WEEKLY QUOTE

“There are no speed limits on the road to excellence.”

– David W. Johnson

WEEKLY TIP

Smart households invest with diversification. They recognize that directing most of their invested assets into one or two investment classes potentially heightens their risk exposure.

WEEKLY RIDDLE

No matter the time of day, it can open what you can’t. If not for it, on your front porch you would stand. What is it?

Last week’s riddle

Frank got behind the wheel and traveled from Fort Lauderdale to Norfolk without any tires. How did he pull this off?

Last week’s answer:

He was behind the captain’s wheel of a boat.

WAGE GROWTH PICKS UP AT LAST

In January, average hourly pay was 2.9% higher than it was a year earlier. That was the key takeaway from the Department of Labor’s latest jobs report, which noted the addition of 200,000 net new workers last month. In January, the headline unemployment rate stayed at 4.1%; the broader U-6 rate, which counts the underemployed, ticked up to 8.2%.(1)

ISM: FACTORY SECTOR IN GREAT SHAPE

The Institute for Supply Management released its January purchasing manager index for the manufacturing industry last week, and the reading of 59.1 surpassed the forecast, made by economists surveyed by MarketWatch, by half a point. A reading approaching 60 indicates significant expansion.(2)

HOUSEHOLDS SPEND MORE, REMAIN OPTIMISTIC

Personal spending and incomes rose 0.4% in December, according to a Department of Commerce report. The Conference Board’s consumer confidence index climbed 2.3 points to 125.4 in January, while the University of Michigan’s final January consumer sentiment index came in at 95.7 Friday, 1.3 points above its prior reading.(3)

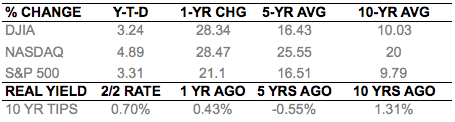

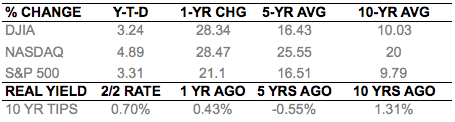

WSTOCKS SLUMP AS FEBRUARY BEGINS

As the 10-year Treasury yield hit 2.85% during Friday’s Wall Street trading session, bears came out of hiding. New wage growth data only added to investor concerns about rising inflation – and how the Federal Reserve might respond to it. For the week: the S&P 500 fell 3.85% to 2,762.13; the Dow Industrials, 4.12% to 25,520.96; the Nasdaq Composite, 3.53% to 7,240.95.(3,4)

THIS WEEK: THIS WEEK: ISM’s service sector PMI appears Monday, along with earnings from Bristol-Myers, Macerich, Panasonic, Suzuki, and Sysco. Akamai, Allergan PLC, Anadarko Petroleum, Aramark, Beazer Homes, BP, Chipotle, Container Store, Cummins, Dunkin’ Brands, General Motors, Genworth Financial, Gilead Sciences, Netgear, Snap, Spirit Airlines, and Walt Disney Co. release earnings Tuesday. Wednesday’s earnings roll call includes news from Allstate, Callaway Golf, Exelon, GlaxoSmithKline, Hasbro, Humana, Invacare, Michael Kors, NetEase, O’Reilly, Peabody Energy, Prudential Financial, Rio Tinto, Take-Two Interactive, Tesla, Twenty-First Century Fox, Valvoline, Yelp, and Zynga. Thursday, a new initial claims report arrives, plus earnings from Activision Blizzard, CBRE, Coty, CVS Health, Expedia, Goodyear, GrubHub, HanesBrands, Kellogg, Lions Gate, NCR, Nvidia, Penske, Philip Morris, Teva Pharmaceuticals, The Hartford, Twitter, Tyson Foods, VeriSign, Viacom, W.R. Grace, and Yum! Brands. Friday, nothing major is scheduled.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nbcnews.com/business/economy/u-s-added-200-000-jobs-january-n843996 [2/2/18]

