WEEKLY QUOTE

“The greatest pleasure in life is doing what people say you cannot do.”

– WALTER BAGEHOT

WEEKLY TIP

If you recently received a promotion or raise, you need not spend more money simply because you have it. Counter the temptation to buy this or that with the question “Do I really need this?” Living within your means could leave you with more money to save and invest for the future.

WEEKLY RIDDLE

It takes a crew of eight workers four hours to dig a 30’ hole in the ground. How long would it take them to dig half a hole?

Last week’s riddle

What is long and narrow, yet can look far and wide?

Last week’s answer:

A telescope.

CONSUMER SENTIMENT EXCEEDS EXPECTATIONS

In its initial September edition, the University of Michigan’s monthly consumer sentiment index rose 4.6 points to 100.8, a 6-month high. Economists polled by Bloomberg had forecast a reading of 96.6. Fifty-six percent of households responding to the survey said that they had made recent financial gains; the all-time high for the survey is 57%, recorded in both March 2018 and February 1998. The index’s future expectations gauge reached a 14-year peak of 91.1.(1)

RETAIL SALES ALMOST FLAT IN AUGUST

The 0.1% August advance was the smallest monthly gain since February. Core retail purchases (which exclude the automotive, food, and home improvement categories) rose by the same amount. The Department of Commerce did revise the July numbers upward: the overall retail sales increase in that month went to 0.7%; the core retail sales gain, to 0.8%.(2)

ANNUALIZED INFLATION DECREASES

August’s Consumer Price Index shows 12-month inflation at 2.7%, down from 2.9%. Yearly core inflation retreated similarly, lessening from 2.4% to 2.2% last month. The headline CPI rose 0.2% in August; the core CPI, 0.1%. Both the headline and core Producer Price Index declined 0.1% in August, significantly reducing their annualized gains. Twelve-month wholesale inflation shrank 0.5% to 2.8%, while yearly core wholesale inflation retreated to 2.3% from 2.7%.(3)

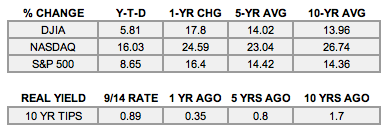

A POSITIVE FIVE DAYS FOR EQUITIES

All three major U.S. stock benchmarks gained ground last week. Out in front was the Nasdaq All three major stock indices advanced last week. The Dow Industrials gained 0.92% to reach 26,154.67 at Friday’s close. Settling at 8,010.04 Friday, the Nasdaq Composite was up 1.36% for the week. The S&P 500 improved 1.16% to 2,904.98. The main barometer of Wall Street volatility, the CBOE VIX, fell 18.88% for the week to 12.07.(4)

THIS WEEK: FedEx announces earnings Monday. | AutoZone, Cracker Barrel, and General Mills present earnings Tuesday. | On Wednesday, the Census Bureau provides a snapshot of August residential construction activity, and Red Hat reports quarterly results. | Investors consider August existing home sales numbers, a new initial jobless claims report, and earnings from Darden Restaurants, Micron Technology, Steelcase, and Thor Industries on Thursday. | Nothing major is slated for Friday.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – bloomberg.com/news/articles/2018-09-14/u-s-consumer-sentiment-rises-to-six-month-high-above-estimate [9/14/18]

2 – cnbc.com/2018/09/14/us-retail-sales-august-2018.html [9/14/18]

3 – investing.com/economic-calendar/ [9/14/18]

4 – markets.wsj.com/us [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F14%2F17&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F14%2F17&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F14%2F17&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F13%2F13&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F13%2F13&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F13%2F13&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F15%2F08&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F15%2F08&x=0&y=0 [9/14/18]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F15%2F08&x=0&y=0 [9/14/18]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/14/18]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/14/18]

SEPTEMBER BRINGS A MEDIOCRE JOBS REPORT

The Department of Labor’s latest employment snapshot shows payrolls expanding by 156,000 net new jobs in August. This was a retreat from the job gains of 200,000+ reported in both June and July. The headline jobless rate ticked up to 4.4%; the U-6 rate, which factors in the underemployed, held steady at 8.6%. Annualized wage growth remained stuck at 2.5%.(1)

POSITIVE NEWS FROM MAIN STREET

Climbing once again, the Conference Board’s consumer confidence index ascended 2.9 points to 122.9 in August. That topped the forecast of economists surveyed by MarketWatch, who anticipated a 122.5 reading. Additionally, the Department of Commerce said that consumer spending advanced 0.3% in July, up from 0.2% in June. Household incomes rose 0.4% in July; they were unchanged in June.(2)

More from Adams Wealth Management.

