WEEKLY QUOTE

“True knowledge exists in knowing that you know nothing.”

– Socrates

WEEKLY TIP

Thinking of going into business? Most new firms are sole proprietorships, but with the recent federal tax reforms, now is an excellent time to consider other business entities and weigh which one might be best for you.

WEEKLY RIDDLE

It is not a pool yet it has a cover, not a tree yet it has leaves, not a website yet it has pages, and not a shirt yet it has sleeves. What could it be?

Last week’s riddle

You can crack it, share it, tell it, make it, play it. What is it, can you name it?

Last week’s answer:

A joke.

FEWER HOMES ARE SELLING

Demand is high, prices are high, and inventory is slim. In view of these factors, the 4.8% year-over-year fall for existing home sales just reported by the National Association of Realtors is not surprising. It represents the largest annual decline seen since August 2014. Other January NAR data showed homebuying down 3.2% from December levels and a median sale price of $240,500, up 5.8% in 12 months.(1)

FED MINUTES EMPHASIZE THE “GRADUAL”

Minutes from the January Federal Open Market Committee meeting appeared Wednesday, and while FOMC members saw “substantial underlying economic momentum,” they also stated that “gradual policy firming would be appropriate.” To many investors and economists, that hinted at a March rate increase. The CME Group’s FedWatch tool puts the odds of a quarter-point March move at 83.1%.(2,3)

OIL ADVANCES for a SECOND STRAIGHT WEEK

A 1.2% Friday climb left WTI crude 3.3% higher than it had been seven days earlier on the NYMEX. Oil settled at $63.55 a barrel Friday, still down 1.8% for February.(4)

STOCKS RISE

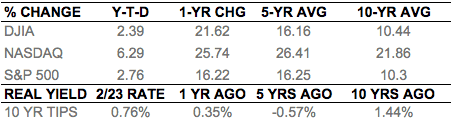

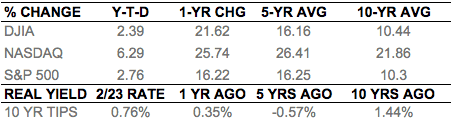

Across February 20-23, all three major Wall Street benchmarks advanced. The Nasdaq Composite set the pace with a 1.35% gain, wrapping up the week at 7,337.39. The S&P 500 and Dow Jones Industrial Average added a little less: the former rose 0.55% to 2,747.30; the latter, 0.36% to 25,309.99.(5)

THIS WEEK: On Monday, Wall Street eyes results from Boise Cascade, CoreLogic, Dean Foods, Fitbit, Nutrisystem, and Palo Alto Networks, and January new home sales numbers also appear. New Federal Reserve chair Jerome Powell testifies on monetary policy in Congress Tuesday; investors will also look at the Conference Board’s latest consumer confidence index, January hard goods orders, and earnings from AutoZone, Bank of Montreal, Discovery Communications, Etsy, Express Scripts, Extended Stay America, Frontier Communications, Hertz Global, IMAX, Live Nation, Macy’s, Papa John’s, Priceline, Sempra Energy, Square, TiVo, and Toll Brothers. On Wednesday, the Street reviews the second estimate of Q4 GDP, January pending home sales, and earnings from Analog Devices, Bayer, Chico’s FAS, Hilton Grand Vacations, Hostess Brands, L Brands, La Quinta Holdings, Lowe’s, Office Depot, Snyder’s-Lance, and Valeant Pharmaceuticals. Thursday offers ISM’s February factory PMI, January personal spending data, and earnings from AMC, Anheuser-Busch, Barnes & Noble, Best Buy, Gap, Kohl’s, and Nordstrom. On Friday, Foot Locker and JCPenney present earnings, and the University of Michigan issues its latest consumer sentiment index.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/02/21/january-existing-home-sales-.html [2/21/18]

2 – investors.com/news/economy/fed-minutes-policy-meeting/ [2/21/18]

