MONTHLY QUOTE

“Reality is something you rise above.”

– Liza Minnelli

MONTHLY TIP

Do you live in a flood-prone region? Are you moving to one? A homeowner insurance policy will not cover flood damage. Consider buying a flood insurance policy, either from an insurance company or the National Flood Insurance Program (NFIP).

MONTHLY RIDDLE

Three sisters walk toward school with just one small umbrella, which they must all try to fit under. When they reach their school, none of them are the slightest bit wet. How is this possible?

Last month’s riddle

The world measures them using units of temperature and time, but they have no clocks or heat. What are these two things?

Last week’s answer:

Latitude and longitude.

THE MONTH IN BRIEF

Stocks went sideways rather than north in March, with the S&P 500 losing just 0.04%. The Federal Reserve made another quarter-point interest rate move, and overseas, the United Kingdom initiated Brexit proceedings. While new data showed weak consumer spending, consumer optimism remained high and hiring was once again strong. A subpar month for commodities did bring major gains for two energy futures. In the housing market, existing home sales decelerated, while new home sales picked up. A little volatility did not upset the primarily bullish outlook on Wall Street.(1)

DOMESTIC ECONOMIC HEALTH

On March 15, the Federal Reserve felt confident enough in the economy to raise the benchmark interest rate to the 0.75%-1.00% range. The central bank left its 2017 dot-plot unchanged – its forecast still calls for a total of three rate hikes this year.(2)

Last month, most of the major indicators affirmed the health of the economy. The only question mark concerned household spending, and the 0.1% February gain may have just been an aberration. Consumer incomes did increase 0.4% in February, so it appeared households were pocketing more of what they had made; in fact, there was only a 0.1% February rise in retail sales. Speaking of consumer spending, the Bureau of Economic Analysis revised fourth-quarter growth up to 2.1% as the month ended; even with that upgrade to the Q4 GDP number, the economy grew just 1.6% last year, a full percentage point less than in 2015.(3,4)

Americans felt very confident about the state of the economy in March. The Conference Board’s index jumped up 9.5 points in a month to a remarkably high reading of 125.6. The University of Michigan’s monthly index of consumer sentiment finished March at 96.9, up 0.6 points from its final February mark.(5,6)

The labor market showed further strength. Department of Labor data showed the economy adding 235,000 net new jobs in February, with the construction and education/health care sectors accounting for 120,000 of them. This sent the U-3 unemployment rate down 0.1% further to 4.7%, while the U-6 rate measuring “total” unemployment declined another 0.2% to 9.2%.(7)

In the opening week of March, the latest Institute for Supply Management gauges of manufacturing and service sector activity showed both sectors in good shape during February. At 57.6, the ISM services PMI reached its highest point since October 2015; the U.S. service sector saw its eighty-sixth straight month of expansion. The ISM factory PMI rose 1.7 points in February to 57.7.(8)

The Federal Reserve’s preferred inflation gauge, the PCE price index, showed a 2.1% annualized gain for the year ending in February. That was a 5-year peak. Surpassing that, the headline Consumer Price Index rose 2.7% in the 12 months concluding in February, even with a mere 0.1% monthly advance. Producer prices were up 2.2% year-over-year with a February increase of 0.3%.(3,5)

GLOBAL ECONOMIC HEALTH

Just before March ended, United Kingdom Prime Minister Theresa May invoked Article 50 of the Lisbon Treaty, formally triggering the start of the Brexit process. The clock is now ticking: within two years, the U.K. will make either a “hard” or “soft” exit from the European Union, with the first round of negotiations getting underway at an E.U. summit commencing April 29. The big question is whether the U.K. will be able to stay in the E.U.’s single market after the Brexit; it has said it might forfeit such trade access in exchange for curbing immigration from other E.U. member nations. Should it retain that trade access, U.K. citizens will still be allowed to work and live in other E.U. countries without getting visas. If negotiations somehow do not result in an exit deal by April 2019, then the terms of the Brexit could be left to the courts and/or the rules of the World Trade Organization.(9)

