metals fell. Gold lost 2.97% for the month; silver, 4.44%; platinum, 8.62%; copper, 4.74%. On the COMEX, gold finished September at $1,282.50; silver, at $16.69.(13,14)

REAL ESTATE

Both new and existing home sales slowed in August. The latest report from the National Association of Realtors showed resales down 1.7%; Census Bureau data had new home buying slumping 3.4%. A month earlier, new home sales had fallen 5.5%, while existing home purchases dipped 1.3%. High prices and slim pickings were hindrances to buyers. The latest 20-city S&P/Case-Shiller home price index (July) showed a 0.3% gain, lifting the 12-month advance from 5.6% to 5.8%. The NAR’s pending home sales index staged a 2.6% retreat in August.(3,4)

Developers built fewer projects during the summer. Housing starts were down 0.8% in August after a (revised) 2.2% retreat in July, according to the Census Bureau. The Bureau’s August report on new construction activity did show a 5.7% rebound for building permits, more than offsetting the 4.1% July fall.(4)

For those who could buy or refinance, mortgage rates were still cheap. They barely budged last month; comparing Freddie Mac’s August 31 and September 28 Primary Mortgage Market Surveys, only the average rate on the 5/1-year ARM showed real movement, up 0.06% to 3.20%. The respective average rates for 30-year and 15-year FRMs ticked just 0.01% higher to 3.83% and 3.13%.(15)

LOOKING BACK…LOOKING FORWARD

The Russell 2000 has lagged the big three all year, but it made up some serious ground in September, rising 6.08% across the month to 1,490.86. America’s prime small cap benchmark finished the third quarter up 9.85% YTD. Closing September at 22,405.09, the Dow Jones Industrial Average gained 2.08% for the month. As noted earlier, the S&P 500 rose 1.93% to 2,519.36; the Nasdaq Composite improved 1.05% to 6,495.96. The CBOE VIX “fear index” fell 10.20% to an extremely low close of 9.51 on the month’s last trading day, taking its YTD loss to 32.26%.(16,17,18)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

UPCOMING ECONOMIC RELEASES: As October unfolds further, investors will await these important news releases: the September Challenger job-cut report (10/5), the Department of Labor’s September employment snapshot (10/6), the September PPI (10/12), September retail sales, the September CPI, and the initial University of Michigan consumer sentiment index for October (10/13), September industrial output (10/17), a new Federal Reserve Beige Book and September groundbreaking and building permits (10/18), September existing home sales (10/20), September durable goods orders and new home sales (10/25), September pending home sales (10/26), the month’s final University of Michigan consumer sentiment index reading and the first estimate of Q3 growth from the Bureau of Economic Analysis (10/27), the September PCE price index and September personal spending report (10/30), and the Conference Board’s latest consumer confidence index (10/31). The Federal Reserve’s next policy announcement occurs November 1.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The DAX 30 is a Blue-Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The FTSE Eurofirst 300 measures the performance of Europe’s largest 300 companies by market capitalization and covers 70% of Europe’s market cap. The MICEX 10 Index is an unweighted price index that tracks the ten most liquid Russian stocks listed on MICEX-RTS in Moscow. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The MERVAL Index (MERcado de VALores, literally Stock Exchange) is the most important index of the Buenos Aires Stock Exchange. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The Bovespa Index is a gross total return index weighted by traded volume & is comprised of the most liquid stocks traded on the Sao Paulo Stock Exchange. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. The Korea Composite Stock Price Index or KOSPI is the major stock market index of South Korea, representing all common stocks traded on the Korea Exchange. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also-called the BSE 30 (BOMBAY STOCK EXCHANGE) or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange (BSE). The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – money.cnn.com/data/markets/sandp/ [10/1/17]2 – nytimes.com/2017/09/20/business/economy/fed-bond-buying.html [9/20/17]3 – marketwatch.com/economy-politics/calendars/economic [10/1/17]4 – investing.com/economic-calendar/ [10/1/17]5 – foxbusiness.com/markets/2017/09/01/us-hiring-cools-off-with-156000-new-jobs-in-august.html [9/1/17]6 – instituteforsupplymanagement.org/ISMReport/MfgROB.cfm [9/1/17]7 – bbc.com/news/business-41186368 [9/7/17]8 – reuters.com/article/us-funds-poll-europe/equity-bulls-hold-strong-in-europe-but-favor-u-s-stocks-reuters-poll-idUSKCN1C41Q5 [9/29/17]9 – reuters.com/article/us-global-economy/asian-factories-rev-up-in-september-ahead-of-year-end-spending-spree-idUSKCN1C70C5 [10/1/17]10 – bbc.com/news/world-asia-41332272 [9/26/17]11 – markets.on.nytimes.com/research/markets/worldmarkets/worldmarkets.asp [9/29/17]12 – msci.com/end-of-day-data-search [9/29/17]13 – money.cnn.com/data/commodities/ [9/29/17]14 – marketwatch.com/investing/index/dxy/historical [9/29/17]15 – freddiemac.com/pmms/archive.html?year=2017 [10/1/17]16 – finance.google.com/finance?q=INDEXSP%3A.INX&ei=dNjOWfLRHsb_jAGU5qX4DQ [9/29/17]17 – money.cnn.com/quote/quote.html?symb=VIX [9/29/17]18 – markets.wsj.com/us [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F29%2F16&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F29%2F16&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F29%2F16&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F28%2F12&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F28%2F12&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F28%2F12&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F28%2F07&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F28%2F07&x=0&y=0 [9/29/17]19 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F28%2F07&x=0&y=0 [9/29/17]20 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/29/17]21 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/29/17]22 – nerdwallet.com/blog/investing/will-october-spook-stock-market-investors/ [9/29/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.