WEEKLY QUOTE

“Don’t ever take a fence down until you know the reason it was put up.”

– G.K. Chesterton

WEEKLY TIP

Once a baby is born, family health insurance policies usually require the parents to add the child to the policy within 30 days. If that is not done, certain benefits may be lost until the next open enrollment period. New parents should contact insurers about their specifications and download enrollment forms ASAP.

WEEKLY RIDDLE

What 10-letter word has three consecutive pairs of letters in its middle? (It starts with the letter B.)

Last week’s riddle

If you push me to extremes, I can rage and boil, but an hour later, I may be silent and stiff. What am I?

Last week’s answer:

Water.

JOB CREATION, JOBLESS RATE DOWN IN MAY

A day after ADP’s employment change report estimated a hiring gain of 253,000 in May, the Department of Labor’s latest jobs report told a far different story. It said employers added just 138,000 workers last month. The U-3 jobless rate fell to a 16-year low of 4.3% in May, partly because of people dropping out of the labor force. The U-6 rate, counting the underemployed, decreased to a 10-year low of 8.4%. Annualized wage growth improved 0.2% to 2.5%.(1,2)

CONSUMER CONFIDENCE INDEX DECLINES

The Conference Board’s monthly consumer confidence gauge remained well north of 100 in May. It came in at 117.9. The index actually descended 1.5 points from its (downwardly revised) April reading of 119.4.(1)

FACTORY GROWTH MAINTAINS ITS PACE

Rising a tenth of a percentage point to 54.9, the Institute for Supply Management’s manufacturing purchasing manager index showed healthy sector expansion in May. ISM last measured a sector contraction (a reading below 50) in August.(3)

PERSONAL SPENDING INCREASES

In April, consumer spending grew by 0.4% according to the Bureau of Economic Analysis. Additionally, the BEA revised the previously flat March personal spending number up to a 0.3% gain. Personal incomes also rose 0.4% in the fourth month of the year, twice the improvement seen in March.(1)

NO REINING IN THE BULLS

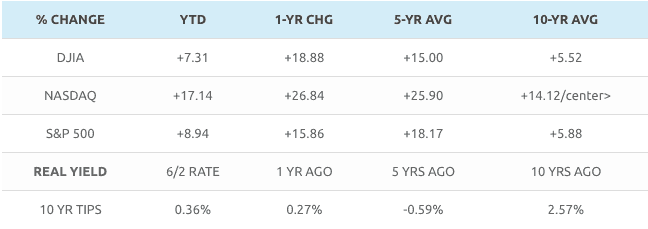

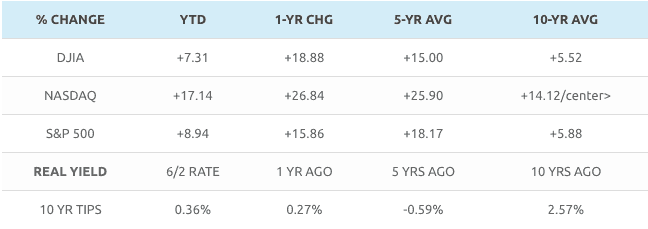

Rising 0.93% across four trading days, the S&P 500 ended last week at 2,439.07. The Nasdaq Composite continued its red-hot run, gaining 1.50% for the week to a June 2 close of 6,305.80. Settling at 21,206.29 Friday, the Dow Jones Industrial Average added 0.56% across its last four trading sessions. The CBOE VIX “fear index” closed at a remarkably low 9.79 Friday, down 30.27% YTD.(4,5)

THIS WEEK: ISM’s May non-manufacturing PMI appears Monday, along with data on April factory orders, and earnings from Casey’s General Stores, Dave & Buster’s, and Thor Industries. Conn’s, Fred’s, and Michaels Companies announce earnings on Tuesday. Navistar reports quarterly results on Wednesday. Thursday, Wall Street examines new initial jobless claims figures and earnings news from Dell Technologies, J.M. Smucker, and Verifone. Nothing major is slated for Friday.

