WEEKLY QUOTE

“Knowledge is the eye of desire and can become the pilot of the soul.”

– Will Durant

WEEKLY TIP

If it feels like your federal student loan debt is holding you back from saving enough for the future, think about switching to an income-based repayment plan, which could cap your loan payments at no more than 10% of your income and free up more money you could contribute to retirement accounts.

WEEKLY RIDDLE

There are 43 hikers walking toward a desert peak. On the way, 6 decide to hike another peak, 12 head back, and 25 make it to the peak. What happens to the rest of them?

Last week’s riddle

It has two rings. It moves upon request. If a mixture is not right, it simply sits and rests. What is it?

Last week’s answer:

A piston.

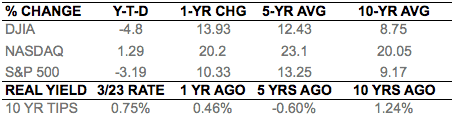

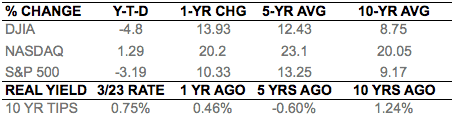

TRADE WAR POSSIBILITY WEIGHS ON STOCKS

Last week, the U.S. imposed excise taxes on steel and aluminum imported from select countries and announced that up to $60 billion of Chinese imports would also soon face tariffs. These protectionist moves weakened bullish sentiment on Wall Street. The S&P 500 fell steadily Thursday and Friday and had its worst week since 2016, slipping 5.95% to 2,588.26; the Dow Industrials sank 5.67% on the week to 23,533.20. The Nasdaq Composite settled at 6,992.67, down 6.54% for the week.(1,2)

FED MAKES ITS FIRST INTEREST RATE MOVE OF 2018

After Federal Reserve officials voted to increase the target range on the federal funds rate by 0.25% to the 1.50-1.75% level Thursday, their dot-plot forecast showed no change in the pace of tightening planned for this year. Three hikes are projected for 2019 and two more in 2020. In succession, the increases envisioned for 2018-20 could leave rates near 3.4% by the final quarter of 2020.(3)

EXISTING HOME SALES INCREASE

New National Association of Realtors data shows that the sales pace improved 3.0% in February. That left resales 1.1% higher, year-over-year. The same cannot be said for new home purchases: they fell 0.6% last month according to the Census Bureau, leaving the seasonally adjusted annual sales rate at its weakest level since October.(4,5)

MEANWHILE, OIL SURGES

WTI crude staged a major rally last week, jumping up 5.6% to close Friday at $65.74 a barrel on the NYMEX. With equities under pressure, gold also gained more allure: prices rose 0.8% across five days to $1,352.90 on the COMEX.(2,6)

THIS WEEK: Monday, Paychex and Red Hat report earnings. On Tuesday, the Conference Board presents its March consumer confidence index; the Street also considers earnings from Lululemon Athletica, Restoration Hardware, Shoe Carnival, and Sonic. Wednesday, investors await the third Q4 GDP estimate, the February pending home sales index from the NAR, and earnings announcements from Blackberry, GameStop, Hudson’s Bay Co., and Walgreens Boots Alliance. February personal spending numbers, the final March University of Michigan consumer sentiment index, and Q4 results from Constellation Brands appear Thursday. Nothing major is scheduled for Friday.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nytimes.com/2018/03/23/business/trade-tariffs-markets-stocks-bonds.html [3/23/18]

2 – markets.wsj.com/us [3/23/18]

3 – marketwatch.com/story/fed-lifts-rates-in-powells-first-meeting-says-outlook-has-strengthened-2018-03-21 [3/21/18]

4 – tradingeconomics.com/united-states/existing-home-sales [3/23/18]

5 – tradingeconomics.com/united-states/new-home-sales [3/23/18]

6 – quotes.wsj.com/futures/CRUDE%20OIL%20-%20ELECTRONIC [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F23%2F17&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F23%2F17&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F23%2F17&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F22%2F13&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F22%2F13&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F22%2F13&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F24%2F08&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F24%2F08&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F24%2F08&x=0&y=0 [3/23/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [3/23/18]

9 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [3/23/18]

TRADE WAR POSSIBILITY WEIGHS ON STOCKS

Last week, the U.S. imposed excise taxes on steel and aluminum imported from select countries and announced that up to $60 billion of Chinese imports would also soon face tariffs. These protectionist moves weakened bullish sentiment on Wall Street. The S&P 500 fell steadily Thursday and Friday and had its worst week since 2016, slipping 5.95% to 2,588.26; the Dow Industrials sank 5.67% on the week to 23,533.20. The Nasdaq Composite settled at 6,992.67, down 6.54% for the week.(1,2)

FED MAKES ITS FIRST INTEREST RATE MOVE OF 2018

After Federal Reserve officials voted to increase the target range on the federal funds rate by 0.25% to the 1.50-1.75% level Thursday, their dot-plot forecast showed no change in the pace of tightening planned for this year. Three hikes are projected for 2019 and two more in 2020. In succession, the increases envisioned for 2018-20 could leave rates near 3.4% by the final quarter of 2020.(3)

EXISTING HOME SALES INCREASE

New National Association of Realtors data shows that the sales pace improved 3.0% in February. That left resales 1.1% higher, year-over-year. The same cannot be said for new home purchases: they fell 0.6% last month according to the Census Bureau, leaving the seasonally adjusted annual sales rate at its weakest level since October.(4,5)

MEANWHILE, OIL SURGES

WTI crude staged a major rally last week, jumping up 5.6% to close Friday at $65.74 a barrel on the NYMEX. With equities under pressure, gold also gained more allure: prices rose 0.8% across five days to $1,352.90 on the COMEX.(2,6)

THIS WEEK: Monday, Paychex and Red Hat report earnings. On Tuesday, the Conference Board presents its March consumer confidence index; the Street also considers earnings from Lululemon Athletica, Restoration Hardware, Shoe Carnival, and Sonic. Wednesday, investors await the third Q4 GDP estimate, the February pending home sales index from the NAR, and earnings announcements from Blackberry, GameStop, Hudson’s Bay Co., and Walgreens Boots Alliance. February personal spending numbers, the final March University of Michigan consumer sentiment index, and Q4 results from Constellation Brands appear Thursday. Nothing major is scheduled for Friday.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – nytimes.com/2018/03/23/business/trade-tariffs-markets-stocks-bonds.html [3/23/18]

2 – markets.wsj.com/us [3/23/18]

3 – marketwatch.com/story/fed-lifts-rates-in-powells-first-meeting-says-outlook-has-strengthened-2018-03-21 [3/21/18]

4 – tradingeconomics.com/united-states/existing-home-sales [3/23/18]

5 – tradingeconomics.com/united-states/new-home-sales [3/23/18]

6 – quotes.wsj.com/futures/CRUDE%20OIL%20-%20ELECTRONIC [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F23%2F17&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F23%2F17&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F23%2F17&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F22%2F13&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F22%2F13&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F22%2F13&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=3%2F24%2F08&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=3%2F24%2F08&x=0&y=0 [3/23/18]

7 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=3%2F24%2F08&x=0&y=0 [3/23/18]

8 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [3/23/18]

9 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [3/23/18]