By World Bank projections, five Asian economies will expand by 6.5% or more this year: Laos (7.0%); Cambodia, Myanmar, and the Philippines (6.9%); and China (6.5%). China’s growth is at a 26-year low in 2017, but foreign investment in the Chinese economy is forecast to rise to 15.0% this year, compared to only 4.1% in 2016. The March impeachment of South Korean President Park Geun-hye delivered another black eye to the fourth largest economy in Asia; Park and several Samsung officials were disgraced with corruption charges this winter, an especially troubling development given that the Samsung conglomerate accounts for about 15% of the South Korean economy. South Korea has already seen the collapse of Hanjin Shipping, one of the world’s major cargo lines, and its government also recently bailed out its major shipbuilders.(10,11)

WORLD MARKETS

March saw many foreign benchmarks advance. At the forefront was Spain’s IBEX 35. It rose 9.50% for the month. Several other indices added 3% or more in March: Argentina’s MERVAL, 5.92%; France’s CAC 40, 5.43%; Germany’s DAX, 4.04%; Mexico’s Bolsa, 3.60%; Korea’s KOSPI, 3.28%; India’s Sensex, 3.05%; the FTSE Eurofirst 300, 3.03%. Other March gains: Australia’s All Ordinaries, 2.48%; MSCI Emerging Markets, 2.35%; Hong Kong’s Hang Seng, 1.56%; Canada’s TSX Composite, 0.96%; the United Kingdom’s FTSE 100, 0.82%; MSCI World, 0.82%.(12,13)

There were also three notable retreats. China’s Shanghai Composite declined 0.59%; Japan’s Nikkei 225 lost 1.10%; and Russia’s MICEX fell 1.96%.(2)

COMMODITIES MARKETS

The price of both natural gas and unleaded gasoline climbed in March: the first of those two commodities gained 15.28%, the second 12.17%. Cocoa futures added 3.87% last month; wheat futures, 0.29%. In sum, that was the good news.(14)

Unfortunately, many commodities turned south in March. Oil made a 5.83% descent on the NYMEX, settling at $50.85 as the month ended. Copper fell 2.07%; heating oil, 3.17%; platinum, 7.39%; soybeans, 7.75%; and sugar, 12.95%. Losses of less than 1% were incurred by silver (0.14%), cotton (0.21%), corn (0.48%), and coffee (0.64%). Gold closed March at $1,247.40; silver at $18.28. The U.S. Dollar Index fell 0.79% to 100.56, slipping to -1.61% YTD.(1,14)

REAL ESTATE

Reports from the National Association of Realtors brought good news and bad news. February had seen a 3.7% dip in existing home sales; on the other hand, there was a 5.5% gain for pending home sales. A Census Bureau report showed new home buying improving 6.1% in February; this was on the heels of a 5.3% gain in January.(5)

The latest (January) edition of the 20-city S&P/Case-Shiller home price index displayed a 0.2% monthly gain, which left its 12-month advance at 5.7%. Housing starts rose 3.0% in February after a 1.9% dip in January, while permits for future construction fell 6.2% after a 4.6% January boost.(5)

Home loan rates did creep a bit higher across March. In Freddie Mac’s March 30 Primary Mortgage Market Survey, the 30-year fixed had an average interest rate of 4.14%, up from 4.10% on March 2. In the same period, the average interest rate on the 15-year FRM moved from 3.32% to 3.39%, while the average rate on the 5/1-year ARM increased from 3.14% to 3.18%.(15)