Sources: wsj.com, bigcharts.com, treasury.gov – 6/2/17 (5,6,7,8)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

For more information about Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – briefing.com/investor/calendars/economic/2017/05/29-02 [6/2/17]

2 – nytimes.com/2017/06/02/business/economy/jobs-report.html [6/2/17]

3 – tradingeconomics.com/united-states/business-confidence [6/24/17]

4 – google.com/finance?q=INDEXDJX:.DJI&ei=wccxWdD3B8GB2AaH_paYDg [6/2/17]

5 – markets.wsj.com/us [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F2%2F16&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F2%2F16&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F2%2F16&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F1%2F12&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F1%2F12&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F1%2F12&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F1%2F07&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F1%2F07&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F1%2F07&x=0&y=0 [6/2/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [6/2/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/2/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.

JOB CREATION, JOBLESS RATE DOWN IN MAY

A day after ADP’s employment change report estimated a hiring gain of 253,000 in May, the Department of Labor’s latest jobs report told a far different story. It said employers added just 138,000 workers last month. The U-3 jobless rate fell to a 16-year low of 4.3% in May, partly because of people dropping out of the labor force. The U-6 rate, counting the underemployed, decreased to a 10-year low of 8.4%. Annualized wage growth improved 0.2% to 2.5%.(1,2)

CONSUMER CONFIDENCE INDEX DECLINES

The Conference Board’s monthly consumer confidence gauge remained well north of 100 in May. It came in at 117.9. The index actually descended 1.5 points from its (downwardly revised) April reading of 119.4.(1)

FACTORY GROWTH MAINTAINS ITS PACE

Rising a tenth of a percentage point to 54.9, the Institute for Supply Management’s manufacturing purchasing manager index showed healthy sector expansion in May. ISM last measured a sector contraction (a reading below 50) in August.(3)

PERSONAL SPENDING INCREASES

In April, consumer spending grew by 0.4% according to the Bureau of Economic Analysis. Additionally, the BEA revised the previously flat March personal spending number up to a 0.3% gain. Personal incomes also rose 0.4% in the fourth month of the year, twice the improvement seen in March.(1)

NO REINING IN THE BULLS

Rising 0.93% across four trading days, the S&P 500 ended last week at 2,439.07. The Nasdaq Composite continued its red-hot run, gaining 1.50% for the week to a June 2 close of 6,305.80. Settling at 21,206.29 Friday, the Dow Jones Industrial Average added 0.56% across its last four trading sessions. The CBOE VIX “fear index” closed at a remarkably low 9.79 Friday, down 30.27% YTD.(4,5)

THIS WEEK: ISM’s May non-manufacturing PMI appears Monday, along with data on April factory orders, and earnings from Casey’s General Stores, Dave & Buster’s, and Thor Industries. Conn’s, Fred’s, and Michaels Companies announce earnings on Tuesday. Navistar reports quarterly results on Wednesday. Thursday, Wall Street examines new initial jobless claims figures and earnings news from Dell Technologies, J.M. Smucker, and Verifone. Nothing major is slated for Friday.

Sources: wsj.com, bigcharts.com, treasury.gov – 6/2/17 (5,6,7,8)

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

For more information about Adams Wealth Management, click here.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – briefing.com/investor/calendars/economic/2017/05/29-02 [6/2/17]

2 – nytimes.com/2017/06/02/business/economy/jobs-report.html [6/2/17]

3 – tradingeconomics.com/united-states/business-confidence [6/24/17]

4 – google.com/finance?q=INDEXDJX:.DJI&ei=wccxWdD3B8GB2AaH_paYDg [6/2/17]

5 – markets.wsj.com/us [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F2%2F16&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F2%2F16&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F2%2F16&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F1%2F12&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F1%2F12&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F1%2F12&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=6%2F1%2F07&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=6%2F1%2F07&x=0&y=0 [6/2/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=6%2F1%2F07&x=0&y=0 [6/2/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [6/2/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [6/2/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.