WEEKLY QUOTE

“One man practicing sportsmanship is better than a hundred teaching it.”

– Knute Rockne

WEEKLY TIP

Business owners should dedicate one hour per month to collect and sort receipts. This is vital for independent contractors, whose tax liability is linked to the expenses they deduct.

WEEKLY RIDDLE

I follow you during the daytime, but at night I can’t be seen. What am I?

Last week’s riddle

Shake me and I’ll do what you want, but first you must extract me from the earth. I may be on the tip of your tongue and over your shoulder. What am I?

Last week’s answer:

Salt.

RETAIL SALES RISE IMPRESSIVELY

In July, they were up 0.6% – the largest monthly increase seen so far in 2017. This gain suggests the economy has gathered momentum in the third quarter. Core retail sales (which do not include food, construction, gas, and auto buying) advanced 0.6% for July as well. The Department of Commerce also revised some spring numbers: retail purchases improved 0.3% in June and were flat a month earlier.(1)

AN UPTURN FOR CONSUMER SENTIMENT

The University of Michigan’s monthly gauge of how U.S. households view current and future economic conditions rose 4.5 points in its preliminary August edition to 97.6. Not since January has the index been so high. In the past 12 months, it has gained 8.7 points.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

HOUSING STARTS RETREAT

Groundbreaking decreased 4.8% in July, according to the latest monthly Census Bureau snapshot of American construction activity. Building permits were also down for the month, with the pace of permits issued declining by 4.1%.(3)

WALL STREET BENCHMARKS SEE WEEKLY LOSSES

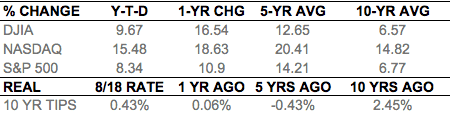

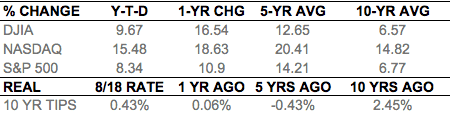

The Barcelona terror attack and concerns over the federal government’s potential to adjust U.S. economic policy impeded equities last week. During August 14-18, the S&P 500 lost 0.65%, settling at 2,425.55 Friday. In its fourth straight weekly retreat, the Nasdaq Composite fell 0.64% to 6,216.53. Like the S&P, the Dow Jones Industrial Average took a second straight weekly loss, ceding 0.84% to reach 21,674.51. In contrast, the Dow Jones Utility Average notched a 1.09% gain across five days. At the end of Friday’s trading session, gold stood at $1,291.60, and WTI crude, at $48.51.(4,5)

THIS WEEK: Ruby Tuesday announces earnings on Monday. Coty, DSW, Intuit, Kirkland’s, La-Z-Boy, Medtronic, Salesforce, and Toll Brothers join the earnings parade Tuesday. Wednesday offers a Census Bureau report on July new home sales and earnings from American Eagle Outfitters, Eaton Vance, Express, HP, Lowe’s, Regis Corp., and Williams-Sonoma. Wall Street learns about July existing home sales Thursday, while also scrutinizing new initial unemployment claims numbers and earnings news from Abercrombie & Fitch, Autodesk, Broadcom, Burlington Stores, Dollar Tree, GameStop, Hormel Foods, Michaels Companies, J.M. Smucker, Staples, Toro, and Ulta Beauty. Federal Reserve chair Janet Yellen speaks on the topic of “financial stability” at the Kansas City Fed’s annual Jackson Hole economic symposium Friday; investors will also consider a report on July hard goods orders.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – reuters.com/article/us-usa-economy-retail-idUSKCN1AV1BZ [8/15/17]

2 – sca.isr.umich.edu/ [8/18/17]

3 – tradingeconomics.com/united-states/housing-starts [8/16/17]

4 – marketwatch.com/story/dow-set-to-fight-for-direction-but-flirts-with-biggest-two-week-drop-in-nearly-a-year-2017-08-18 [8/18/17]

5 – markets.wsj.com/us [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F18%2F16&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F18%2F16&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F18%2F16&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F17%2F12&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F17%2F12&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F17%2F12&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F17%2F07&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F17%2F07&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F17%2F07&x=0&y=0 [8/18/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [8/18/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [8/18/17]

RETAIL SALES RISE IMPRESSIVELY

In July, they were up 0.6% – the largest monthly increase seen so far in 2017. This gain suggests the economy has gathered momentum in the third quarter. Core retail sales (which do not include food, construction, gas, and auto buying) advanced 0.6% for July as well. The Department of Commerce also revised some spring numbers: retail purchases improved 0.3% in June and were flat a month earlier.(1)

AN UPTURN FOR CONSUMER SENTIMENT

The University of Michigan’s monthly gauge of how U.S. households view current and future economic conditions rose 4.5 points in its preliminary August edition to 97.6. Not since January has the index been so high. In the past 12 months, it has gained 8.7 points.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

HOUSING STARTS RETREAT

Groundbreaking decreased 4.8% in July, according to the latest monthly Census Bureau snapshot of American construction activity. Building permits were also down for the month, with the pace of permits issued declining by 4.1%.(3)

WALL STREET BENCHMARKS SEE WEEKLY LOSSES

The Barcelona terror attack and concerns over the federal government’s potential to adjust U.S. economic policy impeded equities last week. During August 14-18, the S&P 500 lost 0.65%, settling at 2,425.55 Friday. In its fourth straight weekly retreat, the Nasdaq Composite fell 0.64% to 6,216.53. Like the S&P, the Dow Jones Industrial Average took a second straight weekly loss, ceding 0.84% to reach 21,674.51. In contrast, the Dow Jones Utility Average notched a 1.09% gain across five days. At the end of Friday’s trading session, gold stood at $1,291.60, and WTI crude, at $48.51.(4,5)

THIS WEEK: Ruby Tuesday announces earnings on Monday. Coty, DSW, Intuit, Kirkland’s, La-Z-Boy, Medtronic, Salesforce, and Toll Brothers join the earnings parade Tuesday. Wednesday offers a Census Bureau report on July new home sales and earnings from American Eagle Outfitters, Eaton Vance, Express, HP, Lowe’s, Regis Corp., and Williams-Sonoma. Wall Street learns about July existing home sales Thursday, while also scrutinizing new initial unemployment claims numbers and earnings news from Abercrombie & Fitch, Autodesk, Broadcom, Burlington Stores, Dollar Tree, GameStop, Hormel Foods, Michaels Companies, J.M. Smucker, Staples, Toro, and Ulta Beauty. Federal Reserve chair Janet Yellen speaks on the topic of “financial stability” at the Kansas City Fed’s annual Jackson Hole economic symposium Friday; investors will also consider a report on July hard goods orders.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – reuters.com/article/us-usa-economy-retail-idUSKCN1AV1BZ [8/15/17]

2 – sca.isr.umich.edu/ [8/18/17]

3 – tradingeconomics.com/united-states/housing-starts [8/16/17]

4 – marketwatch.com/story/dow-set-to-fight-for-direction-but-flirts-with-biggest-two-week-drop-in-nearly-a-year-2017-08-18 [8/18/17]

5 – markets.wsj.com/us [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F18%2F16&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F18%2F16&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F18%2F16&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F17%2F12&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F17%2F12&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F17%2F12&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F17%2F07&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F17%2F07&x=0&y=0 [8/18/17]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F17%2F07&x=0&y=0 [8/18/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [8/18/17]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [8/18/17]