LOOKING BACK…LOOKING FORWARD

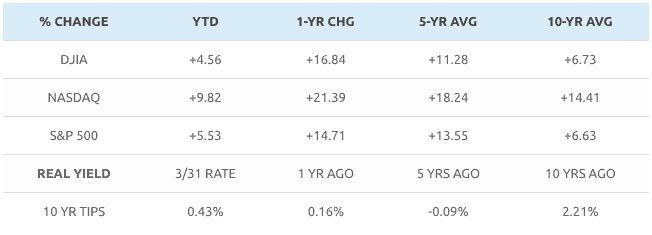

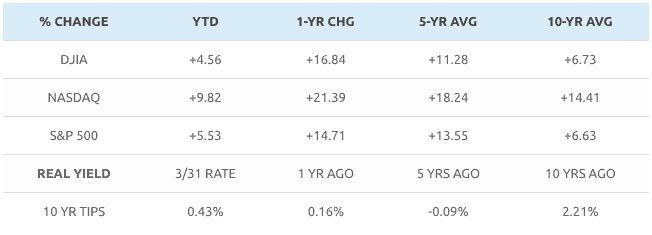

The Nasdaq Composite was the only one of the three major indices to post a March gain, adding a healthy 1.48%. Both the S&P 500 and Russell 2000 took tiny losses, respectively declining 0.04% and 0.05%. The Dow Jones Industrial Average fell 0.72%. The CBOE VIX pulled back 4.26%. When Wall Street closed on March 31, these indices settled as follows: S&P, 2,362.72; DJIA, 20,663.22; NASDAQ, 5,911.74; RUT, 1,385.92; VIX, 12.37. Looking further at market statistics, one notices a 28.30% 52-week gain for the Russell 2000 through the end of March. The best performer last month was the PHLX Semiconductor Sector index, which rose 4.33% to take its 52-week advance to 52.04%.(1)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

March ended quietly, with the bulls taking a breather. Will investors find hopes or fundamentals to rally around in April? The next earnings season is two weeks ahead, and FactSet forecasts annualized earnings growth of 9.1% for S&P 500 firms – a bullish projection, indeed, that would represent the best year-over-year improvement since Q4 2011. Any nascent plans for tax reform could also stoke bullish sentiment, even though reforms could take many months to enact. While the rally waned at the end of March, it could find some fresh legs as the second quarter begins, with the markets experiencing relatively placid weather so far in 2017.(19)

UPCOMING ECONOMIC RELEASES: What major news items will Wall Street watch for in April? The March Challenger job-cut report (4/6), the Department of Labor’s March employment report (4/7), the March PPI and the preliminary April consumer sentiment index from the University of Michigan (4/13), March retail sales and the March CPI (4/14), March industrial production, housing starts and building permits (4/18), a new Federal Reserve Beige Book (4/19), the Conference Board’s latest leading indicators report (4/20), March existing home sales (4/21), the April Conference Board consumer confidence index and March new home sales (4/25), March hard goods orders and pending home sales (4/27), and then, the federal government’s initial estimate of first-quarter growth and the final April consumer sentiment index from the University of Michigan (4/28). The March consumer spending report and PCE price index will both be released on May 1.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. The MERVAL Index (MERcado de VALores, literally Stock Exchange) is the most important index of the Buenos Aires Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The DAX 30 is a Blue Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The Korea Composite Stock Price Index or KOSPI is the major stock market index of South Korea, representing all common stocks traded on the Korea Exchange. The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also-called the BSE 30 (BOMBAY STOCK EXCHANGE) or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange (BSE). The FTSE Eurofirst 300 measures the performance of Europe’s largest 300 companies by market capitalization and covers 70% of Europe’s market cap. The All Ordinaries (XAO) is considered a total market barometer for the Australian stock market and contains the 500 largest ASX-listed companies by way of market capitalization. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The MICEX 10 Index (Russian: Индекс ММВБ10) is an unweighted price index that tracks the ten most liquid Russian stocks listed on MICEX-RTS in Moscow. The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. PHLX Semiconductor Sector (SOX) is a Philadelphia Stock Exchange capitalization-weighted index composed of companies primarily involved in the design, distribution, manufacture, and sale of semiconductors. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – barchart.com/stocks/indices#/viewName=performance [3/31/17]

