WEEKLY QUOTE

“No trumpets sound when the important decisions of our life are made. Destiny is made known silently.”

– Agnes de Mille

WEEKLY TIP

If you are divorcing, be sure to call the card issuers of your joint credit card accounts. Let them know that you are going through a divorce and that you would like to cancel the joint account and open one in your name alone.

WEEKLY RIDDLE

When you say its name, it is no longer there. What is it?

Last week’s riddle

Weight within my stomach, trees on my back, nails in my ribs, and feet I lack. What am I?

Last week’s answer:

A ship.

HIRING WEAKENED IN MARCH

Payrolls expanded by only 103,000 net new jobs last month, according to the latest employment report from the Department of Labor. Some economists wondered if harsh weather distorted the number (job growth was also poor in March 2015 and March 2017). The main jobless rate stayed at 4.1%; the broader U-6 rate, counting the underemployed, fell 0.2% to 8.0%, an 11-year low. Yearly wage growth was at 2.7%. Lastly, February’s huge net job gain was revised up by 13,000 to 326,000.(1)

TRADE TENSIONS PERSIST

Thursday night, the Trump administration announced the possibility of $100 billion of additional tariffs on Chinese imports. In response, the Chinese government issued a statement saying it would “fight back firmly.” Earlier on Thursday, China had presented a list of U.S. goods that could face up to $50 billion in future excise taxes in that nation. Secretary of the Treasury Steven Mnuchin told the media Friday afternoon that U.S. and Chinese officials are both pursuing a resolution to the tariffs battle, stating: “We’re absolutely willing to negotiate.”(2)

ISM INDICES: ANOTHER IMPRESSIVE MONTH

The Institute for Supply Management’s two closely watched purchasing manager indices were lower in March, but their readings still indicated burgeoning U.S. service and factory sectors. ISM’s service sector PMI declined 0.7 points to a mark of 58.8, while its manufacturing industry PMI settled 1.5 points lower at 59.3.(3)

APRIL BEGINS WITH VOLATILITY

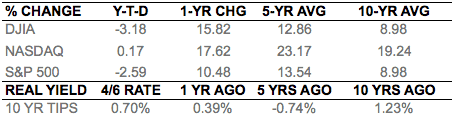

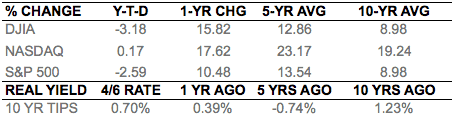

After five days of rollercoastering, the major stock indices ended the week notably lower, as investor worries about tariffs and tech giants continued. Across five trading sessions, the S&P 500 fell 1.38% to 2,604.47; the Nasdaq Composite, 2.10% to 6,915.11; the Dow Jones Industrial Average, 0.71% to 23,932.76. Oil prices fell 4.6% for the week over concerns about U.S.-China trade and a boost in the number of rigs in operation.(4,5)

THIS WEEK: Nothing major is slated for Monday. The March Producer Price Index appears on Tuesday. Minutes from the last Federal Reserve policy meeting arrive Wednesday, along with the March Consumer Price Index and quarterly results from Bed Bath & Beyond and Fastenal. On Thursday, BlackRock and Rite Aid present earnings, and investors also consider the latest initial claims figures. Earnings season is in full swing Friday with announcements from Citigroup, Infosys, JPMorgan Chase, PNC Financial Services Group, and Wells Fargo; complementing all that, the University of Michigan releases its preliminary April consumer sentiment index.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/04/06/nonfarm-payrolls-march-2018.html [4/6/18]

2 – usnews.com/news/business/articles/2018-04-06/the-latest-china-says-it-will-fight-us-tariffs-at-any-cost [4/6/18]

3 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?navItemNumber=31046&SSO=1 [4/4/18]

4 – markets.wsj.com/us [4/6/18]

5 – marketwatch.com/story/oil-futures-end-23-lower-amid-trade-worries-rising-rig-count-2018-04-06/ [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F6%2F17&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F6%2F17&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F6%2F17&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F5%2F13&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F5%2F13&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F5%2F13&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F7%2F08&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F7%2F08&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F7%2F08&x=0&y=0 [4/6/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [4/6/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [4/6/18]

HIRING WEAKENED IN MARCH

Payrolls expanded by only 103,000 net new jobs last month, according to the latest employment report from the Department of Labor. Some economists wondered if harsh weather distorted the number (job growth was also poor in March 2015 and March 2017). The main jobless rate stayed at 4.1%; the broader U-6 rate, counting the underemployed, fell 0.2% to 8.0%, an 11-year low. Yearly wage growth was at 2.7%. Lastly, February’s huge net job gain was revised up by 13,000 to 326,000.(1)

TRADE TENSIONS PERSIST

Thursday night, the Trump administration announced the possibility of $100 billion of additional tariffs on Chinese imports. In response, the Chinese government issued a statement saying it would “fight back firmly.” Earlier on Thursday, China had presented a list of U.S. goods that could face up to $50 billion in future excise taxes in that nation. Secretary of the Treasury Steven Mnuchin told the media Friday afternoon that U.S. and Chinese officials are both pursuing a resolution to the tariffs battle, stating: “We’re absolutely willing to negotiate.”(2)

ISM INDICES: ANOTHER IMPRESSIVE MONTH

The Institute for Supply Management’s two closely watched purchasing manager indices were lower in March, but their readings still indicated burgeoning U.S. service and factory sectors. ISM’s service sector PMI declined 0.7 points to a mark of 58.8, while its manufacturing industry PMI settled 1.5 points lower at 59.3.(3)

APRIL BEGINS WITH VOLATILITY

After five days of rollercoastering, the major stock indices ended the week notably lower, as investor worries about tariffs and tech giants continued. Across five trading sessions, the S&P 500 fell 1.38% to 2,604.47; the Nasdaq Composite, 2.10% to 6,915.11; the Dow Jones Industrial Average, 0.71% to 23,932.76. Oil prices fell 4.6% for the week over concerns about U.S.-China trade and a boost in the number of rigs in operation.(4,5)

THIS WEEK: Nothing major is slated for Monday. The March Producer Price Index appears on Tuesday. Minutes from the last Federal Reserve policy meeting arrive Wednesday, along with the March Consumer Price Index and quarterly results from Bed Bath & Beyond and Fastenal. On Thursday, BlackRock and Rite Aid present earnings, and investors also consider the latest initial claims figures. Earnings season is in full swing Friday with announcements from Citigroup, Infosys, JPMorgan Chase, PNC Financial Services Group, and Wells Fargo; complementing all that, the University of Michigan releases its preliminary April consumer sentiment index.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/04/06/nonfarm-payrolls-march-2018.html [4/6/18]

2 – usnews.com/news/business/articles/2018-04-06/the-latest-china-says-it-will-fight-us-tariffs-at-any-cost [4/6/18]

3 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm?navItemNumber=31046&SSO=1 [4/4/18]

4 – markets.wsj.com/us [4/6/18]

5 – marketwatch.com/story/oil-futures-end-23-lower-amid-trade-worries-rising-rig-count-2018-04-06/ [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F6%2F17&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F6%2F17&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F6%2F17&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F5%2F13&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F5%2F13&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F5%2F13&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=4%2F7%2F08&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=4%2F7%2F08&x=0&y=0 [4/6/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=4%2F7%2F08&x=0&y=0 [4/6/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [4/6/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [4/6/18]