2 – marketwatch.com/economy-politics/calendars/economic [2/2/18]

3 – tinyurl.com/y7wgwjtg [2/2/18]

4 – markets.wsj.com/us [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F2%2F17&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F2%2F17&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F2%2F17&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F1%2F13&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F1%2F13&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F1%2F13&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F1%2F08&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F1%2F08&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F1%2F08&x=0&y=0 [2/2/18]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/2/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/2/18]

WAGE GROWTH PICKS UP AT LAST

In January, average hourly pay was 2.9% higher than it was a year earlier. That was the key takeaway from the Department of Labor’s latest jobs report, which noted the addition of 200,000 net new workers last month. In January, the headline unemployment rate stayed at 4.1%; the broader U-6 rate, which counts the underemployed, ticked up to 8.2%.(1)

ISM: FACTORY SECTOR IN GREAT SHAPE

The Institute for Supply Management released its January purchasing manager index for the manufacturing industry last week, and the reading of 59.1 surpassed the forecast, made by economists surveyed by MarketWatch, by half a point. A reading approaching 60 indicates significant expansion.(2)

HOUSEHOLDS SPEND MORE, REMAIN OPTIMISTIC

Personal spending and incomes rose 0.4% in December, according to a Department of Commerce report. The Conference Board’s consumer confidence index climbed 2.3 points to 125.4 in January, while the University of Michigan’s final January consumer sentiment index came in at 95.7 Friday, 1.3 points above its prior reading.(3)

WSTOCKS SLUMP AS FEBRUARY BEGINS

As the 10-year Treasury yield hit 2.85% during Friday’s Wall Street trading session, bears came out of hiding. New wage growth data only added to investor concerns about rising inflation – and how the Federal Reserve might respond to it. For the week: the S&P 500 fell 3.85% to 2,762.13; the Dow Industrials, 4.12% to 25,520.96; the Nasdaq Composite, 3.53% to 7,240.95.(3,4)

THIS WEEK: THIS WEEK: ISM’s service sector PMI appears Monday, along with earnings from Bristol-Myers, Macerich, Panasonic, Suzuki, and Sysco. Akamai, Allergan PLC, Anadarko Petroleum, Aramark, Beazer Homes, BP, Chipotle, Container Store, Cummins, Dunkin’ Brands, General Motors, Genworth Financial, Gilead Sciences, Netgear, Snap, Spirit Airlines, and Walt Disney Co. release earnings Tuesday. Wednesday’s earnings roll call includes news from Allstate, Callaway Golf, Exelon, GlaxoSmithKline, Hasbro, Humana, Invacare, Michael Kors, NetEase, O’Reilly, Peabody Energy, Prudential Financial, Rio Tinto, Take-Two Interactive, Tesla, Twenty-First Century Fox, Valvoline, Yelp, and Zynga. Thursday, a new initial claims report arrives, plus earnings from Activision Blizzard, CBRE, Coty, CVS Health, Expedia, Goodyear, GrubHub, HanesBrands, Kellogg, Lions Gate, NCR, Nvidia, Penske, Philip Morris, Teva Pharmaceuticals, The Hartford, Twitter, Tyson Foods, VeriSign, Viacom, W.R. Grace, and Yum! Brands. Friday, nothing major is scheduled.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nbcnews.com/business/economy/u-s-added-200-000-jobs-january-n843996 [2/2/18]

2 – marketwatch.com/economy-politics/calendars/economic [2/2/18]

3 – tinyurl.com/y7wgwjtg [2/2/18]

4 – markets.wsj.com/us [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F2%2F17&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F2%2F17&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F2%2F17&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F1%2F13&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F1%2F13&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F1%2F13&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F1%2F08&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F1%2F08&x=0&y=0 [2/2/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F1%2F08&x=0&y=0 [2/2/18]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/2/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/2/18]