2 – marketwatch.com/story/fed-raises-interest-rates-by-a-quarter-point-sees-two-move-moves-this-year-2017-03-15 [3/15/17]

3 – schaeffersresearch.com/content/ezines/2017/03/31/dow-jones-industrial-average-futures-slip-but-stocks-set-for-strong-quarter [3/31/17]

4 – reuters.com/article/us-usa-economy-gdp-idUSKBN1711MX [3/31/17]

5 – investing.com/economic-calendar/ [3/31/17]

6 – sca.isr.umich.edu/ [3/31/17]

7 – equities.com/news/a-strong-jobs-report-and-a-growing-divergence-between-jobs-and-employment [3/10/17]

8 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm [3/3/17]

9 – usatoday.com/story/news/world/2017/03/29/britain-invokes-article-50-4-things-know-brexit/99769996/ [3/29/17]

10 – forbes.com/sites/ralphjennings/2017/03/23/east-asias-5-fastest-growing-countries-in-2017/ [3/23/17]

11 – money.cnn.com/2017/03/10/news/economy/south-korea-economy-president-park-out/ [3/10/17]

12 – markets.on.nytimes.com/research/markets/worldmarkets/worldmarkets.asp [3/31/17]

13 – msci.com/end-of-day-data-search [3/31/17]

14 – money.cnn.com/data/commodities/ [3/31/17]

15 – freddiemac.com/pmms/archive.html?year=2017 [4/2/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F31%2F16&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F31%2F16&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F31%2F16&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F30%2F12&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F30%2F12&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F30%2F12&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F30%2F07&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F30%2F07&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F30%2F07&x=0&y=0 [3/31/17]

17 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [3/31/17]

18 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [3/31/17]

19 – kiplinger.com/article/investing/T052-C008-S001-market-outlook-for-q2.html [3/31/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

THE MONTH IN BRIEF

Stocks went sideways rather than north in March, with the S&P 500 losing just 0.04%. The Federal Reserve made another quarter-point interest rate move, and overseas, the United Kingdom initiated Brexit proceedings. While new data showed weak consumer spending, consumer optimism remained high and hiring was once again strong. A subpar month for commodities did bring major gains for two energy futures. In the housing market, existing home sales decelerated, while new home sales picked up. A little volatility did not upset the primarily bullish outlook on Wall Street.(1)

DOMESTIC ECONOMIC HEALTH

On March 15, the Federal Reserve felt confident enough in the economy to raise the benchmark interest rate to the 0.75%-1.00% range. The central bank left its 2017 dot-plot unchanged – its forecast still calls for a total of three rate hikes this year.(2)

Last month, most of the major indicators affirmed the health of the economy. The only question mark concerned household spending, and the 0.1% February gain may have just been an aberration. Consumer incomes did increase 0.4% in February, so it appeared households were pocketing more of what they had made; in fact, there was only a 0.1% February rise in retail sales. Speaking of consumer spending, the Bureau of Economic Analysis revised fourth-quarter growth up to 2.1% as the month ended; even with that upgrade to the Q4 GDP number, the economy grew just 1.6% last year, a full percentage point less than in 2015.(3,4)

Americans felt very confident about the state of the economy in March. The Conference Board’s index jumped up 9.5 points in a month to a remarkably high reading of 125.6. The University of Michigan’s monthly index of consumer sentiment finished March at 96.9, up 0.6 points from its final February mark.(5,6)

The labor market showed further strength. Department of Labor data showed the economy adding 235,000 net new jobs in February, with the construction and education/health care sectors accounting for 120,000 of them. This sent the U-3 unemployment rate down 0.1% further to 4.7%, while the U-6 rate measuring “total” unemployment declined another 0.2% to 9.2%.(7)