Understanding 401(k) Rollovers

ISM: FACTORY SECTOR IN FINE SHAPE

Can the Institute for Supply Management’s manufacturing purchasing manager index top 60 soon? It rose 2.5 points to 58.8 in August, indicating a high degree of expansion. This was the best reading on the index since April 2011. So far in 2017, the factory PMI has averaged a reading of 56.7.(3)

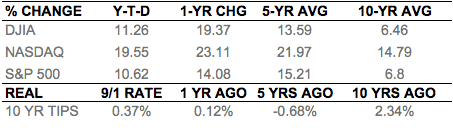

WALL STREET ENDS THE SUMMER WITH A RALLY

All three major U.S. stock benchmarks gained ground last week. Out in front was the Nasdaq Composite, which added 2.71% in five days to settle at 6,435.33 Friday. The S&P 500 rose 1.37% for the week, closing September 1 at 2,476.55. As for the Dow Jones Industrial Average, it moved north 0.80% to 21,987.56. The CBOE VIX dropped 10.02% in five days to 10.15 at Friday’s closing bell. One last detail worth noting: the NYSE Arca Biotech index jumped 8.98% last week to go up 37.65% on the year.(4)

THIS WEEK: Wall Street is closed Monday for the Labor Day holiday. Investors consider earnings from Casey’s General Stores, Hewlett Packard Enterprise, and the Hudson’s Bay Company on Tuesday, plus a report on July factory orders. A new Federal Reserve Beige Book and the August ISM service sector PMI arrive Wednesday, along with earnings releases from Fred’s and Navistar. Thursday, earnings arrive from Barnes & Noble, Dell Technologies, Hovnanian Enterprises, and Verifone, and a new initial unemployment claims report surfaces. On Friday, Kroger reports quarterly results.

Indices are unmanaged, do not incur fees or expenses, and cannot be invested into directly. These returns do not include dividends. 10-year TIPS real yield = projected return at maturity given expected inflation.

However you see your tomorrow, the best time to plan for it is today.

This material was prepared by MarketingPro, Inc., and does not necessarily represent the views of the presenting party, nor their affiliates. The information herein has been derived from sources believed to be accurate. Please note – investing involves risk, and past performance is no guarantee of future results. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. This information should not be construed as investment, tax or legal advice and may not be relied on for the purpose of avoiding any Federal tax penalty. This is neither a solicitation nor recommendation to purchase or sell any investment or insurance product or service, and should not be relied upon as such. All market indices discussed are unmanaged and are not illustrative of any particular investment. Indices do not incur management fees, costs and expenses, and cannot be invested into directly. All economic and performance data is historical and not indicative of future results. The Dow Jones Industrial Average is a price-weighted index of 30 actively traded blue-chip stocks. The NASDAQ Composite Index is a market-weighted index of all over-the-counter common stocks traded on the National Association of Securities Dealers Automated Quotation System. The Standard & Poor’s 500 (S&P 500) is a market-cap weighted index composed of the common stocks of 500 leading companies in leading industries of the U.S. economy. NYSE Group, Inc. (NYSE:NYX) operates two securities exchanges: the New York Stock Exchange (the “NYSE”) and NYSE Arca (formerly known as the Archipelago Exchange, or ArcaEx®, and the Pacific Exchange). NYSE Group is a leading provider of securities listing, trading and market data products and services. The New York Mercantile Exchange, Inc. (NYMEX) is the world’s largest physical commodity futures exchange and the preeminent trading forum for energy and precious metals, with trading conducted through two divisions – the NYMEX Division, home to the energy, platinum, and palladium markets, and the COMEX Division, on which all other metals trade. Additional risks are associated with international investing, such as currency fluctuations, political and economic instability and differences in accounting standards. This material represents an assessment of the market environment at a specific point in time and is not intended to be a forecast of future events, or a guarantee of future results. MarketingPro, Inc. is not affiliated with any person or firm that may be providing this information to you. The publisher is not engaged in rendering legal, accounting or other professional services. If assistance is needed, the reader is advised to engage the services of a competent professional.

Citations.

1 – foxbusiness.com/markets/2017/09/01/us-hiring-cools-off-with-156000-new-jobs-in-august.html [9/1/17]

2 – marketwatch.com/economy-politics/calendars/economic [9/1/17]

3 – instituteforsupplymanagement.org/ISMReport/MfgROB.cfm [9/1/17]

4 – markets.wsj.com/us [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=9%2F1%2F16&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=9%2F1%2F16&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=9%2F1%2F16&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F31%2F12&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F31%2F12&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F31%2F12&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=DJIA&closeDate=8%2F31%2F07&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=COMP&closeDate=8%2F31%2F07&x=0&y=0 [9/1/17]

5 – bigcharts.marketwatch.com/historical/default.asp?symb=SPX&closeDate=8%2F31%2F07&x=0&y=0 [9/1/17]

6 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyield [9/1/17]

7 – treasury.gov/resource-center/data-chart-center/interest-rates/Pages/TextView.aspx?data=realyieldAll [9/1/17]

Other Information:

Adams Wealth Management Group LLC (“Adams Wealth Management”) is a registered investment adviser offering advisory services in the State of Texas and in other jurisdictions where exempted. Registration does not imply a certain level of skill or training. The presence of this website on the Internet shall not be directly or indirectly interpreted as a solicitation of investment advisory services to persons of another jurisdiction unless otherwise permitted by statute. Follow-up or individualized responses to consumers in a particular state by Adams Wealth Management in the rendering of personalized investment advice for compensation shall not be made without our first complying with jurisdiction requirements or pursuant an applicable state exemption.

All written content on this site is for information purposes only. Opinions expressed herein are solely those of Adams Wealth Management, unless otherwise specifically cited. Material presented is believed to be from reliable sources and no representations are made by our firm as to another parties’ informational accuracy or completeness. All information or ideas provided should be discussed in detail with an advisor, accountant or legal counsel prior to implementation.

All investing involves risk, including the potential for loss of principal. There is no guarantee that any investment strategy or plan will be successful.