3 – cmegroup.com/trading/interest-rates/countdown-to-fomc.html/ [2/23/18]

4 – marketwatch.com/story/oil-on-track-for-second-consecutive-weekly-rise-2018-02-23 [2/23/18]

5 – markets.wsj.com/us [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F23%2F17&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F23%2F17&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F23%2F17&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F22%2F13&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F22%2F13&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F22%2F13&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F22%2F08&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F22%2F08&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F22%2F08&x=0&y=0 [2/23/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/23/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/23/18]

FEWER HOMES ARE SELLING

Demand is high, prices are high, and inventory is slim. In view of these factors, the 4.8% year-over-year fall for existing home sales just reported by the National Association of Realtors is not surprising. It represents the largest annual decline seen since August 2014. Other January NAR data showed homebuying down 3.2% from December levels and a median sale price of $240,500, up 5.8% in 12 months.(1)

FED MINUTES EMPHASIZE THE “GRADUAL”

Minutes from the January Federal Open Market Committee meeting appeared Wednesday, and while FOMC members saw “substantial underlying economic momentum,” they also stated that “gradual policy firming would be appropriate.” To many investors and economists, that hinted at a March rate increase. The CME Group’s FedWatch tool puts the odds of a quarter-point March move at 83.1%.(2,3)

OIL ADVANCES for a SECOND STRAIGHT WEEK

A 1.2% Friday climb left WTI crude 3.3% higher than it had been seven days earlier on the NYMEX. Oil settled at $63.55 a barrel Friday, still down 1.8% for February.(4)

STOCKS RISE

Across February 20-23, all three major Wall Street benchmarks advanced. The Nasdaq Composite set the pace with a 1.35% gain, wrapping up the week at 7,337.39. The S&P 500 and Dow Jones Industrial Average added a little less: the former rose 0.55% to 2,747.30; the latter, 0.36% to 25,309.99.(5)

THIS WEEK: On Monday, Wall Street eyes results from Boise Cascade, CoreLogic, Dean Foods, Fitbit, Nutrisystem, and Palo Alto Networks, and January new home sales numbers also appear. New Federal Reserve chair Jerome Powell testifies on monetary policy in Congress Tuesday; investors will also look at the Conference Board’s latest consumer confidence index, January hard goods orders, and earnings from AutoZone, Bank of Montreal, Discovery Communications, Etsy, Express Scripts, Extended Stay America, Frontier Communications, Hertz Global, IMAX, Live Nation, Macy’s, Papa John’s, Priceline, Sempra Energy, Square, TiVo, and Toll Brothers. On Wednesday, the Street reviews the second estimate of Q4 GDP, January pending home sales, and earnings from Analog Devices, Bayer, Chico’s FAS, Hilton Grand Vacations, Hostess Brands, L Brands, La Quinta Holdings, Lowe’s, Office Depot, Snyder’s-Lance, and Valeant Pharmaceuticals. Thursday offers ISM’s February factory PMI, January personal spending data, and earnings from AMC, Anheuser-Busch, Barnes & Noble, Best Buy, Gap, Kohl’s, and Nordstrom. On Friday, Foot Locker and JCPenney present earnings, and the University of Michigan issues its latest consumer sentiment index.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – cnbc.com/2018/02/21/january-existing-home-sales-.html [2/21/18]

2 – investors.com/news/economy/fed-minutes-policy-meeting/ [2/21/18]

3 – cmegroup.com/trading/interest-rates/countdown-to-fomc.html/ [2/23/18]

4 – marketwatch.com/story/oil-on-track-for-second-consecutive-weekly-rise-2018-02-23 [2/23/18]

5 – markets.wsj.com/us [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F23%2F17&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F23%2F17&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F23%2F17&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F22%2F13&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F22%2F13&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F22%2F13&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=2%2F22%2F08&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=2%2F22%2F08&x=0&y=0 [2/23/18]

6 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=2%2F22%2F08&x=0&y=0 [2/23/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [2/23/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [2/23/18]