In the opening week of March, the latest Institute for Supply Management gauges of manufacturing and service sector activity showed both sectors in good shape during February. At 57.6, the ISM services PMI reached its highest point since October 2015; the U.S. service sector saw its eighty-sixth straight month of expansion. The ISM factory PMI rose 1.7 points in February to 57.7.(8)

The Federal Reserve’s preferred inflation gauge, the PCE price index, showed a 2.1% annualized gain for the year ending in February. That was a 5-year peak. Surpassing that, the headline Consumer Price Index rose 2.7% in the 12 months concluding in February, even with a mere 0.1% monthly advance. Producer prices were up 2.2% year-over-year with a February increase of 0.3%.(3,5)

GLOBAL ECONOMIC HEALTH

Just before March ended, United Kingdom Prime Minister Theresa May invoked Article 50 of the Lisbon Treaty, formally triggering the start of the Brexit process. The clock is now ticking: within two years, the U.K. will make either a “hard” or “soft” exit from the European Union, with the first round of negotiations getting underway at an E.U. summit commencing April 29. The big question is whether the U.K. will be able to stay in the E.U.’s single market after the Brexit; it has said it might forfeit such trade access in exchange for curbing immigration from other E.U. member nations. Should it retain that trade access, U.K. citizens will still be allowed to work and live in other E.U. countries without getting visas. If negotiations somehow do not result in an exit deal by April 2019, then the terms of the Brexit could be left to the courts and/or the rules of the World Trade Organization.(9)

By World Bank projections, five Asian economies will expand by 6.5% or more this year: Laos (7.0%); Cambodia, Myanmar, and the Philippines (6.9%); and China (6.5%). China’s growth is at a 26-year low in 2017, but foreign investment in the Chinese economy is forecast to rise to 15.0% this year, compared to only 4.1% in 2016. The March impeachment of South Korean President Park Geun-hye delivered another black eye to the fourth largest economy in Asia; Park and several Samsung officials were disgraced with corruption charges this winter, an especially troubling development given that the Samsung conglomerate accounts for about 15% of the South Korean economy. South Korea has already seen the collapse of Hanjin Shipping, one of the world’s major cargo lines, and its government also recently bailed out its major shipbuilders.(10,11)

WORLD MARKETS

March saw many foreign benchmarks advance. At the forefront was Spain’s IBEX 35. It rose 9.50% for the month. Several other indices added 3% or more in March: Argentina’s MERVAL, 5.92%; France’s CAC 40, 5.43%; Germany’s DAX, 4.04%; Mexico’s Bolsa, 3.60%; Korea’s KOSPI, 3.28%; India’s Sensex, 3.05%; the FTSE Eurofirst 300, 3.03%. Other March gains: Australia’s All Ordinaries, 2.48%; MSCI Emerging Markets, 2.35%; Hong Kong’s Hang Seng, 1.56%; Canada’s TSX Composite, 0.96%; the United Kingdom’s FTSE 100, 0.82%; MSCI World, 0.82%.(12,13)

There were also three notable retreats. China’s Shanghai Composite declined 0.59%; Japan’s Nikkei 225 lost 1.10%; and Russia’s MICEX fell 1.96%.(2)

COMMODITIES MARKETS

The price of both natural gas and unleaded gasoline climbed in March: the first of those two commodities gained 15.28%, the second 12.17%. Cocoa futures added 3.87% last month; wheat futures, 0.29%. In sum, that was the good news.(14)

Unfortunately, many commodities turned south in March. Oil made a 5.83% descent on the NYMEX, settling at $50.85 as the month ended. Copper fell 2.07%; heating oil, 3.17%; platinum, 7.39%; soybeans, 7.75%; and sugar, 12.95%. Losses of less than 1% were incurred by silver (0.14%), cotton (0.21%), corn (0.48%), and coffee (0.64%). Gold closed March at $1,247.40; silver at $18.28. The U.S. Dollar Index fell 0.79% to 100.56, slipping to -1.61% YTD.(1,14)

REAL ESTATE

Reports from the National Association of Realtors brought good news and bad news. February had seen a 3.7% dip in existing home sales; on the other hand, there was a 5.5% gain for pending home sales. A Census Bureau report showed new home buying improving 6.1% in February; this was on the heels of a 5.3% gain in January.(5)

The latest (January) edition of the 20-city S&P/Case-Shiller home price index displayed a 0.2% monthly gain, which left its 12-month advance at 5.7%. Housing starts rose 3.0% in February after a 1.9% dip in January, while permits for future construction fell 6.2% after a 4.6% January boost.(5)

Home loan rates did creep a bit higher across March. In Freddie Mac’s March 30 Primary Mortgage Market Survey, the 30-year fixed had an average interest rate of 4.14%, up from 4.10% on March 2. In the same period, the average interest rate on the 15-year FRM moved from 3.32% to 3.39%, while the average rate on the 5/1-year ARM increased from 3.14% to 3.18%.(15)

LOOKING BACK…LOOKING FORWARD

The Nasdaq Composite was the only one of the three major indices to post a March gain, adding a healthy 1.48%. Both the S&P 500 and Russell 2000 took tiny losses, respectively declining 0.04% and 0.05%. The Dow Jones Industrial Average fell 0.72%. The CBOE VIX pulled back 4.26%. When Wall Street closed on March 31, these indices settled as follows: S&P, 2,362.72; DJIA, 20,663.22; NASDAQ, 5,911.74; RUT, 1,385.92; VIX, 12.37. Looking further at market statistics, one notices a 28.30% 52-week gain for the Russell 2000 through the end of March. The best performer last month was the PHLX Semiconductor Sector index, which rose 4.33% to take its 52-week advance to 52.04%.(1)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

March ended quietly, with the bulls taking a breather. Will investors find hopes or fundamentals to rally around in April? The next earnings season is two weeks ahead, and FactSet forecasts annualized earnings growth of 9.1% for S&P 500 firms – a bullish projection, indeed, that would represent the best year-over-year improvement since Q4 2011. Any nascent plans for tax reform could also stoke bullish sentiment, even though reforms could take many months to enact. While the rally waned at the end of March, it could find some fresh legs as the second quarter begins, with the markets experiencing relatively placid weather so far in 2017.(19)

UPCOMING ECONOMIC RELEASES: What major news items will Wall Street watch for in April? The March Challenger job-cut report (4/6), the Department of Labor’s March employment report (4/7), the March PPI and the preliminary April consumer sentiment index from the University of Michigan (4/13), March retail sales and the March CPI (4/14), March industrial production, housing starts and building permits (4/18), a new Federal Reserve Beige Book (4/19), the Conference Board’s latest leading indicators report (4/20), March existing home sales (4/21), the April Conference Board consumer confidence index and March new home sales (4/25), March hard goods orders and pending home sales (4/27), and then, the federal government’s initial estimate of first-quarter growth and the final April consumer sentiment index from the University of Michigan (4/28). The March consumer spending report and PCE price index will both be released on May 1.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. The Russell 2000 Index measures the performance of the small-cap segment of the U.S. equity universe. The CBOE Volatility Index® (VIX®) is a key measure of market expectations of near-term volatility conveyed by S&P 500 stock index option prices. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. The IBEX 35 is the benchmark stock market index of the Bolsa de Madrid, Spain’s principal stock exchange. The MERVAL Index (MERcado de VALores, literally Stock Exchange) is the most important index of the Buenos Aires Stock Exchange. The CAC-40 Index is a narrow-based, modified capitalization-weighted index of 40 companies listed on the Paris Bourse. The DAX 30 is a Blue Chip stock market index consisting of the 30 major German companies trading on the Frankfurt Stock Exchange. The Mexican Stock Exchange, commonly known as Mexican Bolsa, Mexbol, or BMV, is the only stock exchange in Mexico. The Korea Composite Stock Price Index or KOSPI is the major stock market index of South Korea, representing all common stocks traded on the Korea Exchange. The BSE SENSEX (Bombay Stock Exchange Sensitive Index), also-called the BSE 30 (BOMBAY STOCK EXCHANGE) or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on the Bombay Stock Exchange (BSE). The FTSE Eurofirst 300 measures the performance of Europe’s largest 300 companies by market capitalization and covers 70% of Europe’s market cap. The All Ordinaries (XAO) is considered a total market barometer for the Australian stock market and contains the 500 largest ASX-listed companies by way of market capitalization. The MSCI Emerging Markets Index is a float-adjusted market capitalization index consisting of indices in more than 25 emerging economies. The Hang Seng Index is a free float-adjusted market capitalization-weighted stock market index that is the main indicator of the overall market performance in Hong Kong. The S&P/TSX Composite Index is an index of the stock (equity) prices of the largest companies on the Toronto Stock Exchange (TSX) as measured by market capitalization. The FTSE 100 Index is a share index of the 100 companies listed on the London Stock Exchange with the highest market capitalization. The MSCI World Index is a free-float weighted equity index that includes developed world markets, and does not include emerging markets. The SSE Composite Index is an index of all stocks (A shares and B shares) that are traded at the Shanghai Stock Exchange. Nikkei 225 (Ticker: ^N225) is a stock market index for the Tokyo Stock Exchange (TSE). The Nikkei average is the most watched index of Asian stocks. The MICEX 10 Index (Russian: Индекс ММВБ10) is an unweighted price index that tracks the ten most liquid Russian stocks listed on MICEX-RTS in Moscow. The US Dollar Index measures the performance of the U.S. dollar against a basket of six currencies. PHLX Semiconductor Sector (SOX) is a Philadelphia Stock Exchange capitalization-weighted index composed of companies primarily involved in the design, distribution, manufacture, and sale of semiconductors. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – barchart.com/stocks/indices#/viewName=performance [3/31/17]

2 – marketwatch.com/story/fed-raises-interest-rates-by-a-quarter-point-sees-two-move-moves-this-year-2017-03-15 [3/15/17]

3 – schaeffersresearch.com/content/ezines/2017/03/31/dow-jones-industrial-average-futures-slip-but-stocks-set-for-strong-quarter [3/31/17]

4 – reuters.com/article/us-usa-economy-gdp-idUSKBN1711MX [3/31/17]

5 – investing.com/economic-calendar/ [3/31/17]

6 – sca.isr.umich.edu/ [3/31/17]

7 – equities.com/news/a-strong-jobs-report-and-a-growing-divergence-between-jobs-and-employment [3/10/17]

8 – instituteforsupplymanagement.org/ISMReport/NonMfgROB.cfm [3/3/17]

9 – usatoday.com/story/news/world/2017/03/29/britain-invokes-article-50-4-things-know-brexit/99769996/ [3/29/17]

10 – forbes.com/sites/ralphjennings/2017/03/23/east-asias-5-fastest-growing-countries-in-2017/ [3/23/17]

11 – money.cnn.com/2017/03/10/news/economy/south-korea-economy-president-park-out/ [3/10/17]

12 – markets.on.nytimes.com/research/markets/worldmarkets/worldmarkets.asp [3/31/17]

13 – msci.com/end-of-day-data-search [3/31/17]

14 – money.cnn.com/data/commodities/ [3/31/17]

15 – freddiemac.com/pmms/archive.html?year=2017 [4/2/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F31%2F16&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F31%2F16&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F31%2F16&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F30%2F12&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F30%2F12&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F30%2F12&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F30%2F07&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F30%2F07&x=0&y=0 [3/31/17]

16 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F30%2F07&x=0&y=0 [3/31/17]

17 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [3/31/17]

18 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [3/31/17]

19 – kiplinger.com/article/investing/T052-C008-S001-market-outlook-for-q2.html [3/31/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.